Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chamberlane Ltd is an agricultural company quoted on the JSE. The directors of the company hold 52% of the issued share capital between them

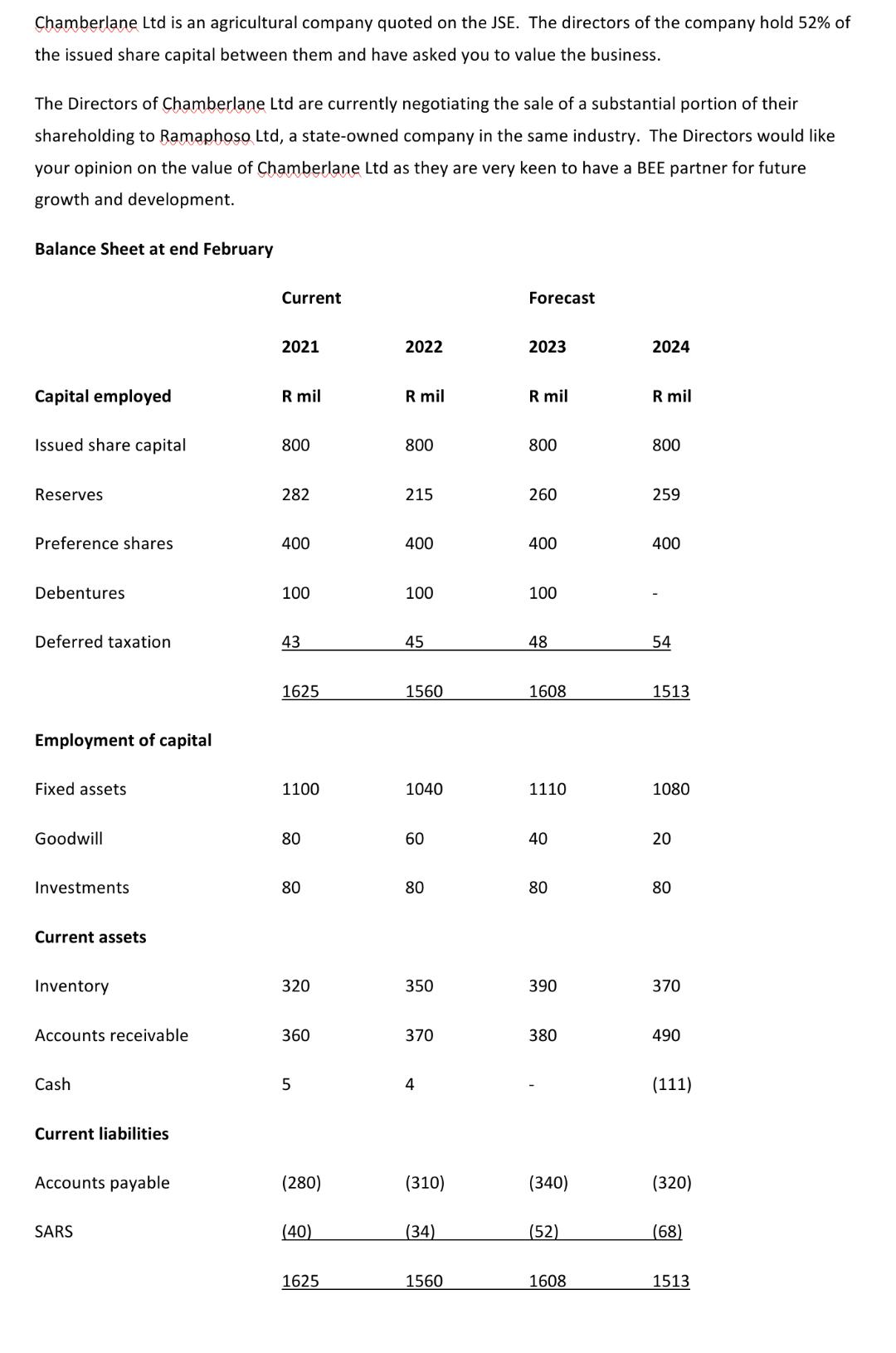

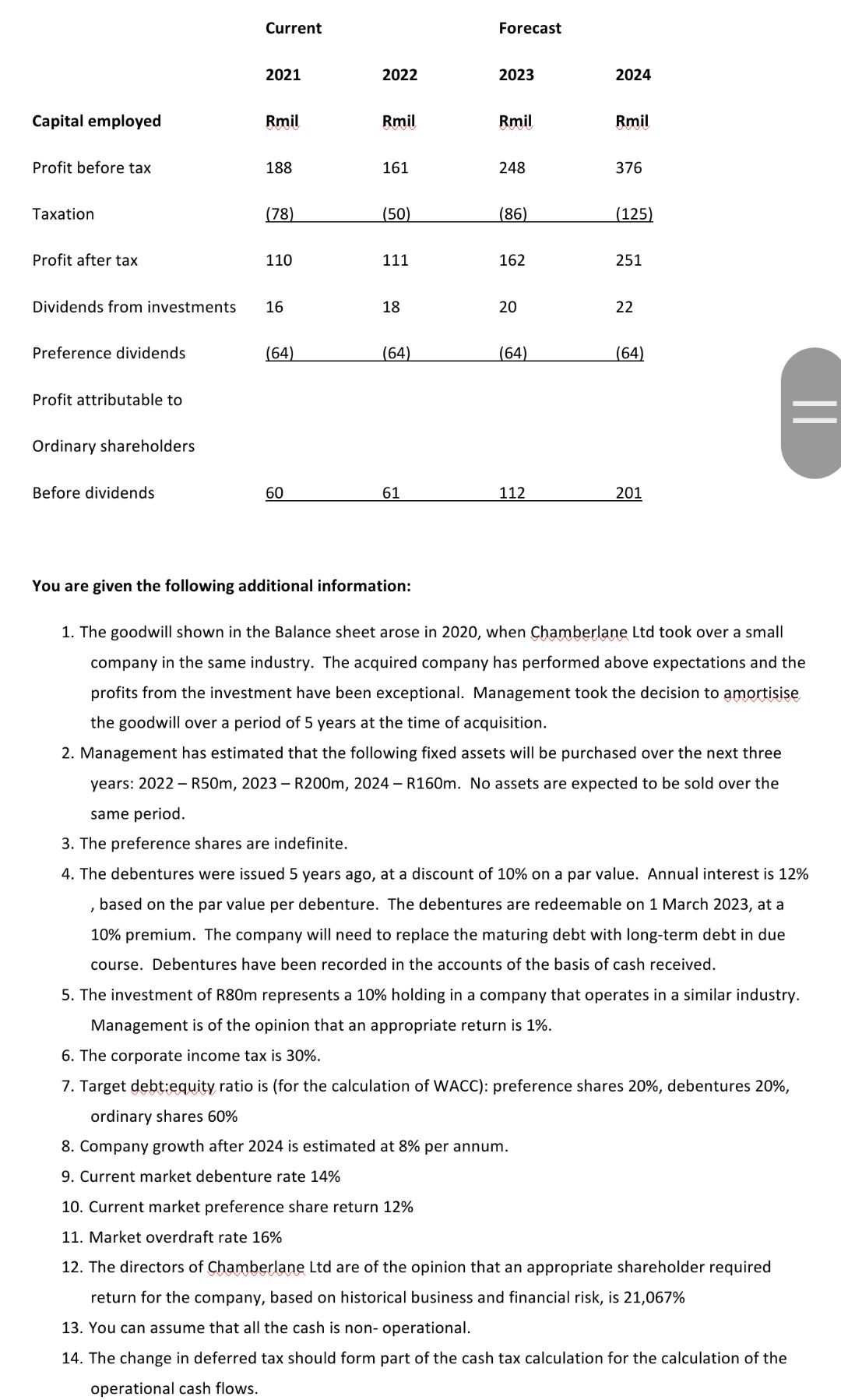

Chamberlane Ltd is an agricultural company quoted on the JSE. The directors of the company hold 52% of the issued share capital between them and have asked you to value the business. The Directors of Chamberlane Ltd are currently negotiating the sale of a substantial portion of their shareholding to Ramaphoso Ltd, a state-owned company in the same industry. The Directors would like your opinion on the value of Chamberlane Ltd as they are very keen to have a BEE partner for future growth and development. Balance Sheet at end February Capital employed Issued share capital Reserves Preference shares Debentures Deferred taxation Employment of capital Fixed assets Goodwill Investments Current assets Inventory Accounts receivable Cash Current liabilities Accounts payable SARS Current 2021 R mil 800 282 400 100 43 1625 1100 80 80 320 360 5 (280) (40) 1625 2022 R mil 800 215 400 100 45 1560 1040 60 80 350 370 4 (310) (34) 1560 Forecast 2023 R mil 800 260 400 100 48 1608 1110 40 80 390 380 (340) (52) 1608 2024 R mil 800 259 400 54 1513 1080 20 80 370 490 (111) (320) (68) 1513 Capital employed Profit before tax Taxation Profit after tax Preference dividends Profit attributable to Ordinary shareholders Before dividends Current 2021 Dividends from investments 16 Rmil 188 " (78) 110 (64) 60 2022 Rmil 161 (50) 111 18 (64) 61 You are given the following additional information: Forecast 2023 10. Current market preference share return 12% 11. Market overdraft rate 16% Rmil 248 (86) 162 20 (64) 112 2024 Rmil 376 (125) 251 22 (64) 1. The goodwill shown in the Balance sheet arose in 2020, when Chamberlane Ltd took over a small company in the same industry. The acquired company has performed above expectations and the profits from the investment have been exceptional. Management took the decision to amortisise the goodwill over a period of 5 years at the time of acquisition. 2. Management has estimated that the following fixed assets will be purchased over the next three years: 2022 - R50m, 2023 - R200m, 2024 - R160m. No assets are expected to be sold over the same period. 201 3. The preference shares are indefinite. 4. The debentures were issued 5 years ago, at a discount of 10% on a par value. Annual interest is 12% based on the par value per debenture. The debentures are redeemable on 1 March 2023, at a 10% premium. The company will need to replace the maturing debt with long-term debt in due course. Debentures have been recorded in the accounts of the basis of cash received. 5. The investment of R80m represents a 10% holding in a company that operates in a similar industry. Management is of the opinion that an appropriate return is 1%. 6. The corporate income tax is 30%. 7. Target debt:equity ratio is (for the calculation of WACC): preference shares 20%, debentures 20%, ordinary shares 60% 8. Company growth after 2024 is estimated at 8% per annum. 9. Current market debenture rate 14% 12. The directors of Chamberlane Ltd are of the opinion that an appropriate shareholder required return for the company, based on historical business and financial risk, is 21,067% 13. You can assume that all the cash is non-operational. 14. The change in deferred tax should form part of the cash tax calculation for the calculation of the operational cash flows. You are required to: Value the shares held be the Directors of Chamberlane Ltd using the free cash flow method. Include your workings and any assumptions you have made arriving at your valuation. The date for the valuation is 1 March 2021 and your projections/calculations should be for 2022, 2023 and 2024 Neat and logic presentation (36 marks) (4 marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To value the shares held by the Directors of Chamberlane Ltd using the free cash flow method we need to calculate the free cash flows for the years 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started