Question: CHALLENGE (Question 23) LO 4 23. Net Fixed Assets and Depreciation On the balance sheet, the net fixed assets (NFA) account is equal to the

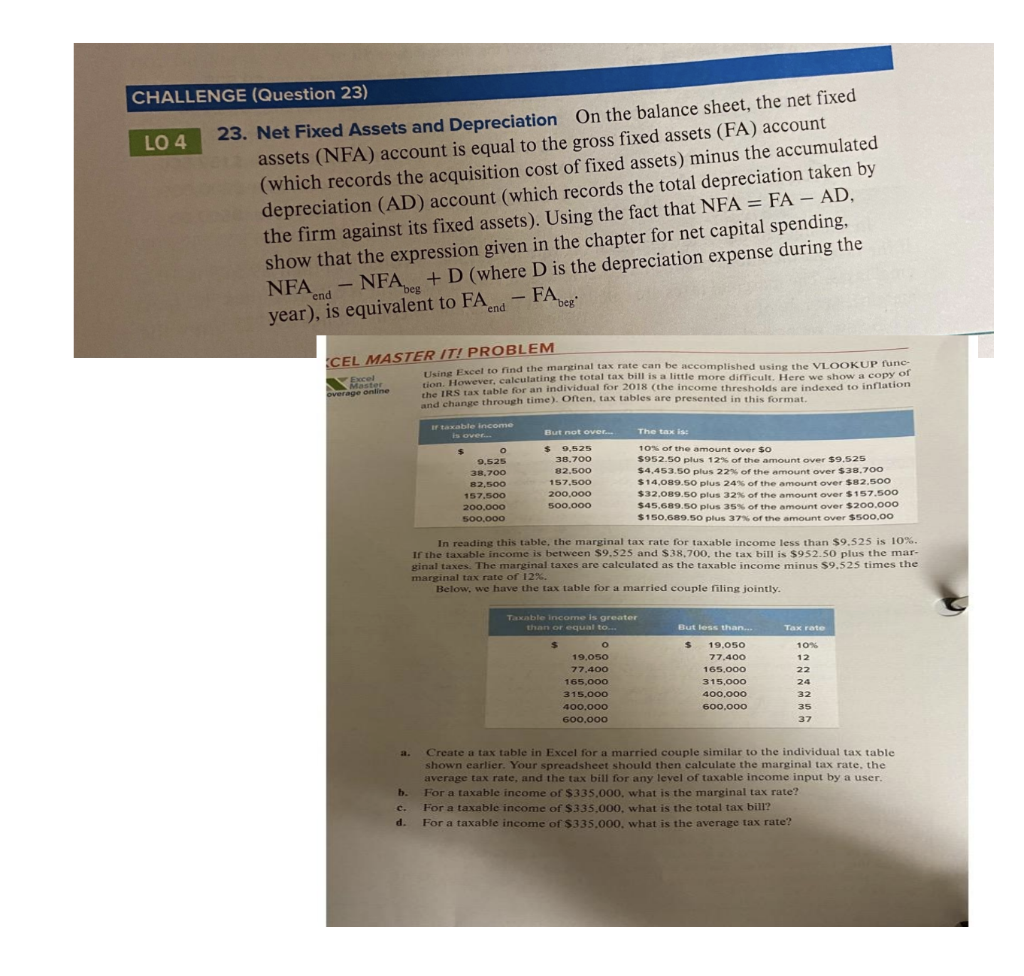

CHALLENGE (Question 23) LO 4 23. Net Fixed Assets and Depreciation On the balance sheet, the net fixed assets (NFA) account is equal to the gross fixed assets (FA) account (which records the acquisition cost of fixed assets) minus the accumulated depreciation (AD) account (which records the total depreciation taken by the firm against its fixed assets). Using the fact that NFA = FA AD, show that the expression given in the chapter for net capital spending, NFA - NFA + D (where D is the depreciation expense during the year), is equivalent to FA FA beg end end overage online CEL MASTER IT! PROBLEM Using Excel to find the martial tax rate can be accomplished using the VLOOKUP func - Excel Master tion. However, calculating the total tax bill is a little more difficult. Here we show a copy of the IRS tax table for an individual for 2018 (the income thresholds are indexed to inflation and change through time). Orten, tax tables are presented in this format. Ir taxable income is over But not over The tax is $ o $ 9,525 10% of the amount over so 9,525 38.700 $952.50 plus 12% of the amount over $9.525 38,700 82.500 $4,453.50 plus 22% of the amount over $38.700 82,500 157.500 $14,089.50 plus 24% of the amount over $82,500 157.500 200,000 $32,089.50 plus 32% of the amount over $157.500 200.000 500.000 $45,689.50 plus 35% of the amount over $200.000 500.000 $150,689.50 plus 37% of the amount over $500,00 In reading this table, the marginal tax rate for taxable income less than $9.525 is 10%. If the taxable income is between $9.525 and $38.700. the tax bill is $952.50 plus the mar- ginal taxes. The marginal taxes are calculated as the taxable income minus $9.525 times the marginal tax rate of 12% Below, we have the tax table for a married couple filing jointly. Tax rate Taxable income is greater than or equal to.. $ o 19.050 77.400 165,000 315.000 400.000 600.000 But less than... $ 19.050 77.400 165.000 315.000 400.000 600,000 10% 12 22 24 32 35 37 a. b. Create a tax table in Excel for a married couple similar to the individual tax table shown earlier. Your spreadsheet should then calculate the marginal tax rate, the average tax rate, and the tax bill for any level of taxable income input by a user. For a taxable income of $335.000, what is the marginal tax rate? For a taxable income of $335.000, what is the total tax bill? For a taxable income of $335.000. what is the average tax rate? c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts