Answered step by step

Verified Expert Solution

Question

1 Approved Answer

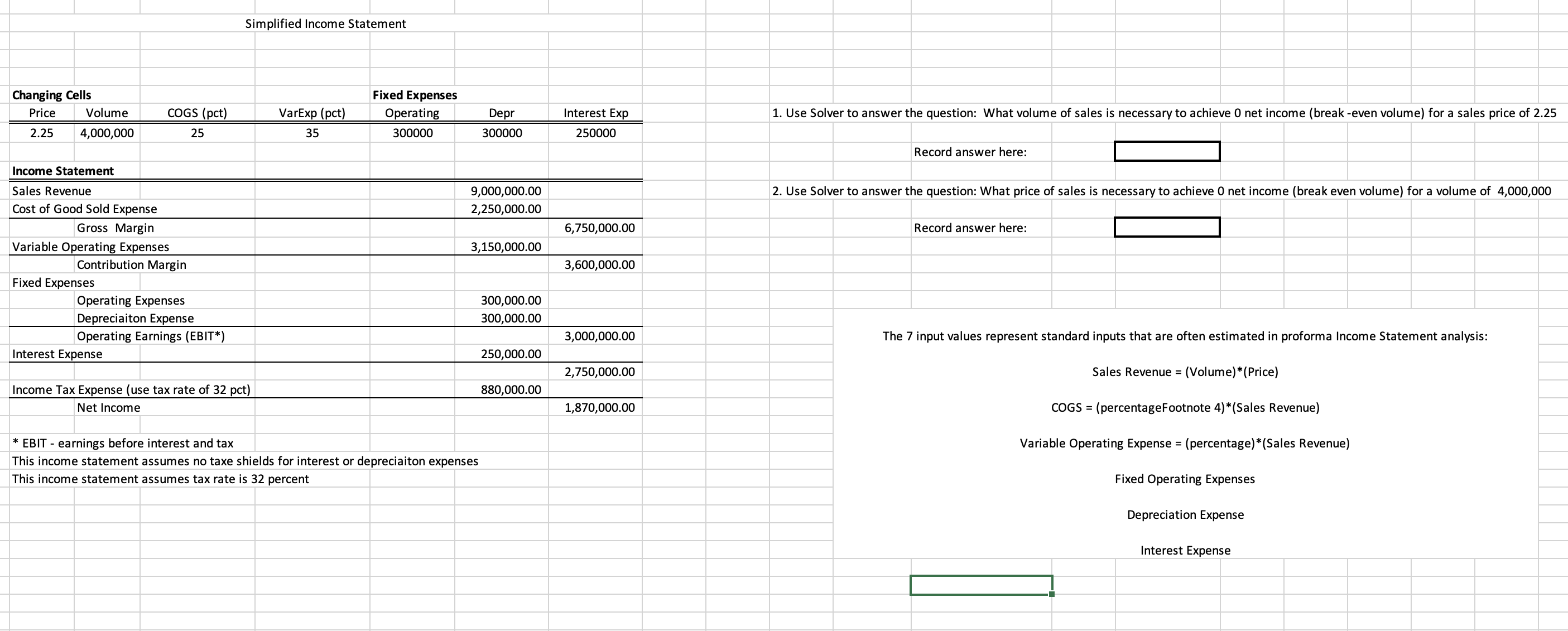

Changing Cells Price Volume 2.25 4,000,000 Income Statement Sales Revenue Cost of Good Sold Expense Gross Margin Variable Operating Expenses COGS (pct) 25 Contribution

Changing Cells Price Volume 2.25 4,000,000 Income Statement Sales Revenue Cost of Good Sold Expense Gross Margin Variable Operating Expenses COGS (pct) 25 Contribution Margin Fixed Expenses Operating Expenses Depreciaiton Expense Operating Earnings (EBIT*) Interest Expense Simplified Income Statement Income Tax Expense (use tax rate of 32 pct) Net Income VarExp (pct) 35 Fixed Expenses Operating 300000 Depr 300000 9,000,000.00 2,250,000.00 3,150,000.00 * EBIT - earnings before interest and tax This income statement assumes no taxe shields for interest or depreciaiton expenses This income statement assumes tax rate is 32 percent 300,000.00 300,000.00 250,000.00 880,000.00 Interest Exp 250000 6,750,000.00 3,600,000.00 3,000,000.00 2,750,000.00 1,870,000.00 1. Use Solver to answer the question: What volume of sales is necessary to achieve 0 net income (break-even volume) for a sales price of 2.25 Record answer here: 2. Use Solver to answer the question: What price of sales is necessary to achieve 0 net income (break even volume) for a volume of 4,000,000 Record answer here: The 7 input values represent standard inputs that are often estimated in proforma Income Statement analysis: Sales Revenue = (Volume)*(Price) COGS = (percentage Footnote 4)*(Sales Revenue) Variable Operating Expense = (percentage)*(Sales Revenue) Fixed Operating Expenses Depreciation Expense Interest Expense

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 What volume is needed to break even at a price of 225 Set up the income statement formula Net Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started