CHAP 2 Q9

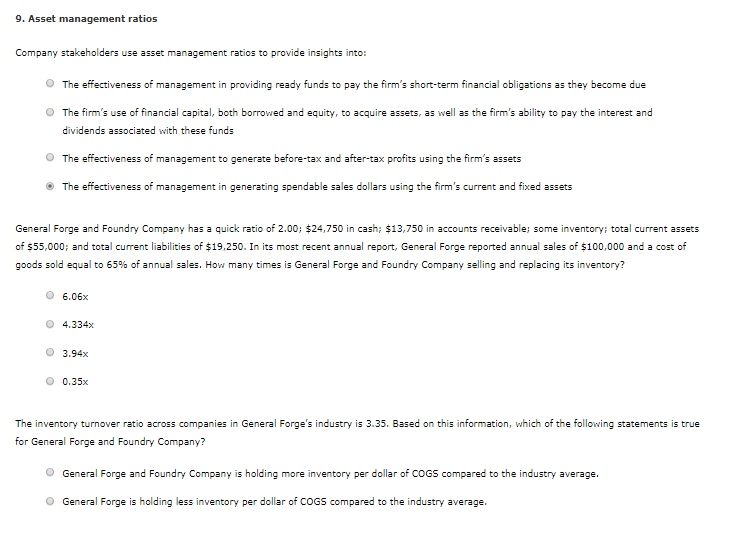

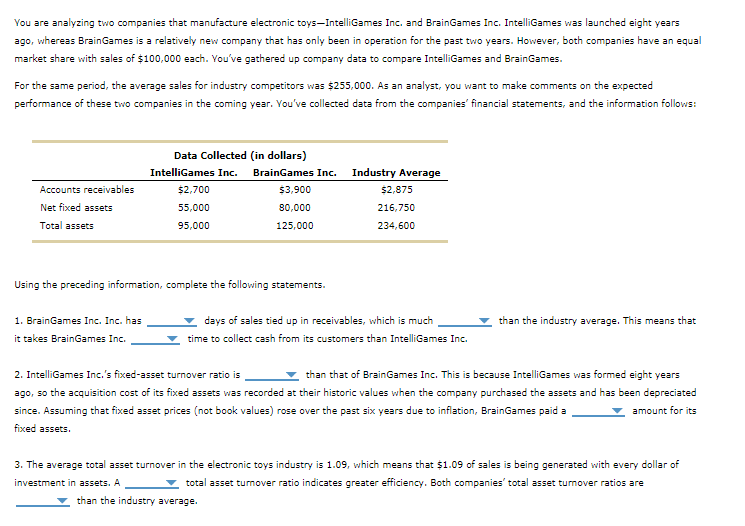

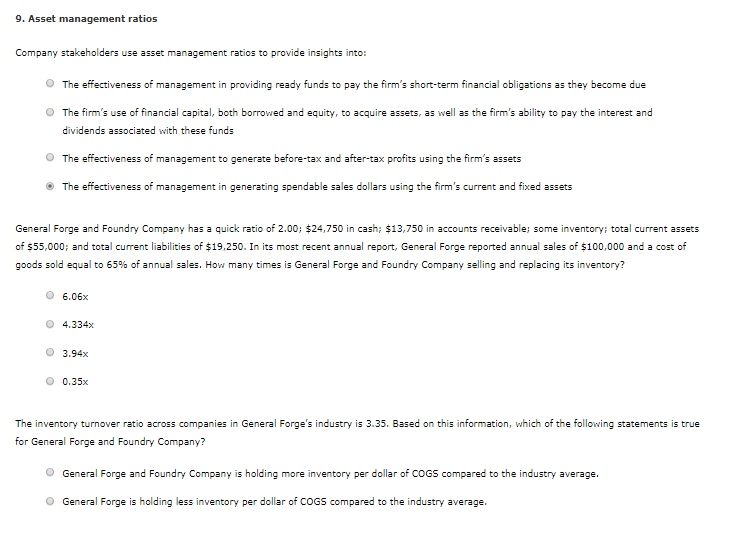

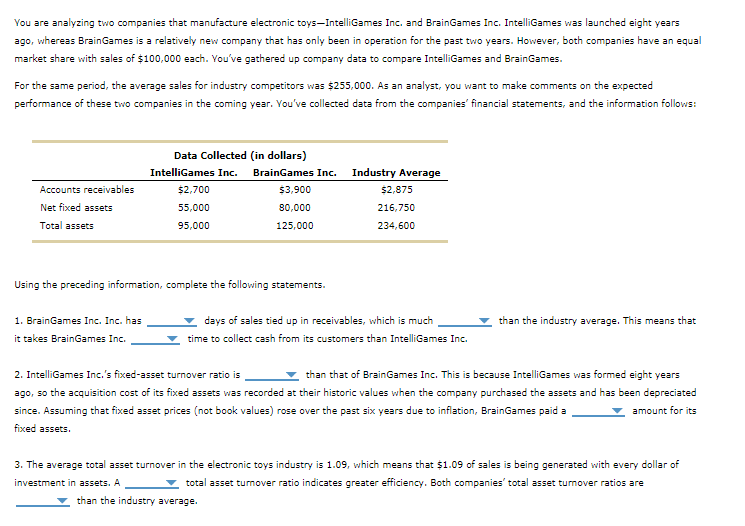

9. Asset management ratios Company stakeholders use asset management ratios to provide insights into: The effectiveness of management in providing ready funds to pay the firm's short-term financial obligations as they become due The firm's use of financial capital, both borrowed and equity, to acquire assets, as well as the firm's ability to pay the interest and dividends associated with these funds The effectiveness of management to generate before-tax and after-tax profits using the firm's assets The effectiveness of management in generating spendable sales dollars using the firm's current and fixed assets General Forge and Foundry Company has a quick ratio of 2.00; $24,750 in cash; $13,750 in accounts receivable; some inventory; total current assets of $55,000; and total current liabilities of $19,250. In its most recent annual report, General Forge reported annual sales of $100,000 and a cost of goods sold equal to 65% of annual sales. How many times is General Forge and Foundry Company selling and replacing its inventory? O 6.06% 4.334x 3.94x O 0.35x The inventory turnover ratio across companies in General Forge's industry is 3.35. Based on this information, which of the following statements is true for General Forge and Foundry Company? General Forge and Foundry Company is holding more inventory per dollar of COGS compared to the industry average. General Forge is holding less inventory per dollar of COGS compared to the industry average. You are analyzing two companies that manufacture electronic toys-IntelliGames Inc. and BrainGames Inc. IntelliGames was launched eight years ago, whereas Brain Games is a relatively new company that has only been in operation for the past two years. However, both companies have an equal market share with sales of $100,000 each. You've gathered up company data to compare IntelliGames and Brain Games. For the same period, the average sales for industry competitors was $255,000. As an analyst, you want to make comments on the expected performance of these two companies in the coming year. You've collected data from the companies' financial statements, and the information follows: Accounts receivables Net fixed assets Total assets Data Collected (in dollars) IntelliGames Inc. BrainGames Inc. $2,700 $3,900 55,000 80,000 95,000 125,000 Industry Average 52,875 216,750 234,600 Using the preceding information, complete the following statements. than the industry average. This means that 1. Brain Games Inc. Inc. has it takes Brain Games Inc. days of sales tied up in receivables, which is much time to collect cash from its customers than IntelliGames Inc. 2. IntelliGames Inc.'s fixed-asset turnover ratio is than that of Brain Games Inc. This is because IntelliGames was formed eight years ago, so the acquisition cost of its fixed assets was recorded at their historic values when the company purchased the assets and has been depreciated since. Assuming that fixed asset prices (not book values) rose over the past six years due to inflation, BrainGames paid a - amount for its fixed assets. 3. The average total asset turnover in the electronic toys industry is 1.09, which means that $1.09 of sales is being generated with every dollar of investment in assets. A total asset tumover ratio indicates greater efficiency. Both companies' total asset tumover ratios are than the industry average