Question

CHAP 22/25 - If you're not able to answer each question, please skip entirely. Thank you. 1) Leno Company makes swimsuits and sells these suits

CHAP 22/25 - If you're not able to answer each question, please skip entirely. Thank you.

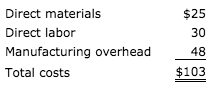

1) Leno Company makes swimsuits and sells these suits directly to retailers. Although Leno has a variety of suits, it does not make the All-Body suit used by highly skilled swimmers. The market research department believes that a strong market exists for this type of suit. The department indicates that the All-Body suit would sell for approximately $105. Given its experience, Leno believes the All-Body suit would have the following manufacturing costs.

What is the highest acceptable manufacturing cost Leno would be willing to incur to produce the All-Body swimsuit, if it desired a profit of $27 per unit? (Assume target costing.) ____________________________________________________________

2) Rap Corporation produces outdoor portable fireplace units. The following per unit cost information is available: direct materials $25, direct labor $28, variable manufacturing overhead $19, fixed manufacturing overhead $21, variable selling and administrative expenses $14, and fixed selling and administrative expenses $13. The company's ROI per unit is $17.

Compute Rap Corporations markup percentage using variable-cost pricing. (Round answer to 2 decimal places, e.g. 10.50.)

_____________________________________________________________

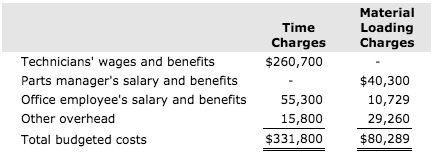

3) Second Chance Welding rebuilds spot welders for manufacturers. The following budgeted cost data for 2017 is available for Second Chance.

The company desires a $38.00 profit margin per hour of labor and a 24.00% profit margin on parts. It has budgeted for 7,900 hours of repair time in the coming year, and estimates that the total invoice cost of parts and materials in 2017 will be $418,000. Compute the material loading percentage. (Round answer to 3 decimal places, e.g. 10.501.) _____________________________________________________________________

4)

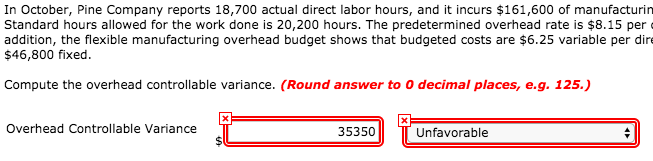

$25 30 Direct materials Direct labor Manufacturing overhead Total costs 48 $103 Time Charges $260,700 Material Loading Charges Technicians' wages and benefits Parts manager's salary and benefits Office employee's salary and benefits Other overhead Total budgeted costs 55,300 15,800 $331,800 $40,300 10,729 29,260 $80,289 In October, Pine Company reports 18,700 actual direct labor hours, and it incurs $161,600 of manufacturin Standard hours allowed for the work done is 20,200 hours. The predetermined overhead rate is $8.15 per addition, the flexible manufacturing overhead budget shows that budgeted costs are $6.25 variable per dire $46,800 fixed. Compute the overhead controllable variance. (Round answer to 0 decimal places, e.g. 125.) Overhead Controllable Variance 35350 Unfavorable $25 30 Direct materials Direct labor Manufacturing overhead Total costs 48 $103 Time Charges $260,700 Material Loading Charges Technicians' wages and benefits Parts manager's salary and benefits Office employee's salary and benefits Other overhead Total budgeted costs 55,300 15,800 $331,800 $40,300 10,729 29,260 $80,289 In October, Pine Company reports 18,700 actual direct labor hours, and it incurs $161,600 of manufacturin Standard hours allowed for the work done is 20,200 hours. The predetermined overhead rate is $8.15 per addition, the flexible manufacturing overhead budget shows that budgeted costs are $6.25 variable per dire $46,800 fixed. Compute the overhead controllable variance. (Round answer to 0 decimal places, e.g. 125.) Overhead Controllable Variance 35350 Unfavorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started