Answered step by step

Verified Expert Solution

Question

1 Approved Answer

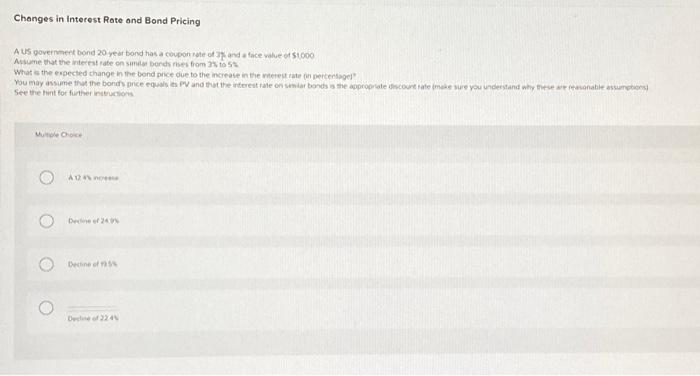

Changes in Interest Rate and Bond Pricing A US government bond 20-year bond has a coupon rate of 3% and a face value of $1,000

Changes in Interest Rate and Bond Pricing A US government bond 20-year bond has a coupon rate of 3% and a face value of $1,000 Assume that the interest rate on similar bonds rises from 3% to 5%. What is the expected change in the bond price due to the increase in the interest rate (in percentage)? You may assume that the bond's price equals its PV and that the interest rate on similar bonds is the appropriate discount rate (make sure you understand why these are reasonable assumptions). See the hint for further instructions. Multiple Choice A 12 4% Increase Decline of 24.9% Decline of 19.5% Decline of 22.4%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started