Change Purse Inc. is a small business that is planned to be located in a small Nova Scotia town. The town was incorporated in 1889

Change Purse Inc. is a small business that is planned to be located in a small Nova Scotia town. The town was incorporated in 1889 and, like many communities in Nova Scotia, it prides itself on being able to offer a unique quality of life to its citizens. Much of its history recognizes the importance of individuals, family, and community. The town's council has emphasized attracting small businesses to the area based on its quality of life.

Bethany Ng, the owner of Change Purse Inc., believes that there is a market for handbags in the town and surrounding area. Bethany just received her degree in design from a provincial college of art and design and thought about starting the business during the last year of her academic program. Bethany believes that her unique approach to design and her use of "green" materials in ·the production of the handbags will attract potential customers. Her assessment of the market demand included a phone survey of a random sampling of town residents, an analysis of population data retrieved from the Statistics Canada website, and an assessment of the availability of competitive products in the town and surrounding area. Following her market assessment, Bethany incorporated a business with the intention of opening a small location on July 1, 20X3, on the town's main street, where she would manufacture and sell a variety of bags, from diaper bags to evening bags. All the materials will be sourced from local suppliers and the manufacturing will be done by Bethany.

Although handbags represent a difficult market to conquer, Bethany expects sales to be reasonably strong. She spent the last few months working on a business plan and she has considered various aspects of her business model. Handbag sales are anticipated to come from the Internet (15%), mail orders over the phone (15%), and walk-ins to the store (70%). All on-line and mail-order sales are to be paid by credit card and the in-store sales are anticipated to be paid by cash (10%), debit card (30%), aJld credit card (60%). Bethany has made an arrangement with a local financial institution such that the debit processing will be done the same day but the credit card processing will be done on the last day of the month for the entire month's credit card sales. The cost of credit card processing is a fee of 5% of the total amount processed, while the debit card processing is covered by her monthly business banking fees.

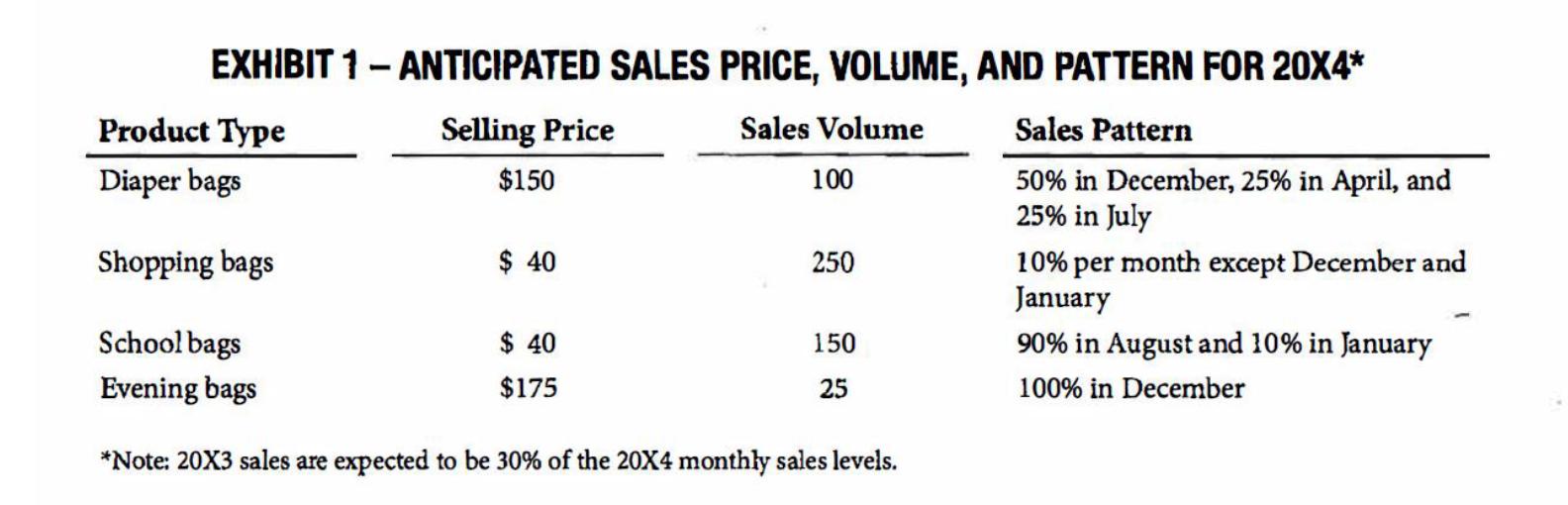

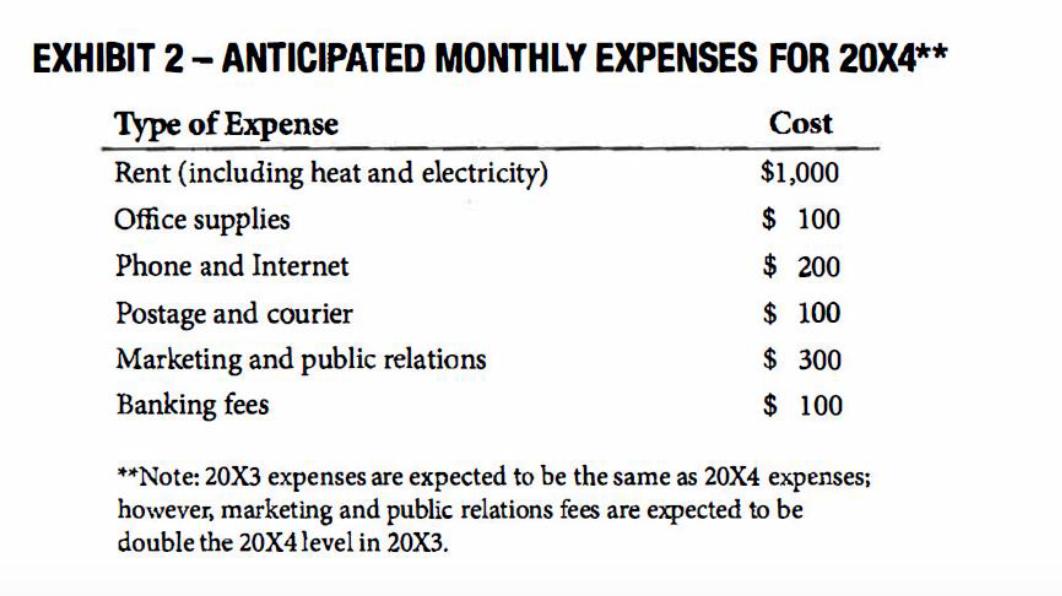

The manufacturing process takes approximately two months. To take advantage of fabric and material purchase discounts, Bethany plans to buy the material for the year in January and February (50% in each month) and she will do all the manufacturing herself. Because Bethany will be buying material in July for 20X3, she will need to purchase and pay for all the material at once to get the discount. The cost of the materials will vary depending on the type of bag, with costs approximating $20, $10, $10, and $50 per bag for diaper, shopping, school, and evening bags, respectively; the cost includes the discount for buying in January and February. Bethany has already contributed $1,000 in cash when incorporating the business; therefore, she expects to have access to the $1,000 in cash that she contributed and a $10,000 line of credit (5% annual interest cost) that she has already secured from her financial institution and from which she can borrow in $1,000 increments. The anticipated sales price, volume, and pattern are presented in Exhibit 1 and the expected monthly expenses are presented in Exhibit 2; monthly expenses are paid in cash in the month incurred.

Required:

Bethany Ng has come to you, a professional accountant, for advice concerning her proposed business plan. In particular, Bethany wants help in budgeting her monthly financial resources and projecting her potential monthly income. Write a report to Bethany.

Question:

1) Quantitative Analysis

a. Is there appropriate analysis of data? Was data useful or irrelevant and how did it assist with the decision/recommendation?

b. Was the analysis used in the discussion and does the analysis support or contradict the discussion?

c. Was the information used appropriate and up to date?

2) Qualitative Analysis

a. Adequate/appropriate qualitative discussion in a comprehensive, valid and persuasive form?

b. Did the qualitative analysis have independent support or just conjecture?

c. Have any references used been approached critically and used in an analytical fashion as opposed to just descriptive?

d. Were independent thoughts of the student offered and explained?

3) Discussion and Conclusion

a. Was a balanced discussion presented in a logical sequence?

b. Were both qualitative and quantitative aspects presented and discussed?

c. Was the conclusion consistent with the analysis?

d. Was the conclusion reasonable and thoroughly considered?

EXHIBIT 1 - ANTICIPATED SALES PRICE, VOLUME, AND PATTERN FOR 20X4* Product Type Selling Price Sales Pattern Sales Volume 100 Diaper bags $150 50% in December, 25% in April, and 25% in July Shopping bags $ 40 250 10% per month except December and January Schoolbags $ 40 150 90% in August and 10% in January 100% in December Evening bags $175 25 *Note: 20X3 sales are expected to be 30% of the 20X4 monthly sales levels.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1aThe data used in the quantitative analysis was appropriate and assisted with the decision making process The data helped to identify the potential m...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started