Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Changing the credit period Making changes to a firm's credit policy involves trade - offs. Assuming that all other factors remain constant, which of the

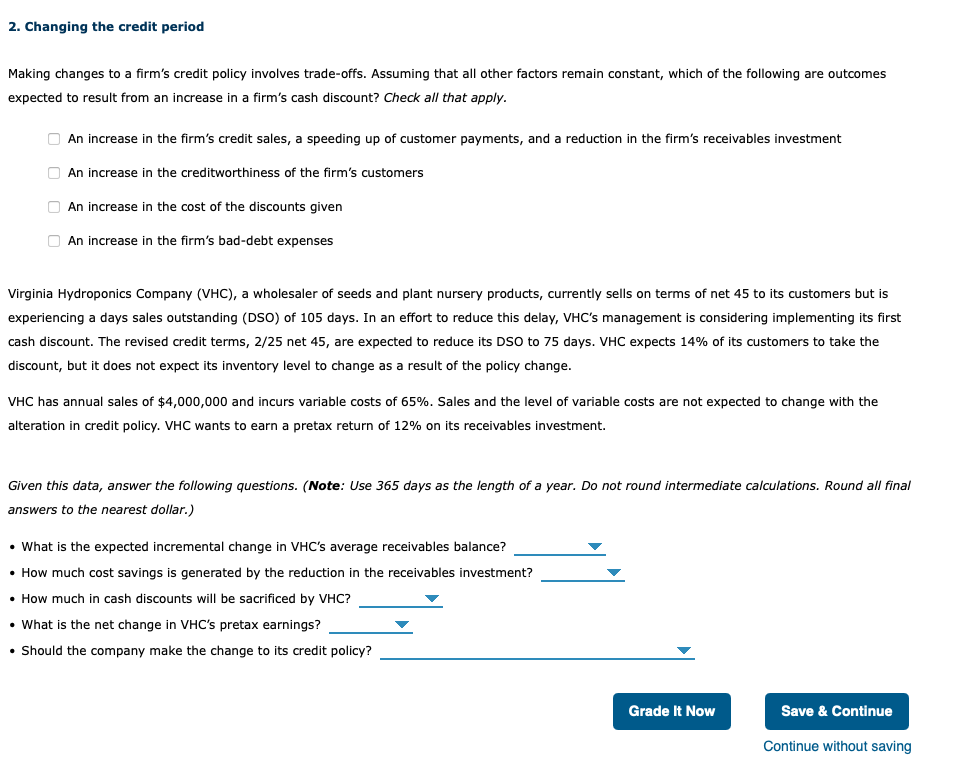

Changing the credit period

Making changes to a firm's credit policy involves tradeoffs. Assuming that all other factors remain constant, which of the following are outcomes

expected to result from an increase in a firm's cash discount? Check all that apply.

An increase in the firm's credit sales, a speeding up of customer payments, and a reduction in the firm's receivables investment

An increase in the creditworthiness of the firm's customers

An increase in the cost of the discounts given

An increase in the firm's baddebt expenses

Virginia Hydroponics Company VHC a wholesaler of seeds and plant nursery products, currently sells on terms of net to its customers but is

experiencing a days sales outstanding DSO of days. In an effort to reduce this delay, VHCs management is considering implementing its first

cash discount. The revised credit terms, net are expected to reduce its DSO to days. VHC expects of its customers to take the

discount, but it does not expect its inventory level to change as a result of the policy change.

VHC has annual sales of $ and incurs variable costs of Sales and the level of variable costs are not expected the

alteration in credit policy. VHC wants to earn a pretax return of on its receivables investment.

Given this data, answer the following questions. Note: Use days as the length of a year. Do not round intermediate calculations. Round all final

answers to the nearest dollar.

What is the expected incremental change in VHCs average receivables balance?

How much cost savings is generated by the reduction in the receivables investment?

How much in cash discounts will be sacrificed by VHC

What is the net change in VHCs pretax earnings?

Should the company make the change to its credit policy?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started