Answered step by step

Verified Expert Solution

Question

1 Approved Answer

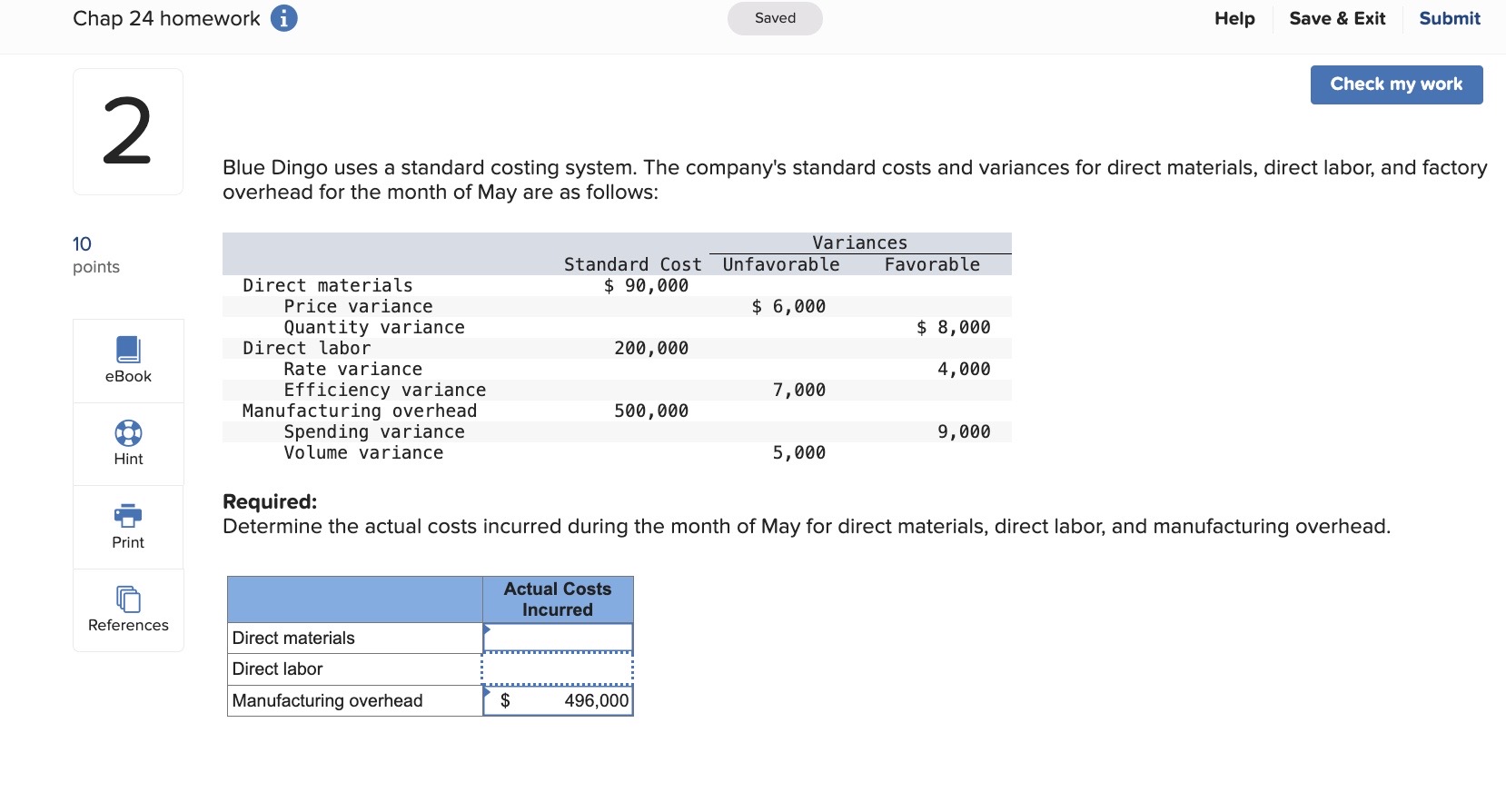

Chap 24 homework i 2 10 points Saved Help Save & Exit Submit Check my work Blue Dingo uses a standard costing system. The

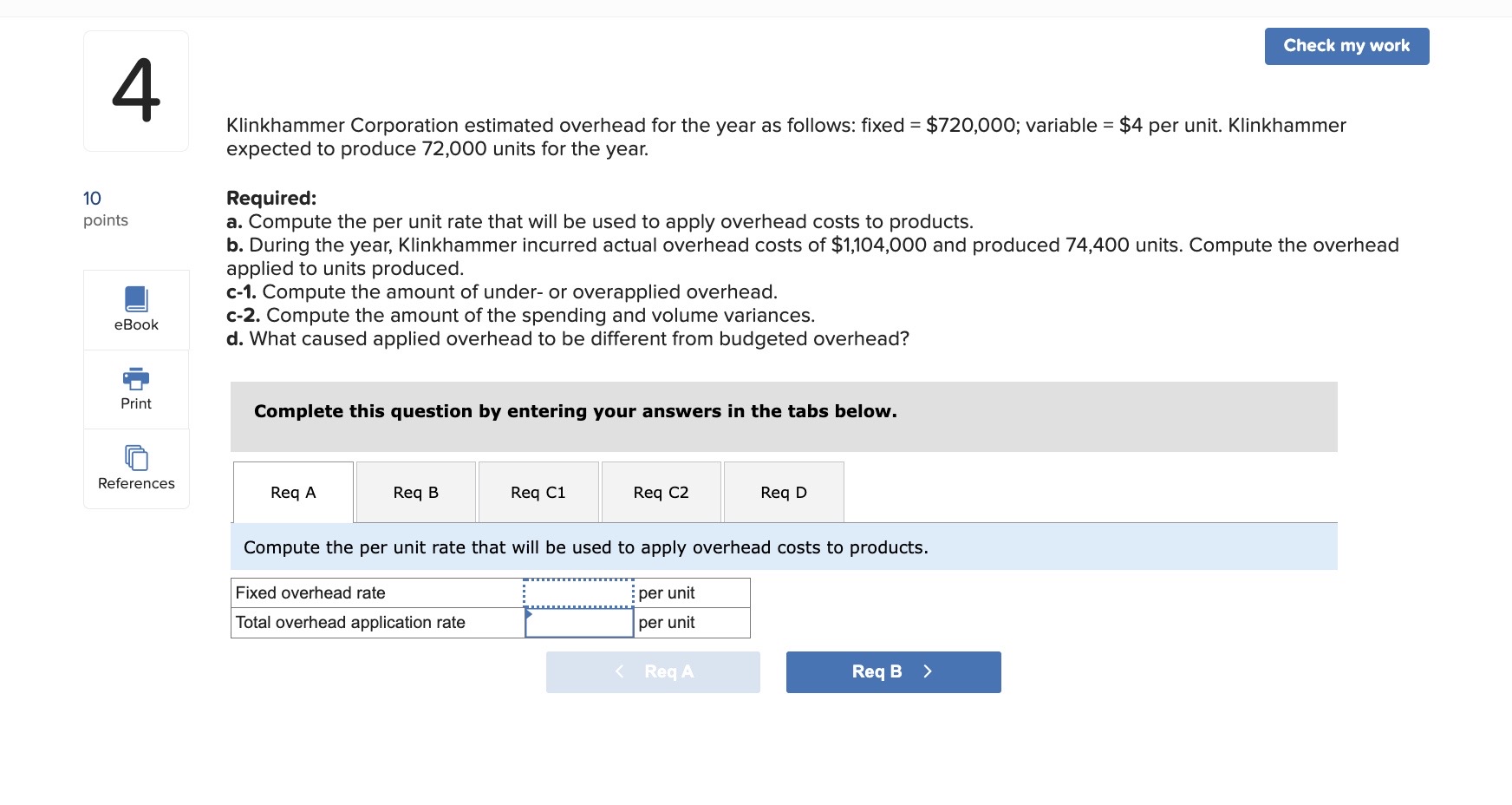

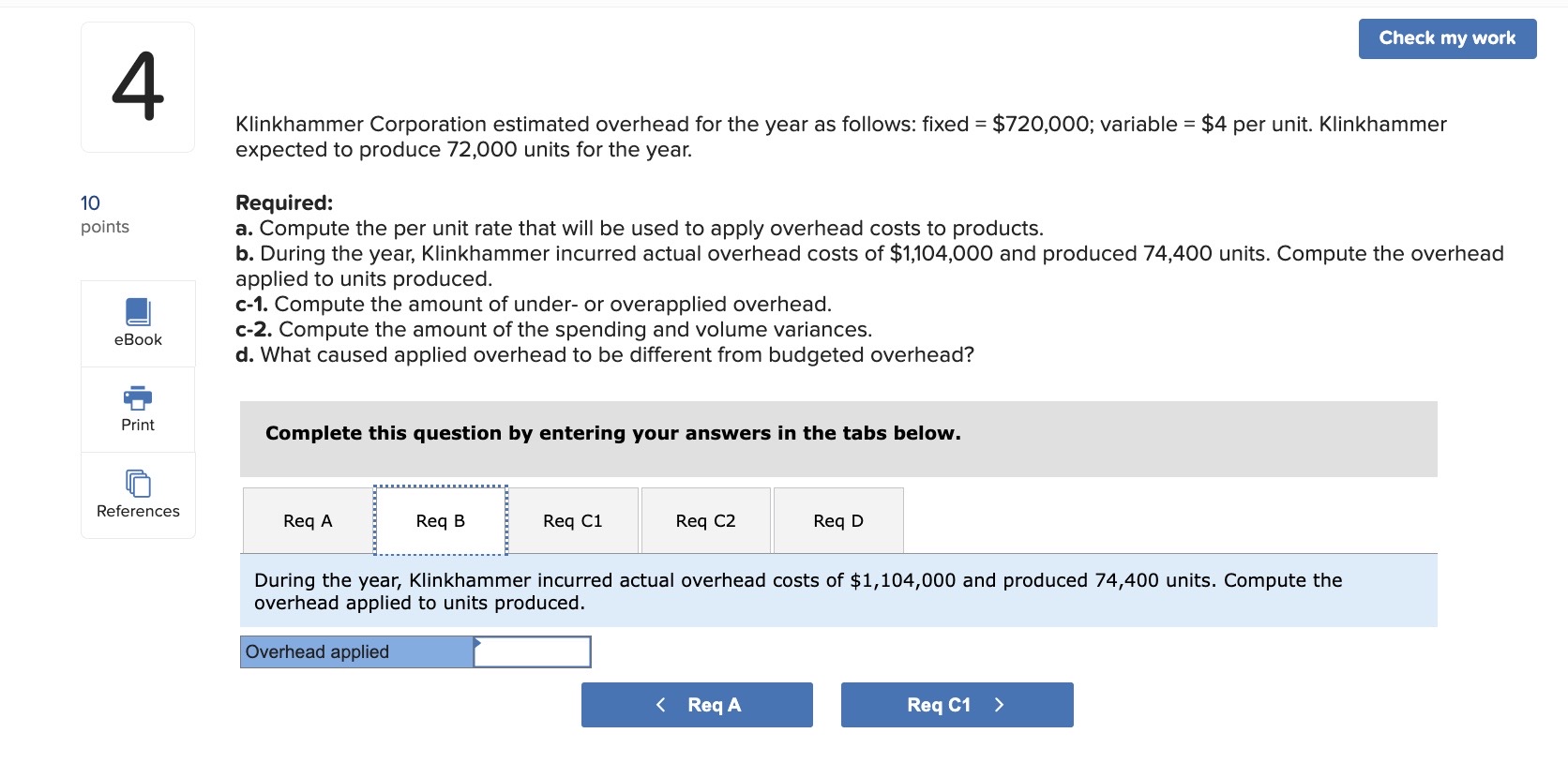

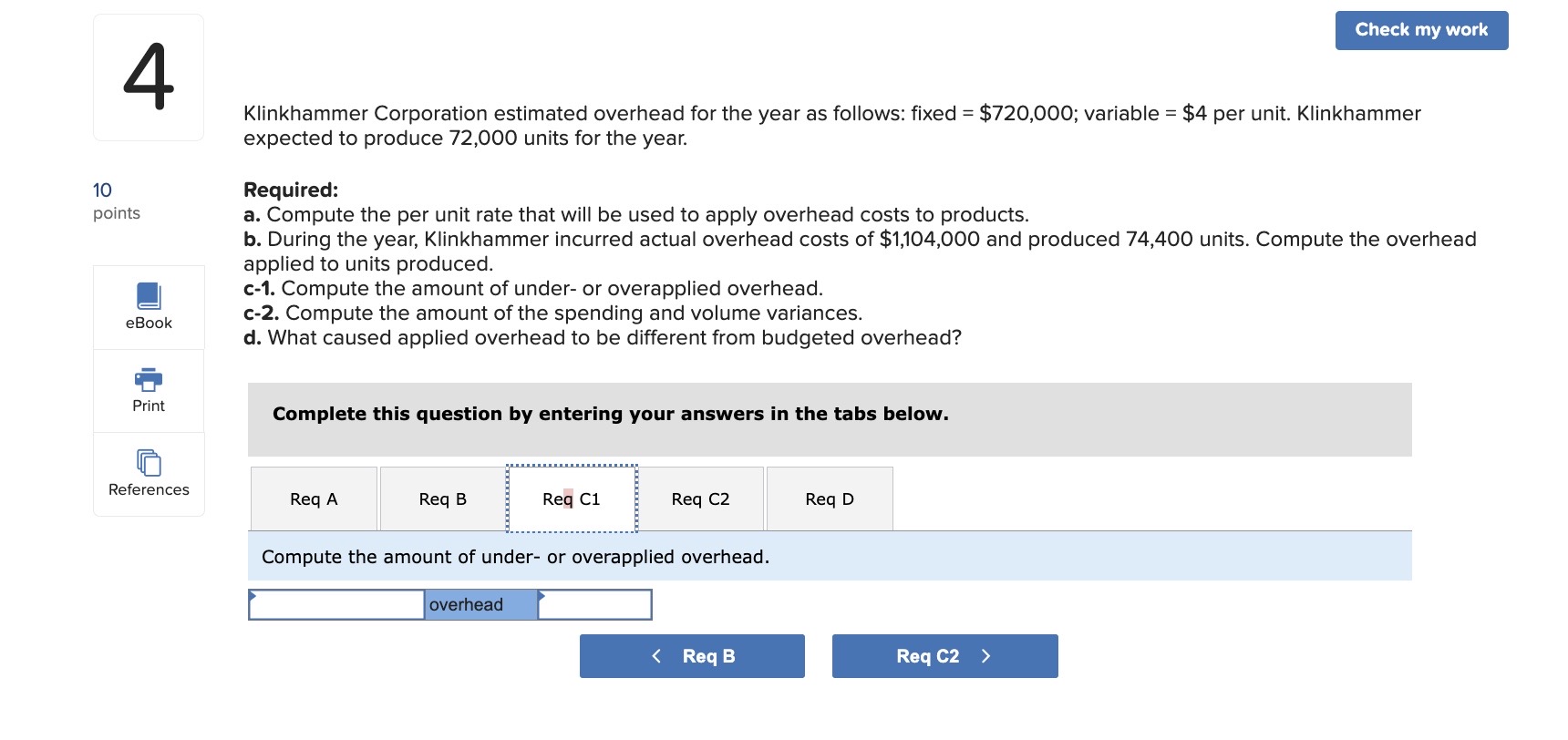

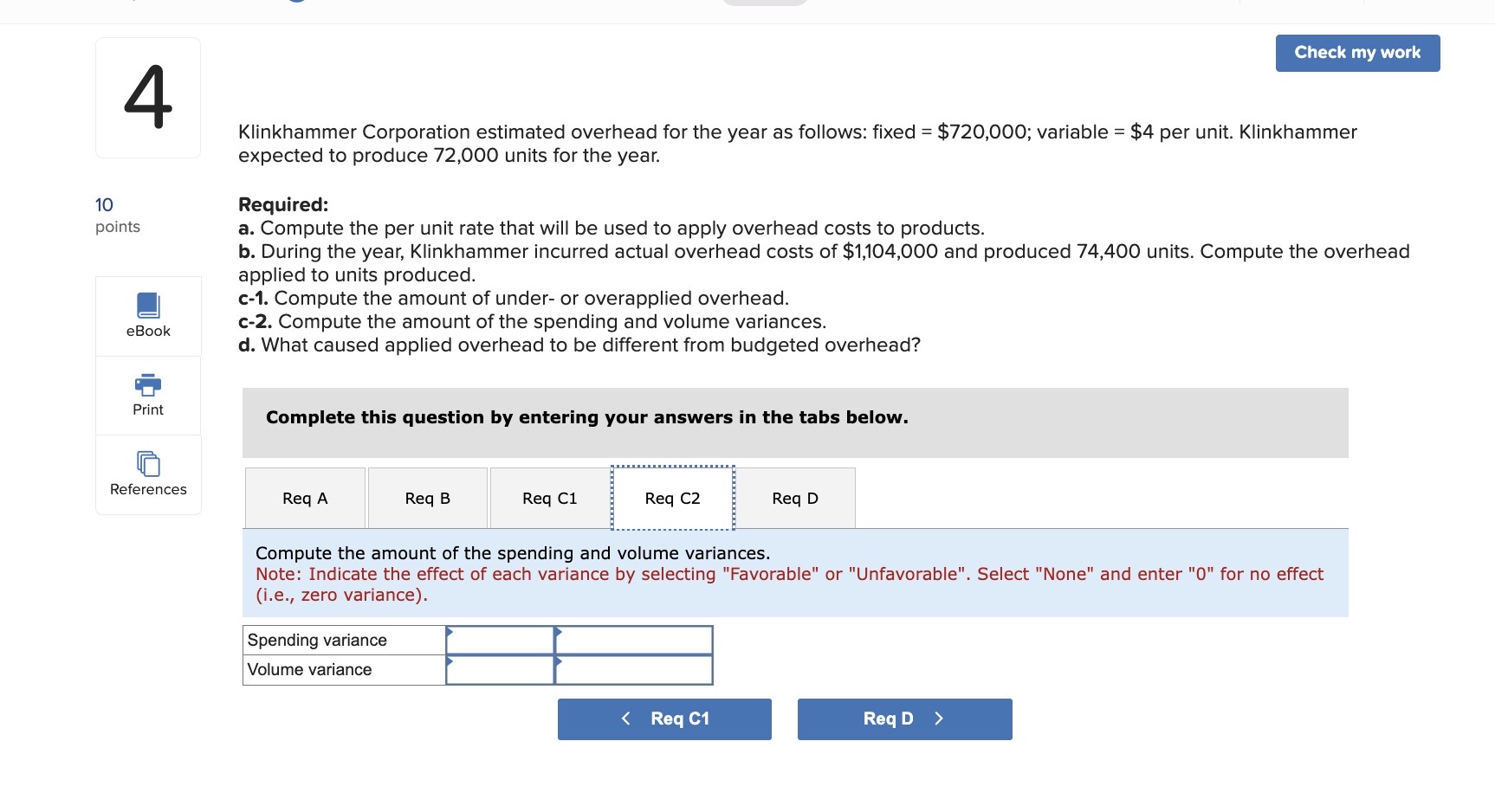

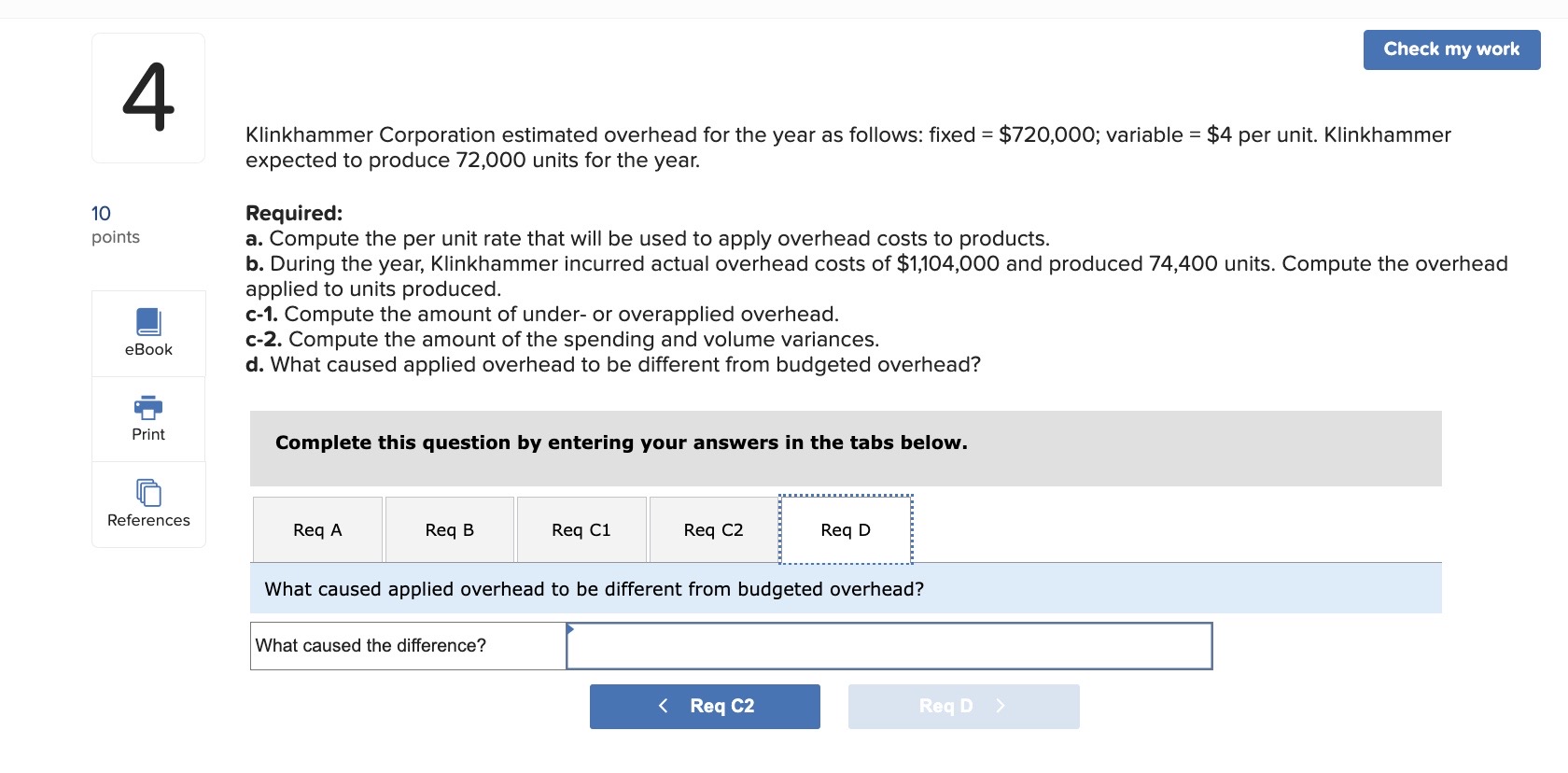

Chap 24 homework i 2 10 points Saved Help Save & Exit Submit Check my work Blue Dingo uses a standard costing system. The company's standard costs and variances for direct materials, direct labor, and factory overhead for the month of May are as follows: Variances Standard Cost Unfavorable Favorable Direct materials $ 90,000 Price variance Quantity variance $ 6,000 $ 8,000 200,000 4,000 eBook O Direct labor Rate variance Efficiency variance Manufacturing overhead Spending variance Volume variance Hint Required: Print 7,000 500,000 9,000 5,000 Determine the actual costs incurred during the month of May for direct materials, direct labor, and manufacturing overhead. Actual Costs Incurred References Direct materials Direct labor Manufacturing overhead $ 496,000 Check my work 4 10 points eBook Klinkhammer Corporation estimated overhead for the year as follows: fixed = $720,000; variable = $4 per unit. Klinkhammer expected to produce 72,000 units for the year. Required: a. Compute the per unit rate that will be used to apply overhead costs to products. b. During the year, Klinkhammer incurred actual overhead costs of $1,104,000 and produced 74,400 units. Compute the overhead applied to units produced. c-1. Compute the amount of under- or overapplied overhead. c-2. Compute the amount of the spending and volume variances. d. What caused applied overhead to be different from budgeted overhead? Print Complete this question by entering your answers in the tabs below. References Req A Req B Req C1 Req C2 Req D Compute the per unit rate that will be used to apply overhead costs to products. Fixed overhead rate per unit Total overhead application rate per unit < Req A Req B > Check my work 4 10 points eBook Klinkhammer Corporation estimated overhead for the year as follows: fixed = $720,000; variable = $4 per unit. Klinkhammer expected to produce 72,000 units for the year. Required: a. Compute the per unit rate that will be used to apply overhead costs to products. b. During the year, Klinkhammer incurred actual overhead costs of $1,104,000 and produced 74,400 units. Compute the overhead applied to units produced. c-1. Compute the amount of under- or overapplied overhead. c-2. Compute the amount of the spending and volume variances. d. What caused applied overhead to be different from budgeted overhead? Print Complete this question by entering your answers in the tabs below. References Req A Req B Req C1 Req C2 Req D During the year, Klinkhammer incurred actual overhead costs of $1,104,000 and produced 74,400 units. Compute the overhead applied to units produced. Overhead applied < Req A Req C1 > Check my work 4 10 points eBook Klinkhammer Corporation estimated overhead for the year as follows: fixed = $720,000; variable = $4 per unit. Klinkhammer expected to produce 72,000 units for the year. Required: a. Compute the per unit rate that will be used to apply overhead costs to products. b. During the year, Klinkhammer incurred actual overhead costs of $1,104,000 and produced 74,400 units. Compute the overhead applied to units produced. c-1. Compute the amount of under- or overapplied overhead. c-2. Compute the amount of the spending and volume variances. d. What caused applied overhead to be different from budgeted overhead? Print Complete this question by entering your answers in the tabs below. References Req A Req B Req C1 Req C2 Req D Compute the amount of under- or overapplied overhead. overhead < Req B Req C2 > Check my work 4 Klinkhammer Corporation estimated overhead for the year as follows: fixed = $720,000; variable = $4 per unit. Klinkhammer expected to produce 72,000 units for the year. 10 points Required: eBook a. Compute the per unit rate that will be used to apply overhead costs to products. b. During the year, Klinkhammer incurred actual overhead costs of $1,104,000 and produced 74,400 units. Compute the overhead applied to units produced. c-1. Compute the amount of under- or overapplied overhead. c-2. Compute the amount of the spending and volume variances. d. What caused applied overhead to be different from budgeted overhead? Print Complete this question by entering your answers in the tabs below. References Req A Req B Req C1 Req C2 Req D Compute the amount of the spending and volume variances. Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance). Spending variance Volume variance < Req C1 Req D > Check my work 4 Klinkhammer Corporation estimated overhead for the year as follows: fixed $720,000; variable = $4 per unit. Klinkhammer expected to produce 72,000 units for the year. 10 points Required: eBook a. Compute the per unit rate that will be used to apply overhead costs to products. b. During the year, Klinkhammer incurred actual overhead costs of $1,104,000 and produced 74,400 units. Compute the overhead applied to units produced. c-1. Compute the amount of under- or overapplied overhead. c-2. Compute the amount of the spending and volume variances. d. What caused applied overhead to be different from budgeted overhead? Print Complete this question by entering your answers in the tabs below. References Req A Req B Req C1 Req C2 Req D What caused applied overhead to be different from budgeted overhead? What caused the difference? < Req C2 Req D >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started