Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chang's Consulting Inc. (Chang's), which provides architectural consulting services, has a December 31 year end. It prepares its financial statements in accordance with IFRS.

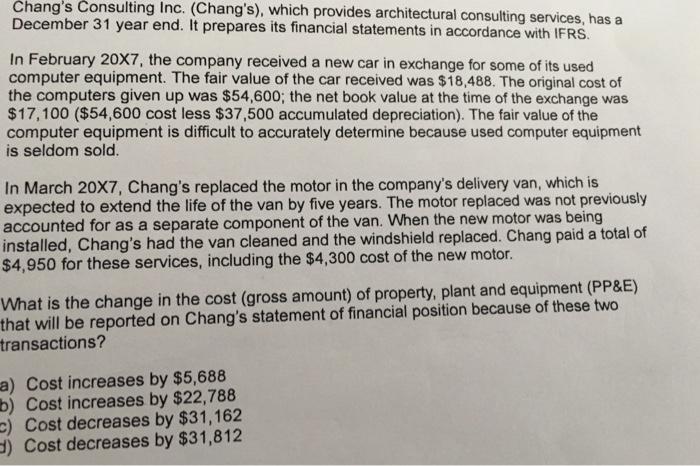

Chang's Consulting Inc. (Chang's), which provides architectural consulting services, has a December 31 year end. It prepares its financial statements in accordance with IFRS. In February 20X7, the company received a new car in exchange for some of its used computer equipment. The fair value of the car received was $18,488. The original cost of the computers given up was $54,600; the net book value at the time of the exchange was $17,100 ($54,600 cost less $37,500 accumulated depreciation). The fair value of the computer equipment is difficult to accurately determine because used computer equipment is seldom sold. In March 20X7, Chang's replaced the motor in the company's delivery van, which is expected to extend the life of the van by five years. The motor replaced was not previously accounted for as a separate component of the van. When the new motor was being installed, Chang's had the van cleaned and the windshield replaced. Chang paid a total of $4,950 for these services, including the $4,300 cost of the new motor. What is the change in the cost (gross amount) of property, plant and equipment (PP&E) that will be reported on Chang's statement of financial position because of these two transactions? a) Cost increases by $5,688 b) Cost increases by $22,788 C) Cost decreases by $31,162 d) Cost decreases by $31,812

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started