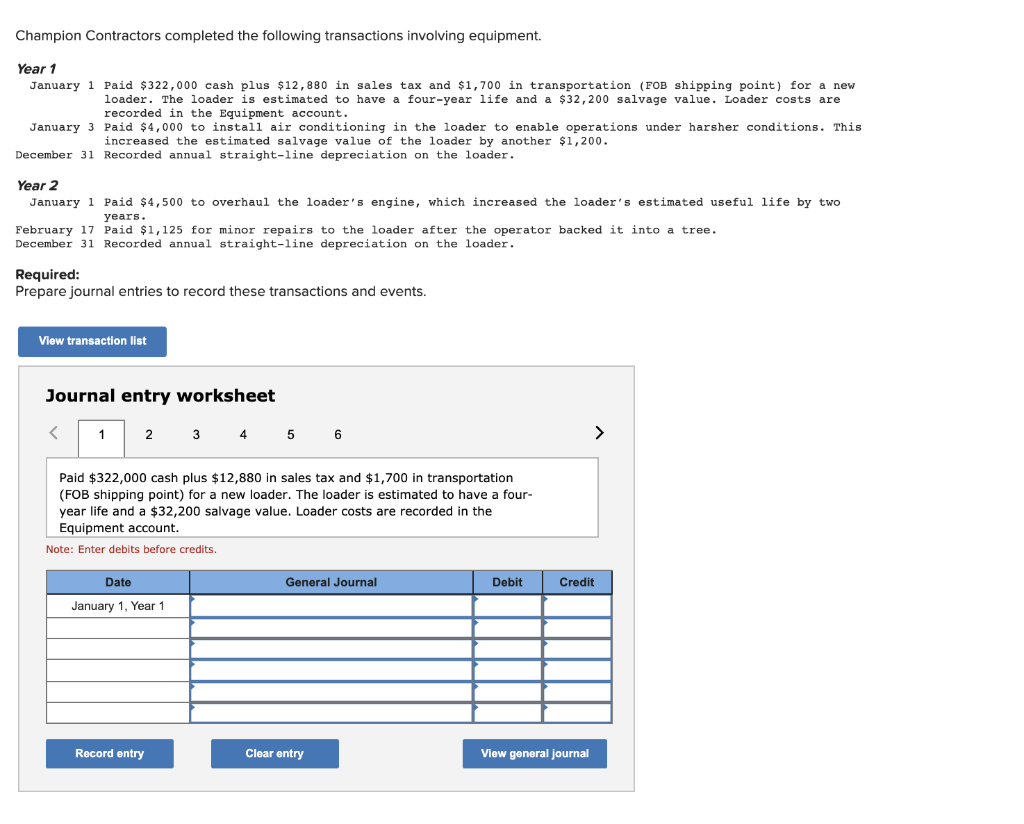

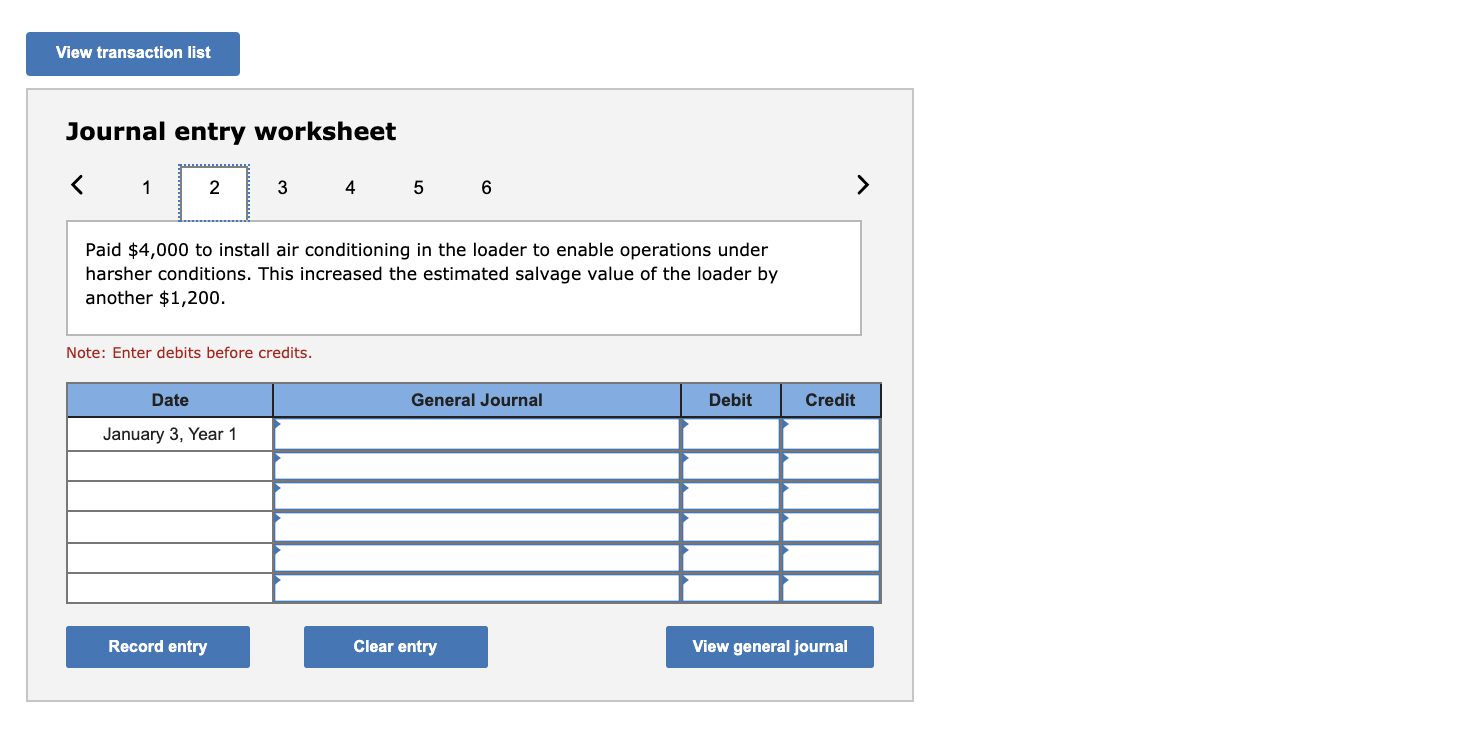

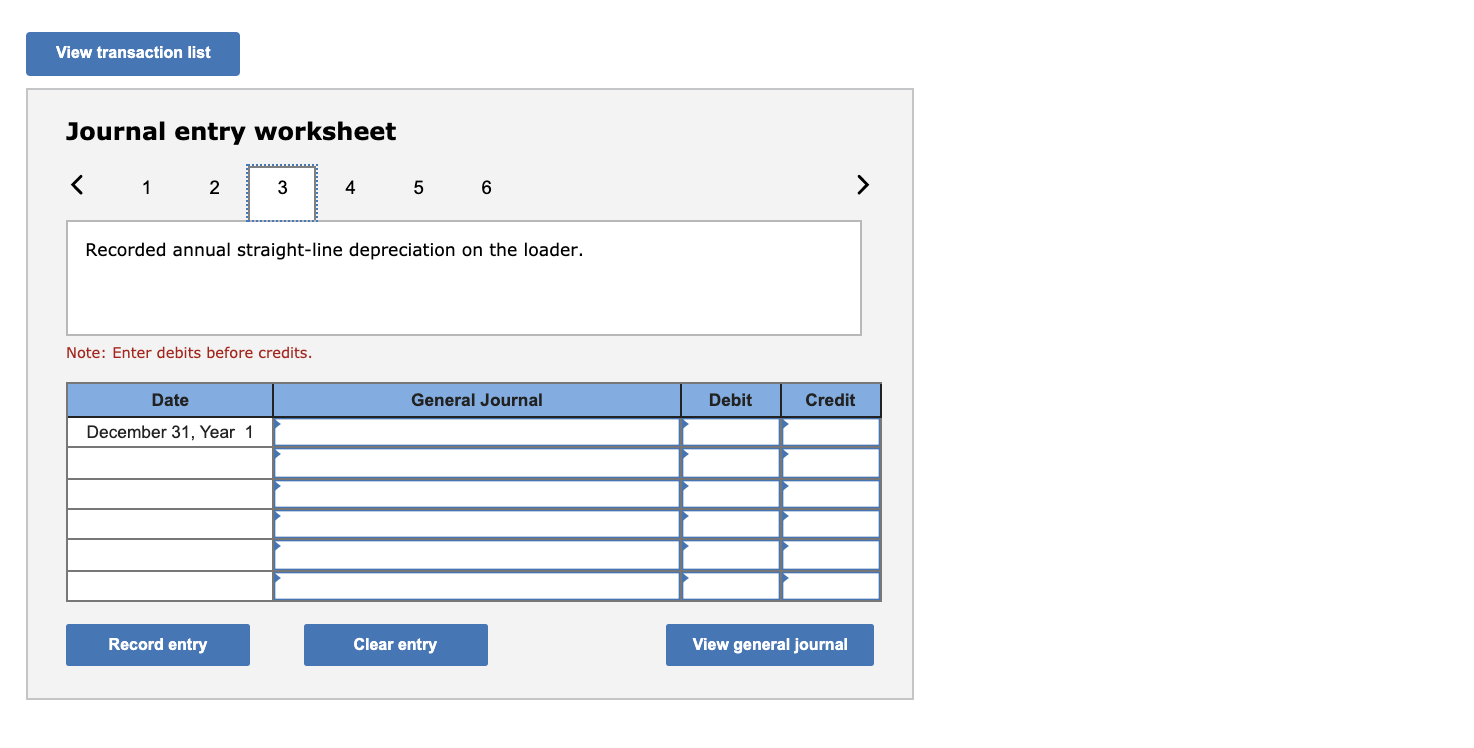

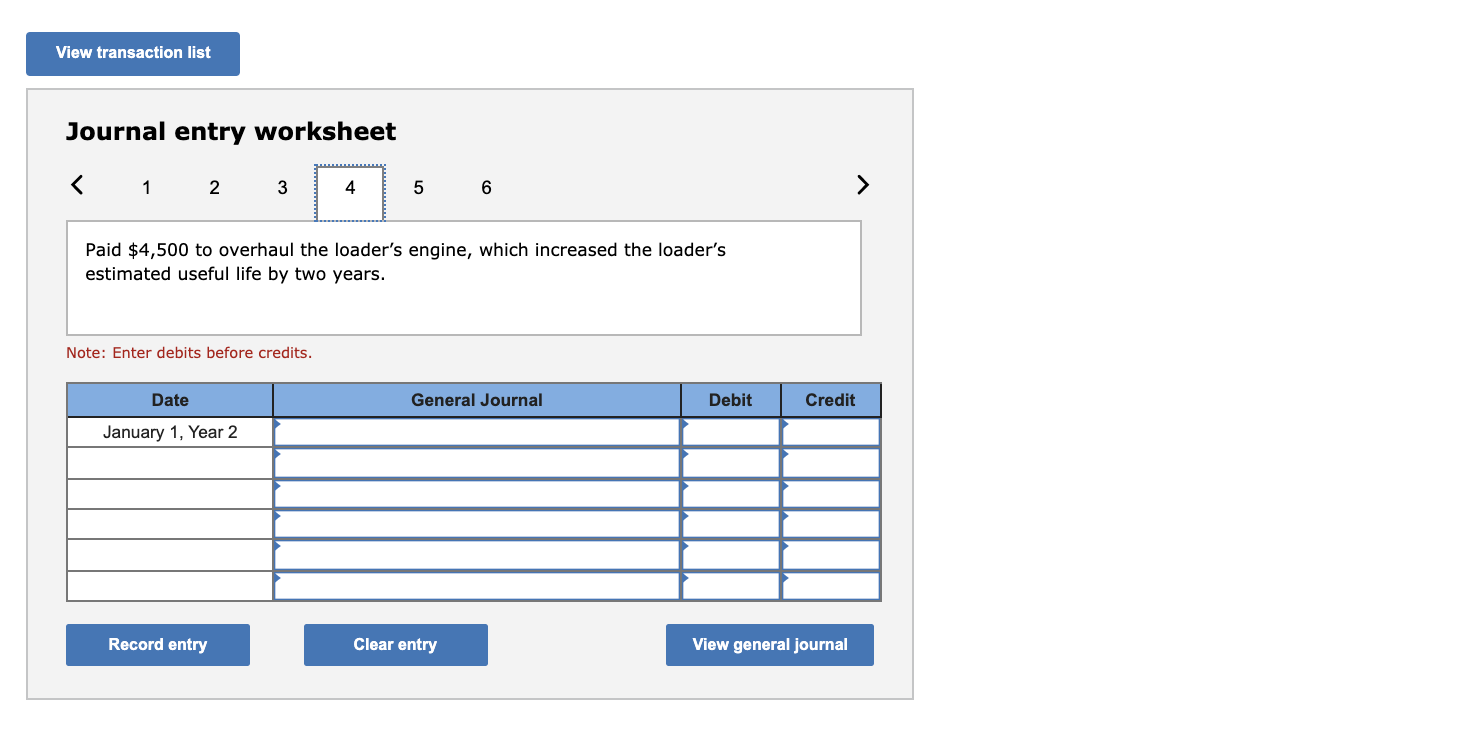

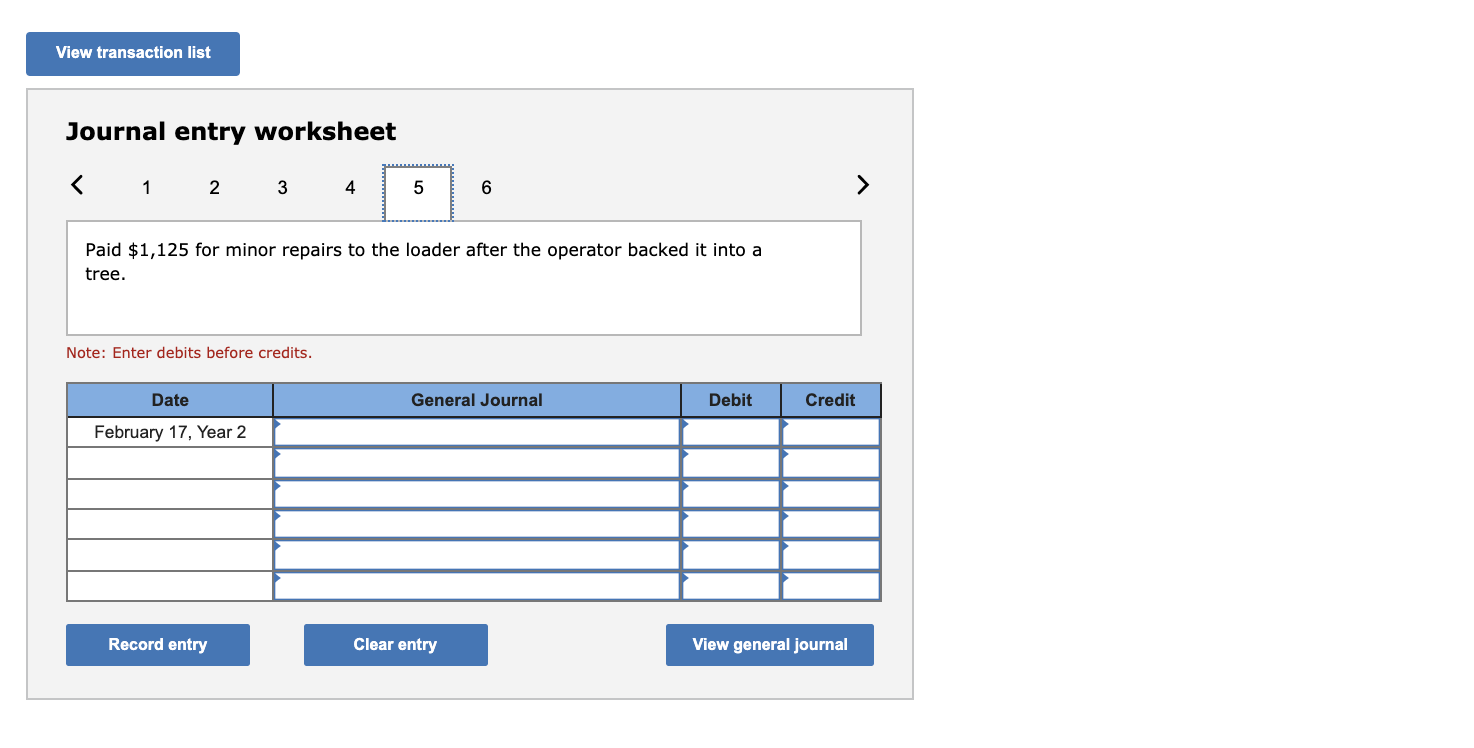

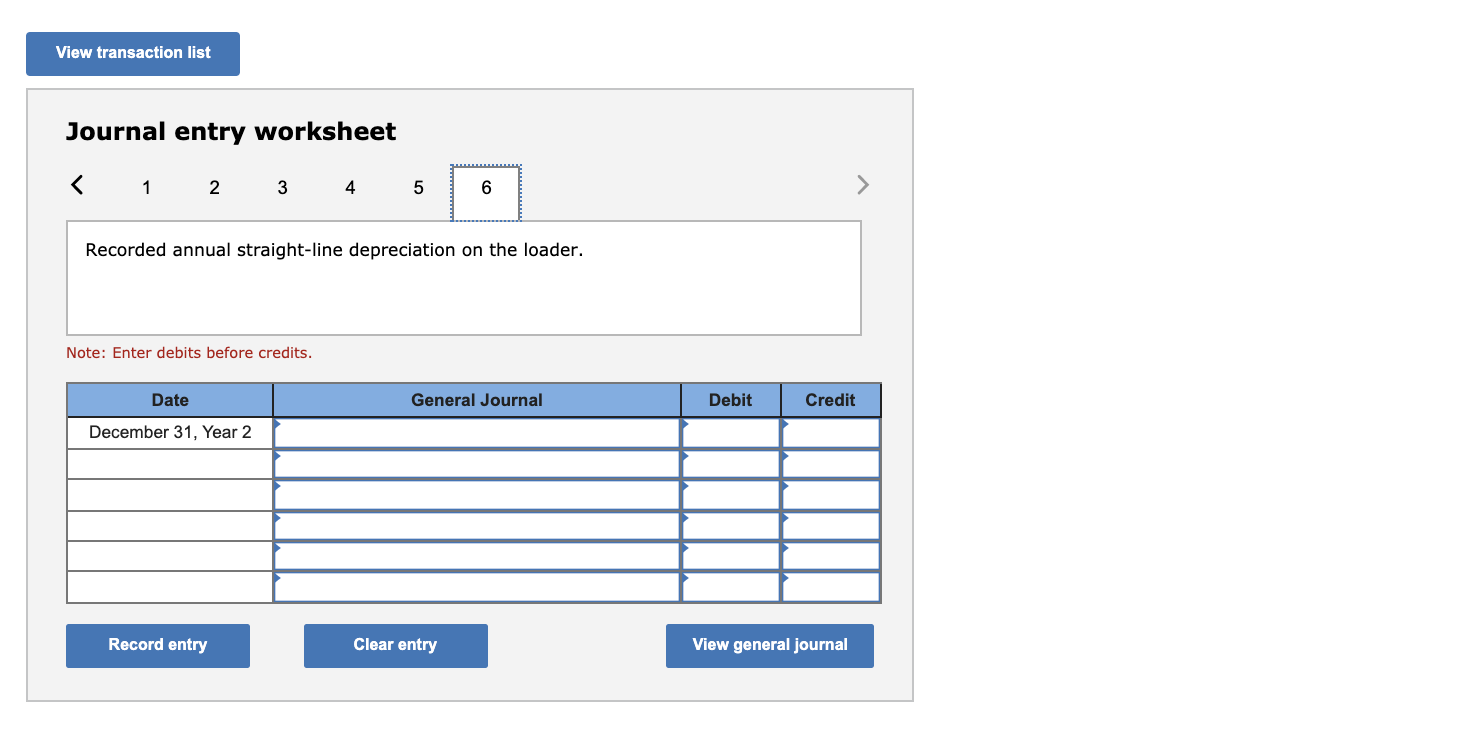

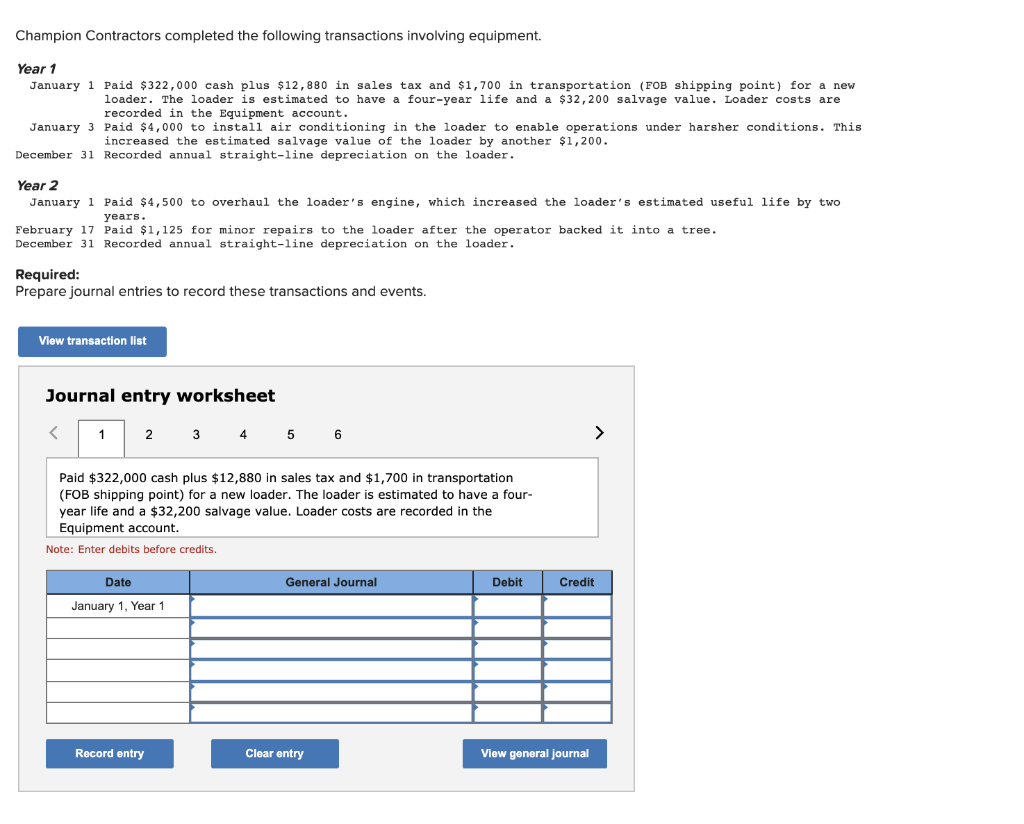

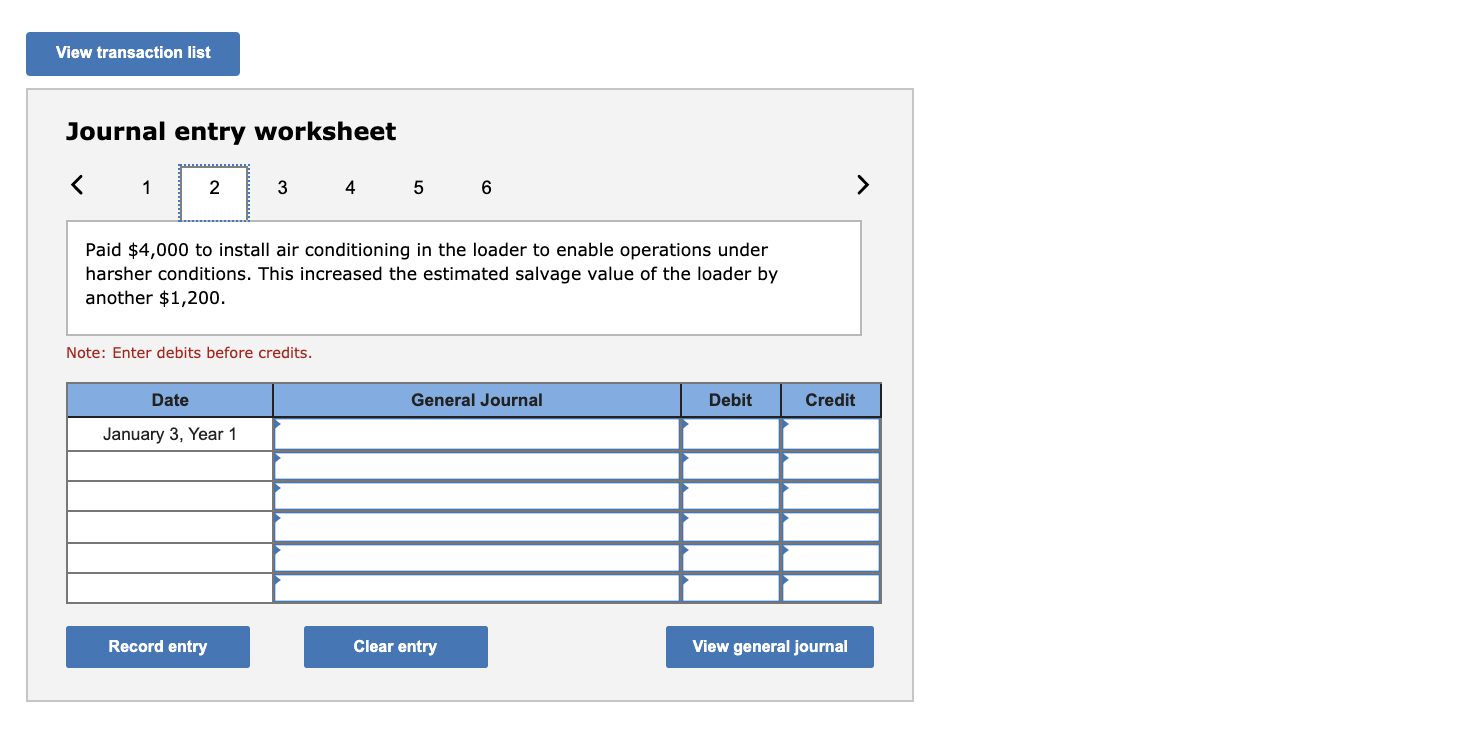

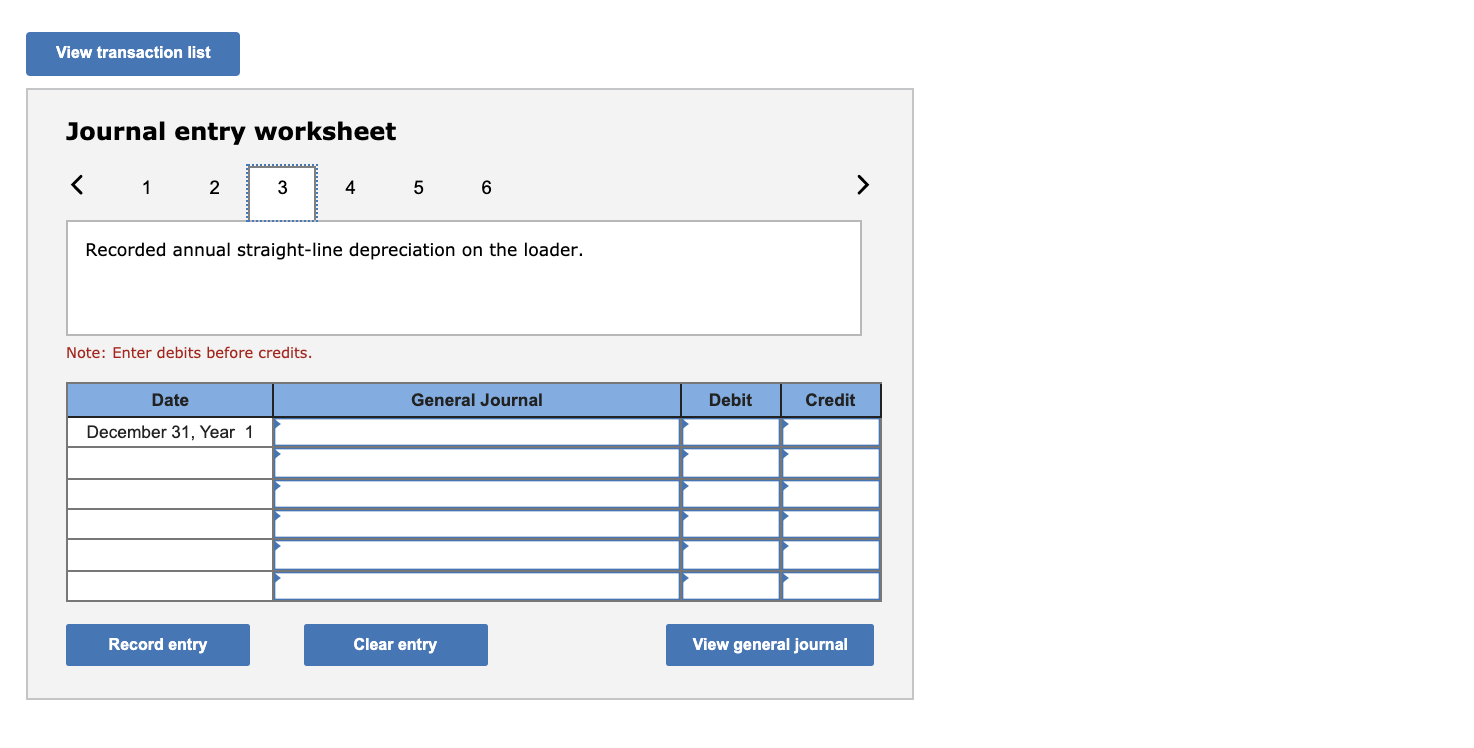

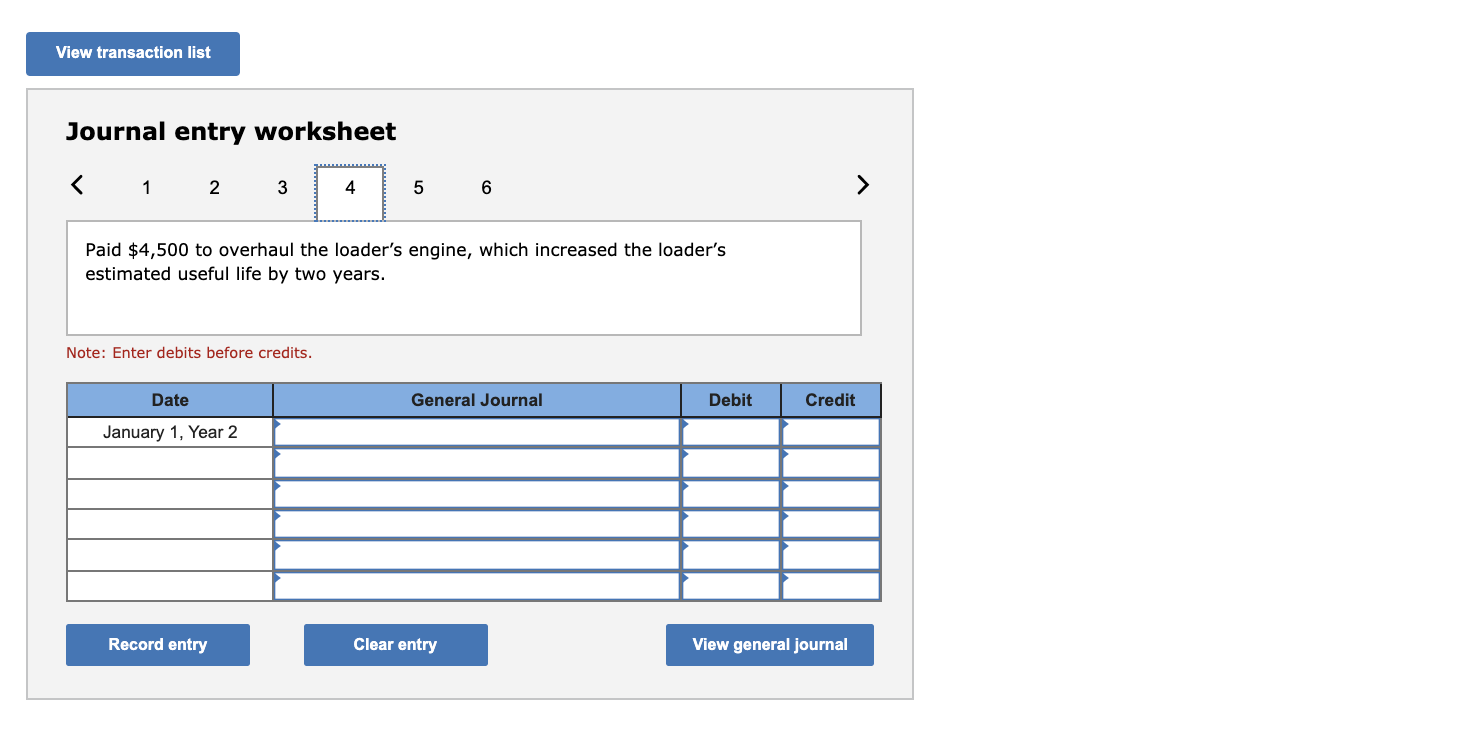

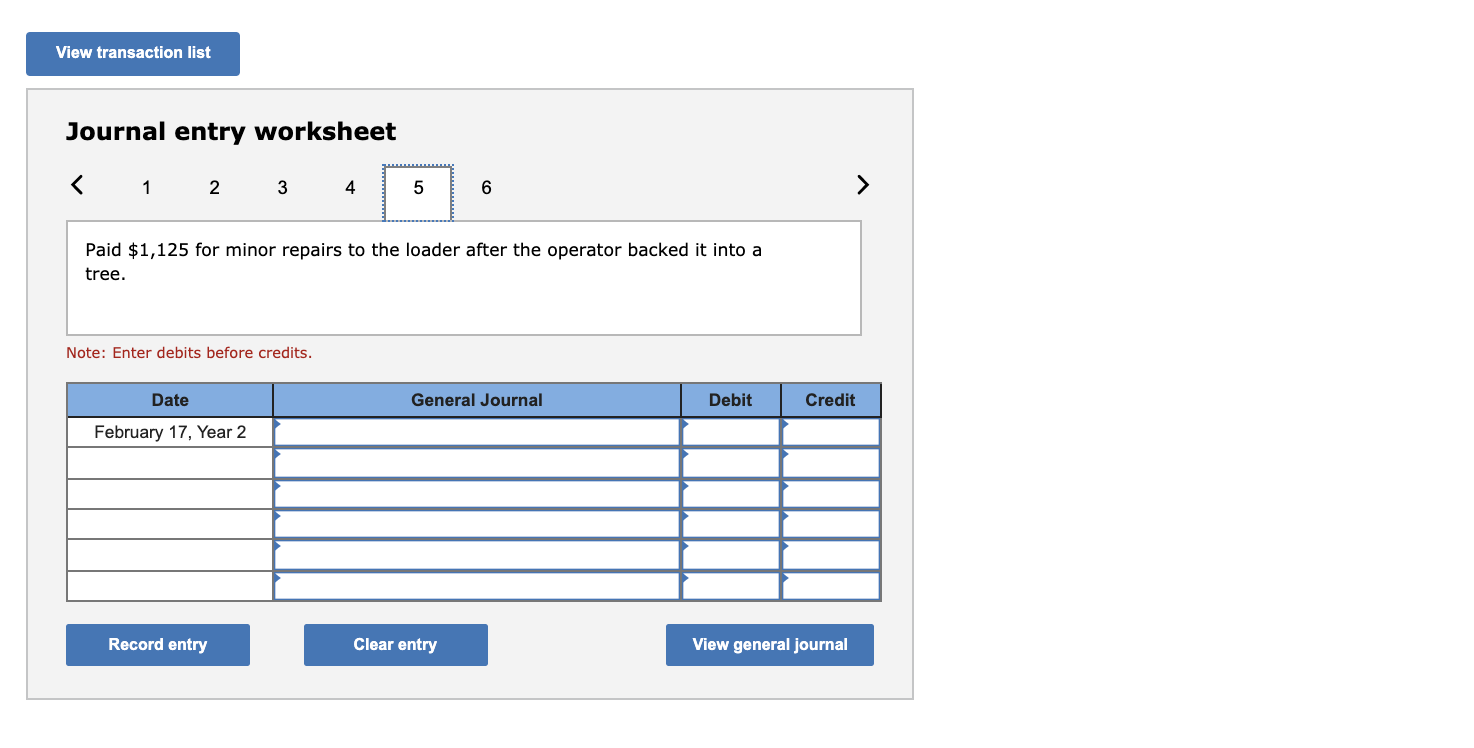

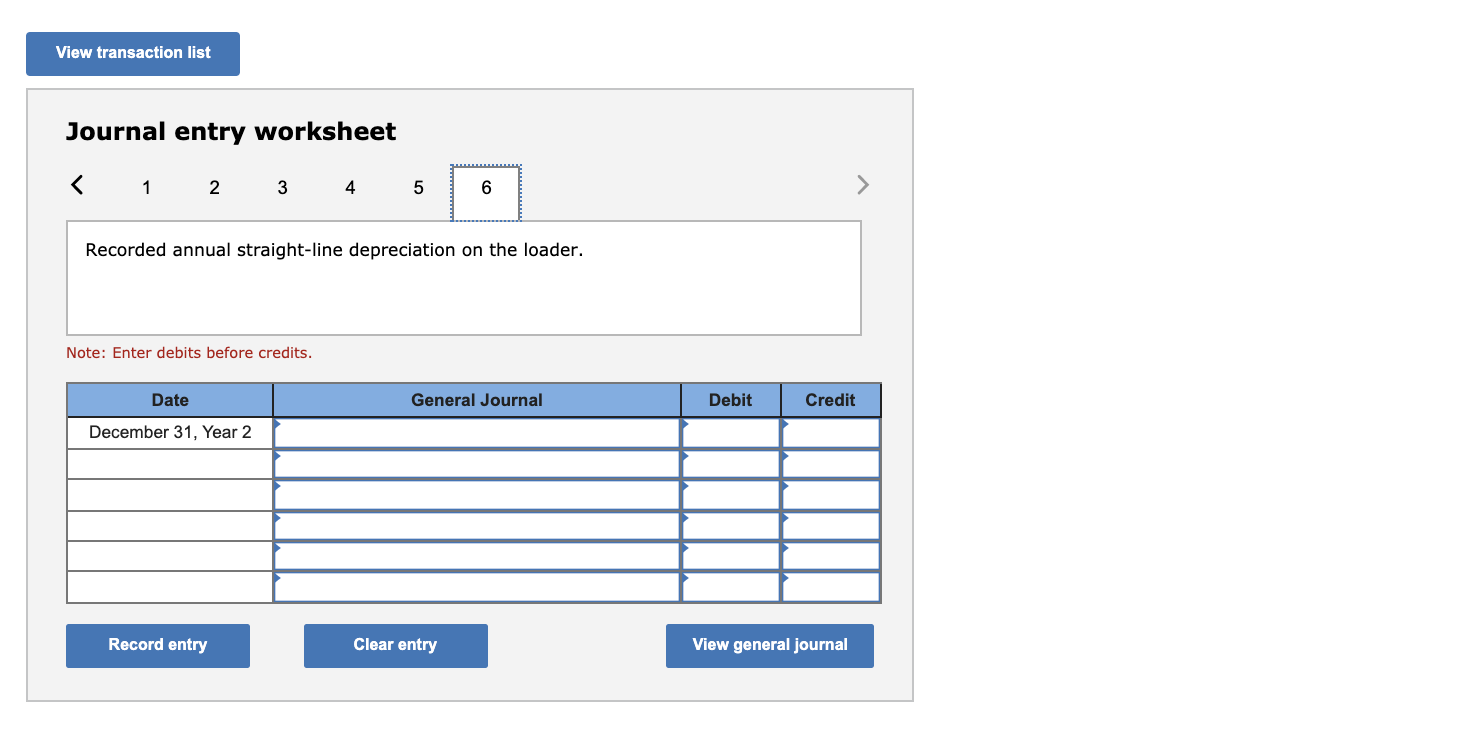

Champion Contractors completed the following transactions involving equipment. Year 1 January 1 Paid $322,000 cash plus $12,880 in sales tax and $1,700 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $32,200 salvage value. Loader costs are recorded in the Equipment account. January 3 Paid $4,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,200. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,500 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $1,125 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. View transaction list Journal entry worksheet Paid $322,000 cash plus $12,880 in sales tax and $1,700 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four- year life and a $32,200 salvage value. Loader costs are recorded in the Equipment account. Note: Enter debits before credits. Date General Journal Debit Credit January 1, Year 1 Record entry Clear entry View general Journal View transaction list Journal entry worksheet 1 2 3 4 5 6 > Paid $4,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,200. Note: Enter debits before credits. Date General Journal Debit Credit January 3, Year 1 Record entry Clear entry View general journal View transaction list Journal entry worksheet Recorded annual straight-line depreciation on the loader. Note: Enter debits before credits. Date General Journal Debit Credit December 31, Year 1 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 5 6 > Paid $4,500 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Note: Enter debits before credits. Date General Journal Debit Credit January 1, Year 2 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 5 6 > Paid $1,125 for minor repairs to the loader after the operator backed it into a tree. Note: Enter debits before credits. Date General Journal Debit Credit February 17, Year 2 Record entry Clear entry View general journal View transaction list Journal entry worksheet