Answered step by step

Verified Expert Solution

Question

1 Approved Answer

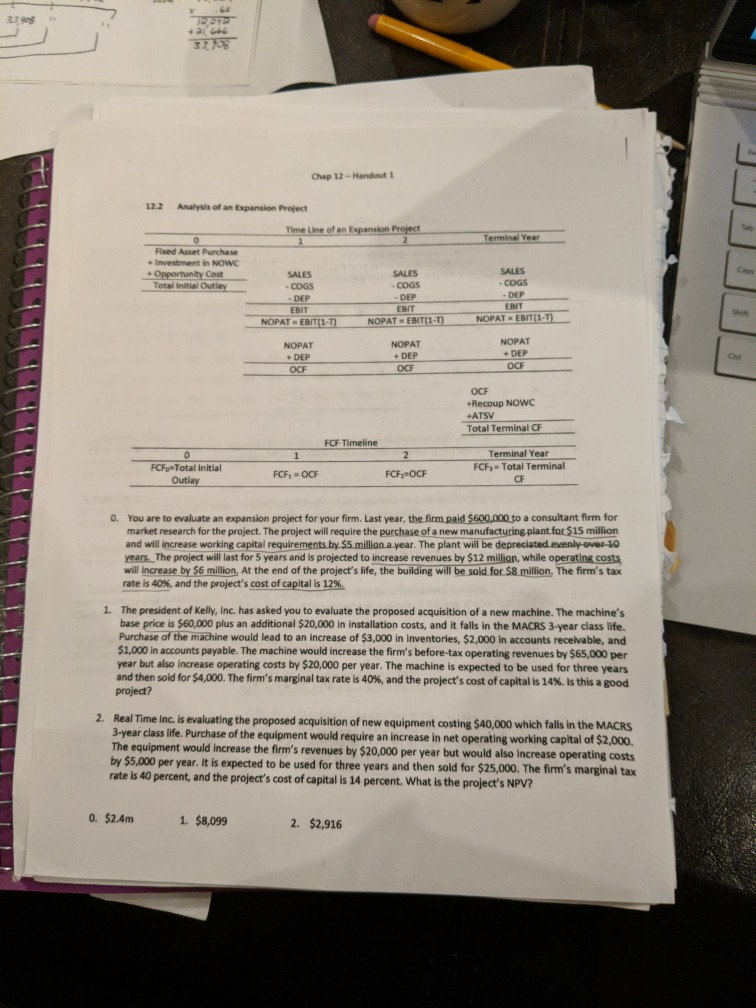

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES

Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES Opportunity Cost Total Initial Outiay NOPAT-EBIT NOPAT . EBIT(1M NOPAT-EBTan NOPAT DEP OCF NOPAT + DEP OCF NOPAT + DEP OCF Cthr OCF Recoup NOwc +ATSV Total Teminal CF FCF Timeline Terminal Year FCFs Total Terminal CF FCFo Total initial 0. You are to evaluate an expansion project for your firm. Last year, the firm paid $600,000 to a consultant firm for market research for the project. The project will require the purchase of a new manufacturing plant for $15 million and will increase working capital requirements by $5 million a year. The plant will be depreciated evenly-over10 years. The project will last for 5 years and is projected to increase revenues by $12 million, while operating costs will increase by $6 million, At the end of the project's life, the building will be sold for $8 million, The firm's tax rate is 40%, and the project's costofcapitalis12%. 1. The president of Kelly, Inc. has asked you to evaluate the proposed acquisition of a new machine. The machine's base price is $60,000 plus an additional $20,000 in installation costs, and it falls in the MACRS 3-year class life. Purchase of the machine would lead to an increase of $3,000 in inventories, $2,000 in accounts receivable, and $1,000 in accounts payable. The machine would increase the firm's before-tax operating revenues by $65,000 per year but also increase operating costs by $20,000 per year. The machine is expected to be used for three years and then sold for $4,000. The firm's marginal tax rate is 40%, and the project's cost of capital is 14%. Is this a good project? 2. Real Time Inc. is evaluating the proposed acquisition of new equipment costing $40,000 which falls in the MACRS 3-year class life. Purchase of the equipment would require an increase in net operating working capital of $2,000 The equipment would increase the firm's revenues by $20,000 per year but would also increase operating costs by $5,000 per year. it is expected to be used for three years and then sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent. What is the project's NPV? 0. $2.4m 1. $8,099 2. $2,916 Chap 12- Handout 1 12.2 Analysis of an Expansion Project Fxed Asset Purchase + Investment in NOWC SALES COGS DEP EBIT SALES COGS DEP SALES Opportunity Cost Total Initial Outiay NOPAT-EBIT NOPAT . EBIT(1M NOPAT-EBTan NOPAT DEP OCF NOPAT + DEP OCF NOPAT + DEP OCF Cthr OCF Recoup NOwc +ATSV Total Teminal CF FCF Timeline Terminal Year FCFs Total Terminal CF FCFo Total initial 0. You are to evaluate an expansion project for your firm. Last year, the firm paid $600,000 to a consultant firm for market research for the project. The project will require the purchase of a new manufacturing plant for $15 million and will increase working capital requirements by $5 million a year. The plant will be depreciated evenly-over10 years. The project will last for 5 years and is projected to increase revenues by $12 million, while operating costs will increase by $6 million, At the end of the project's life, the building will be sold for $8 million, The firm's tax rate is 40%, and the project's costofcapitalis12%. 1. The president of Kelly, Inc. has asked you to evaluate the proposed acquisition of a new machine. The machine's base price is $60,000 plus an additional $20,000 in installation costs, and it falls in the MACRS 3-year class life. Purchase of the machine would lead to an increase of $3,000 in inventories, $2,000 in accounts receivable, and $1,000 in accounts payable. The machine would increase the firm's before-tax operating revenues by $65,000 per year but also increase operating costs by $20,000 per year. The machine is expected to be used for three years and then sold for $4,000. The firm's marginal tax rate is 40%, and the project's cost of capital is 14%. Is this a good project? 2. Real Time Inc. is evaluating the proposed acquisition of new equipment costing $40,000 which falls in the MACRS 3-year class life. Purchase of the equipment would require an increase in net operating working capital of $2,000 The equipment would increase the firm's revenues by $20,000 per year but would also increase operating costs by $5,000 per year. it is expected to be used for three years and then sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent. What is the project's NPV? 0. $2.4m 1. $8,099 2. $2,916

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started