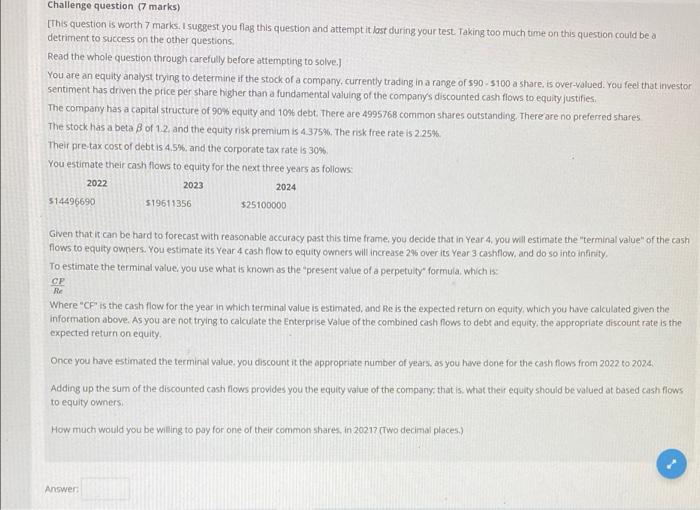

Challenge question (7 marks) [This question is worth 7 marks. I suggest you flag this question and attempt it last during your test. Taking too much time on this question could be a detriment to success on the other questions Read the whole question through carefully before attempting to solve.) You are an equity analyst trying to determine if the stock of a company, currently trading in a range of 590 5100 a share is over-valued. You feel that investor sentiment has driven the price per share higher than a fundamental valuing of the company's discounted cash flows to equity justifies The company has a capital structure of 90% equity and 10% debt. There are 4995768 common shares outstanding. There are no preferred shares The stock has a beta 8 of 1.2. and the equity risk premium is 4.3754. The risk free rate is 2.25%. Their pre-tax cost of debtis 4.5%, and the corporate tax rate is 30% You estimate their cash flows to equity for the next three years as follows: 2022 2023 2024 514496690 519611356 $25100000 Given that it can be hard to forecast with reasonable accuracy past this time frame you decide that in Year 4, you will estimate the "terminal values of the cash flows to equity owners. You estimate its Year 4 cash flow to equity owners will increase 2% over its Year 3 cashflow, and do so into Infinity To estimate the terminal value you use what is known as the present value of a perpetuity" formula, which is CP Re Where "CF" is the cash flow for the year in which terminal value is estimated, and He is the expected return on equity, which you have calculated given the information above. As you are not trying to calculate the enterprise Value of the combined cash flows to debt and equity, the appropriate discount rate is the expected return on equity. Once you have estimated the terminal value you discount it the appropriate number of years, as you have done for the cash flows from 2022 to 2024. Adding up the sum of the discounted cash flows provides you the equity value of the company that is what their equity should be valued at based cash flows to equity owners How much would you be willing to pay for one of their common shares, in 20217 (Two decimal places) Answer Challenge question (7 marks) [This question is worth 7 marks. I suggest you flag this question and attempt it last during your test. Taking too much time on this question could be a detriment to success on the other questions Read the whole question through carefully before attempting to solve.) You are an equity analyst trying to determine if the stock of a company, currently trading in a range of 590 5100 a share is over-valued. You feel that investor sentiment has driven the price per share higher than a fundamental valuing of the company's discounted cash flows to equity justifies The company has a capital structure of 90% equity and 10% debt. There are 4995768 common shares outstanding. There are no preferred shares The stock has a beta 8 of 1.2. and the equity risk premium is 4.3754. The risk free rate is 2.25%. Their pre-tax cost of debtis 4.5%, and the corporate tax rate is 30% You estimate their cash flows to equity for the next three years as follows: 2022 2023 2024 514496690 519611356 $25100000 Given that it can be hard to forecast with reasonable accuracy past this time frame you decide that in Year 4, you will estimate the "terminal values of the cash flows to equity owners. You estimate its Year 4 cash flow to equity owners will increase 2% over its Year 3 cashflow, and do so into Infinity To estimate the terminal value you use what is known as the present value of a perpetuity" formula, which is CP Re Where "CF" is the cash flow for the year in which terminal value is estimated, and He is the expected return on equity, which you have calculated given the information above. As you are not trying to calculate the enterprise Value of the combined cash flows to debt and equity, the appropriate discount rate is the expected return on equity. Once you have estimated the terminal value you discount it the appropriate number of years, as you have done for the cash flows from 2022 to 2024. Adding up the sum of the discounted cash flows provides you the equity value of the company that is what their equity should be valued at based cash flows to equity owners How much would you be willing to pay for one of their common shares, in 20217 (Two decimal places)