Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* change to 10% for the last pic, thank you~ Solve various time value of money scenarios. (Click the icon to view the scenarios.) (Click

* change to 10% for the last pic, thank you~

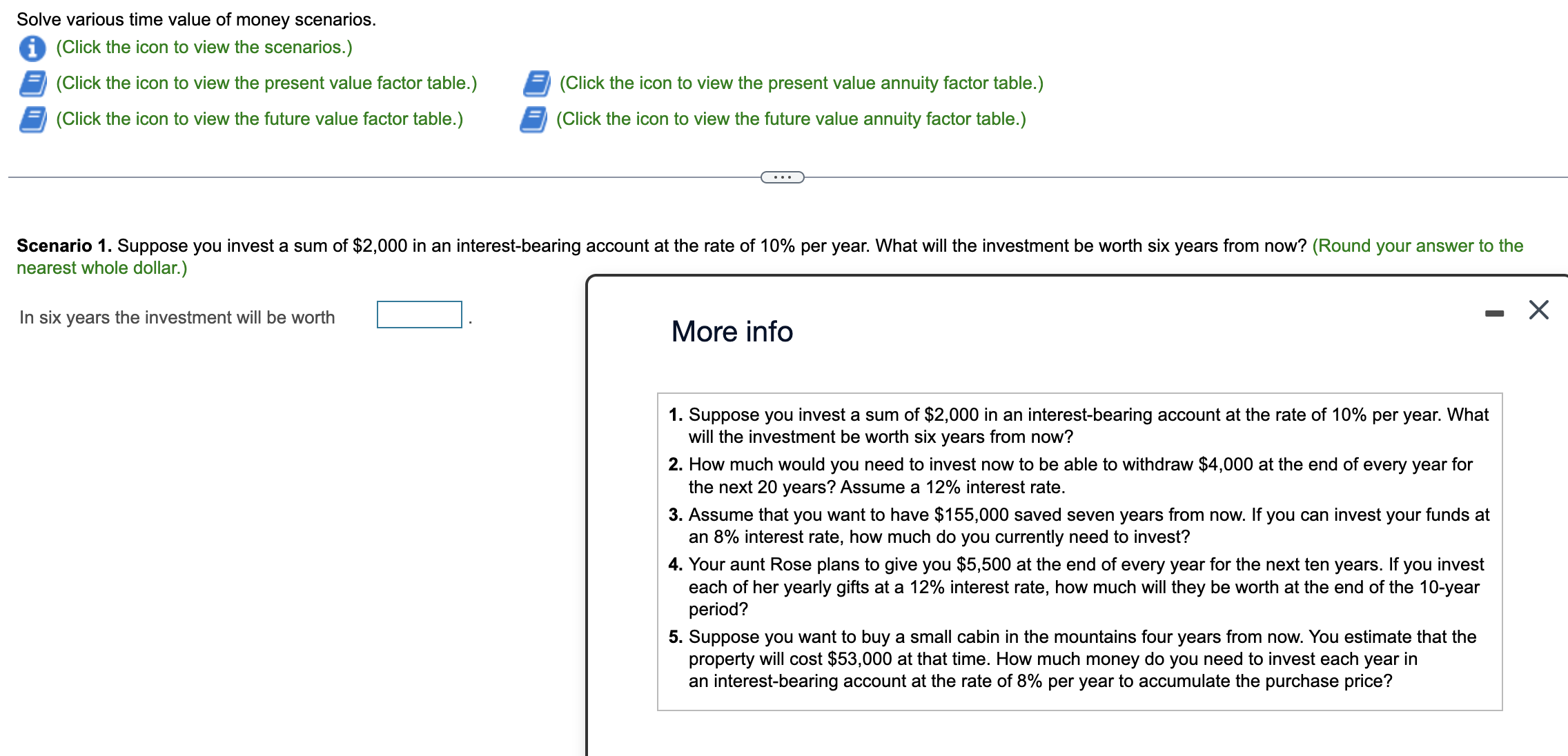

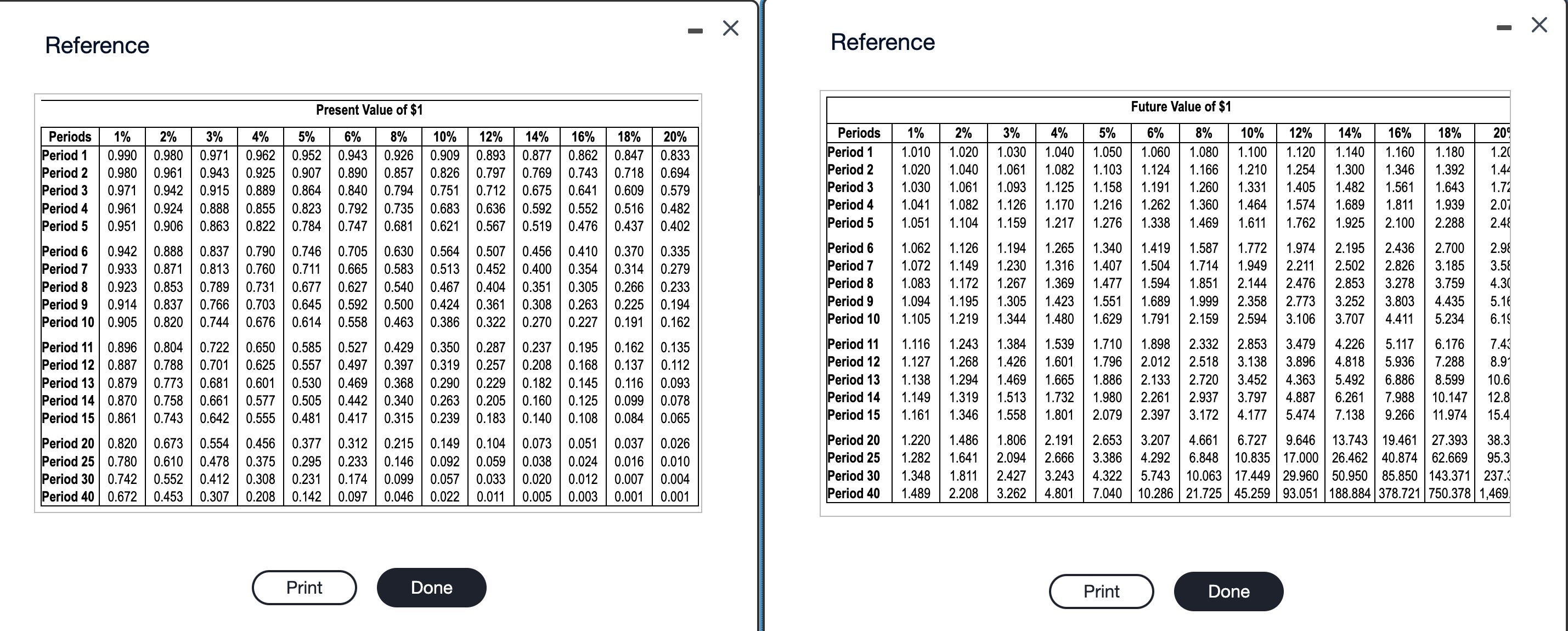

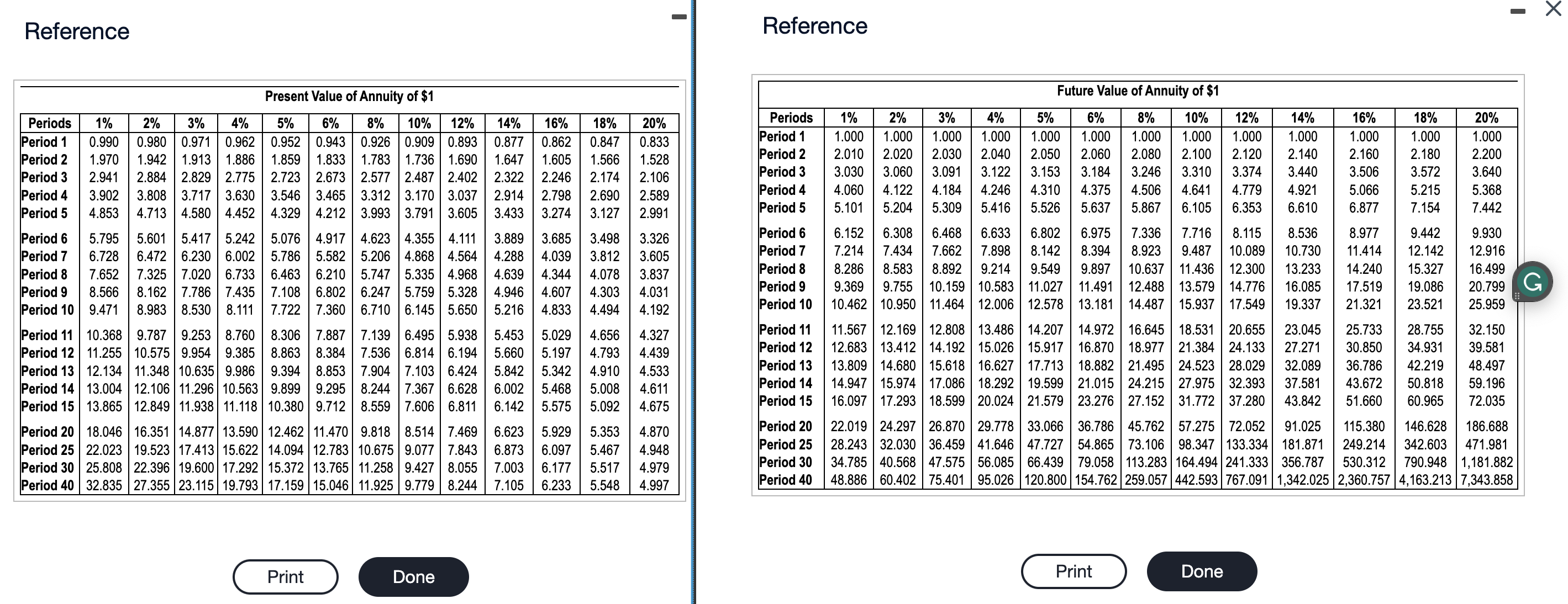

Solve various time value of money scenarios. (Click the icon to view the scenarios.) (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the future value factor table.) (Click the icon to view the future value annuity factor table.) Scenario 1. Suppose you invest a sum of $2,000 in an interest-bearing account at the rate of 10% per year. What will the investment be worth six years from now? (Round your answer to th nearest whole dollar.) In six years the investment will be worth More info 1. Suppose you invest a sum of $2,000 in an interest-bearing account at the rate of 10% per year. What will the investment be worth six years from now? 2. How much would you need to invest now to be able to withdraw $4,000 at the end of every year for the next 20 years? Assume a 12% interest rate. 3. Assume that you want to have $155,000 saved seven years from now. If you can invest your funds at an 8% interest rate, how much do you currently need to invest? 4. Your aunt Rose plans to give you $5,500 at the end of every year for the next ten years. If you invest each of her yearly gifts at a 12% interest rate, how much will they be worth at the end of the 10 -year period? 5. Suppose you want to buy a small cabin in the mountains four years from now. You estimate that the property will cost $53,000 at that time. How much money do you need to invest each year in an interest-bearing account at the rate of 8% per year to accumulate the purchase price? Reference Reference \begin{tabular}{ll|l} Reference & - & Reference \end{tabular} Requirement 2. Could you characterize this stream of cash flows as an annuity? Why or why not? The stream of cash flows an annuity because it is a stream of cash payments made at time intervals. Requirement 3. Use the Present Value of Ordinary Annuity of $1 table to determine the present value of the same stream of cash flows. Compare your results to your answer to Requirement 1. (Round to three decimal places, X.XXX.) (Click the icon to view Present Value of Ordinary Annuity of \$1 table.) The present value of an annuity of $1 received each year for five years, at 8% per year is $ The sum of the present values in Requirement 1 the present value calculated with the Present Value of Ordinary Annuity of $1 table. Requirement 4. Explain your findings. This exercise shows how Annuity PV factors of the PV factors found in the Present Value of \$1 tablesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started