Answered step by step

Verified Expert Solution

Question

1 Approved Answer

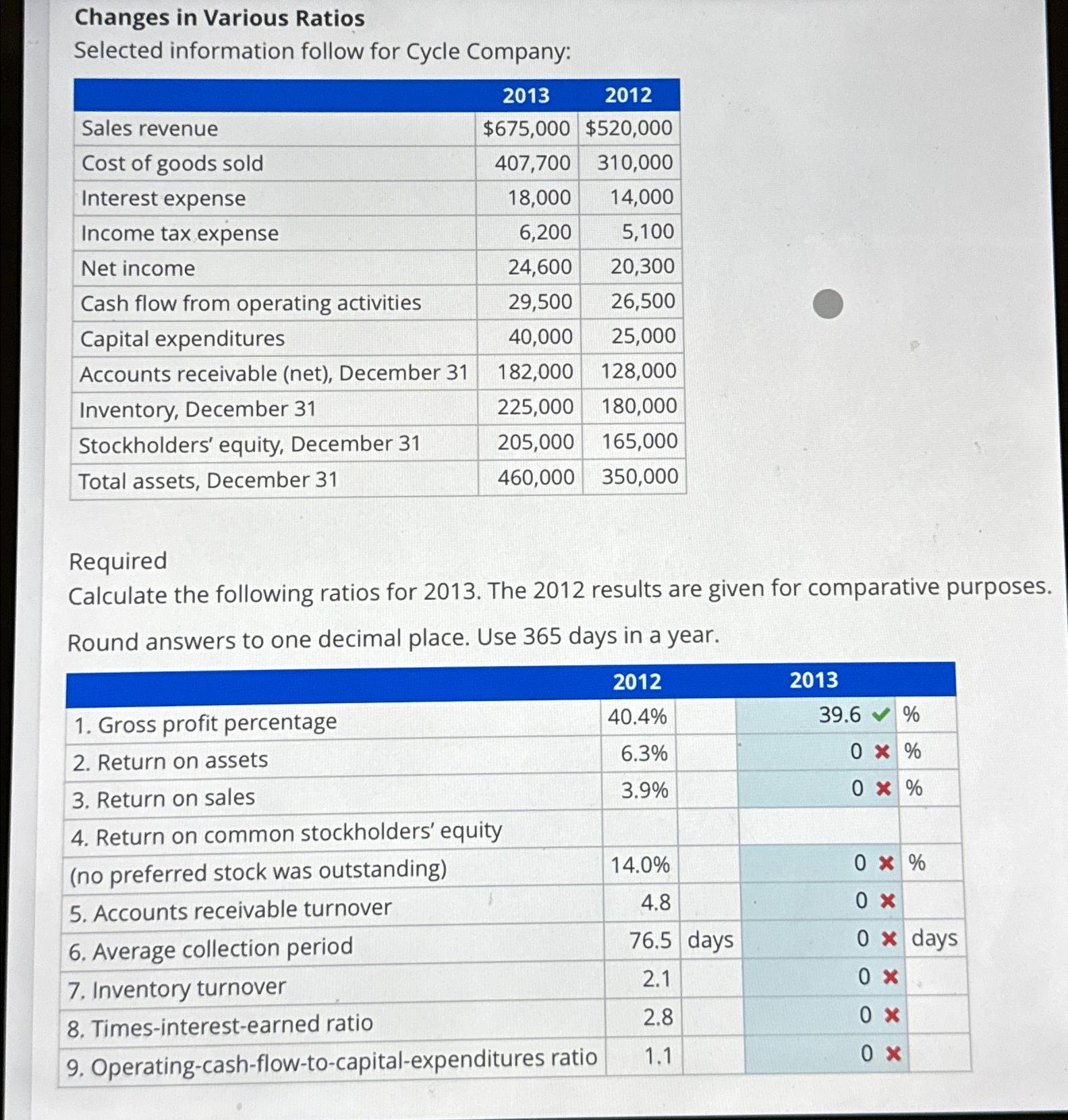

Changes in Various Ratios Selected information follow for Cycle Company: 2013 2012 Sales revenue Cost of goods sold $675,000 $520,000 407,700 310,000 Interest expense

Changes in Various Ratios Selected information follow for Cycle Company: 2013 2012 Sales revenue Cost of goods sold $675,000 $520,000 407,700 310,000 Interest expense 18,000 14,000 Income tax expense 6,200 5,100 Net income 24,600 20,300 Cash flow from operating activities 29,500 26,500 Capital expenditures 40,000 25,000 Accounts receivable (net), December 31 182,000 128,000 Inventory, December 31 Stockholders' equity, December 31 Total assets, December 31 225,000 180,000 205,000 165,000 460,000 350,000 Required Calculate the following ratios for 2013. The 2012 results are given for comparative purposes. Round answers to one decimal place. Use 365 days in a year. 2012 1. Gross profit percentage 40.4% 2. Return on assets 6.3% 3. Return on sales 3.9% 2013 39.6 % 0% 0% 4. Return on common stockholders' equity (no preferred stock was outstanding) 14.0% 0*% 5. Accounts receivable turnover 4.8 0% 6. Average collection period 76.5 days 0x days 7. Inventory turnover 2.1 0 * 8. Times-interest-earned ratio 2.8 0% 9. Operating-cash-flow-to-capital-expenditures ratio 1.1 0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started