Question

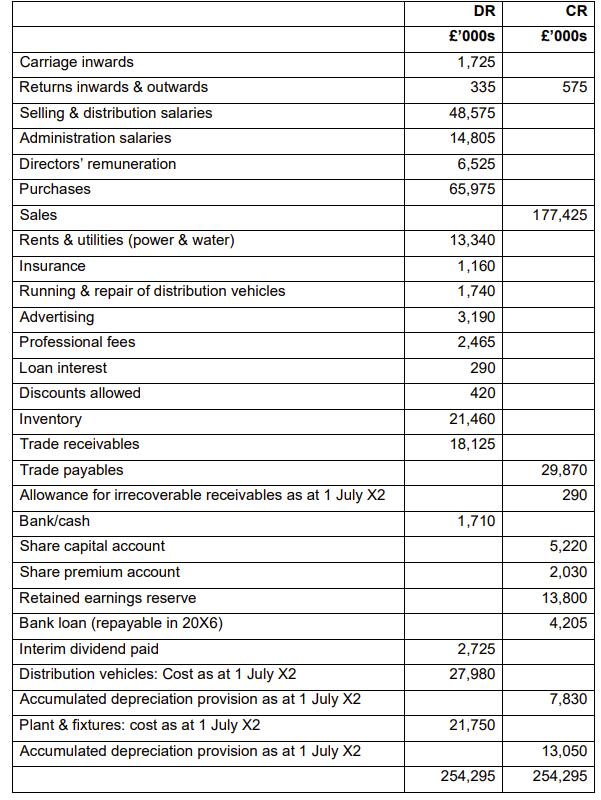

Chands tech Ltd prepares accounts for the 30 th of June every year. Its trial balance for the year ended 30 June 20X7 is shown

Chands tech Ltd prepares accounts for the 30th of June every year. Its trial balance for the year ended 30 June 20X7 is shown below. All figures in the trial balance and in the additional information supplied beneath it are in £’000s.

The following additional information is also necessary:

The closing inventory on 30 June 20X7 was valued at £25,100.

Utility costs and rent are split between the distribution and selling department and the administration department in the ratio of 75:25

Included within rent in the trial balance is a sum of £3,000 relating to a unit leased by the business for a period of 12 months from 1 November 20X6.

Depreciation is charged on distribution vehicles at a rate of 20% on a reducing-balance basis.

A £900 accrual for power is required.

Plant and fixtures are regarded as selling and distribution assets and are depreciated using the straight-line method at a rate of 10% per annum.

Due to a dispute with the customer, an invoice for £725 should be written off and an allowance for irrecoverable receivables at a rate of 5% of the year-end trade receivables balance is required. Debts written off and movements on the allowance are classified as relating to administration.

Provision should be made for taxation at a rate of 20% of the profit after finance costs.

1)Prepare the company’s Statement of Profit or Loss for the year ended 30 June 20X7, in a form suitable for publication

2)Prepare the company’s Statement of Financial Position as of that date.

Carriage inwards Returns inwards & outwards Selling & distribution salaries Administration salaries Directors' remuneration Purchases Sales Rents & utilities (power & water) Insurance Running & repair of distribution vehicles Advertising Professional fees Loan interest Discounts allowed Inventory Trade receivables Trade payables Allowance for irrecoverable receivables as at 1 July X2 Bank/cash Share capital account Share premium account Retained earnings reserve Bank loan (repayable in 20X6) Interim dividend paid Distribution vehicles: Cost as at 1 July X2 Accumulated depreciation provision as at 1 July X2 Plant & fixtures: cost as at 1 July X2 Accumulated depreciation provision as at 1 July X2 DR '000s 1,725 335 48,575 14,805 6,525 65,975 13,340 1,160 1,740 3,190 2,465 290 420 21,460 18,125 1,710 2,725 27,980 21,750 254,295 CR '000s 575 177,425 29,870 290 5,220 2,030 13,800 4,205 7,830 13,050 254,295

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Income Statement Sales Less Returns inwards Less Discount Allowed Net Sales Cost of Goods Sold Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started