Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 1 4 . Real Options Assume that you have just been hired as a financial analyst by Tropical Sweets Inc., a mid - alized

Chapter Real Options

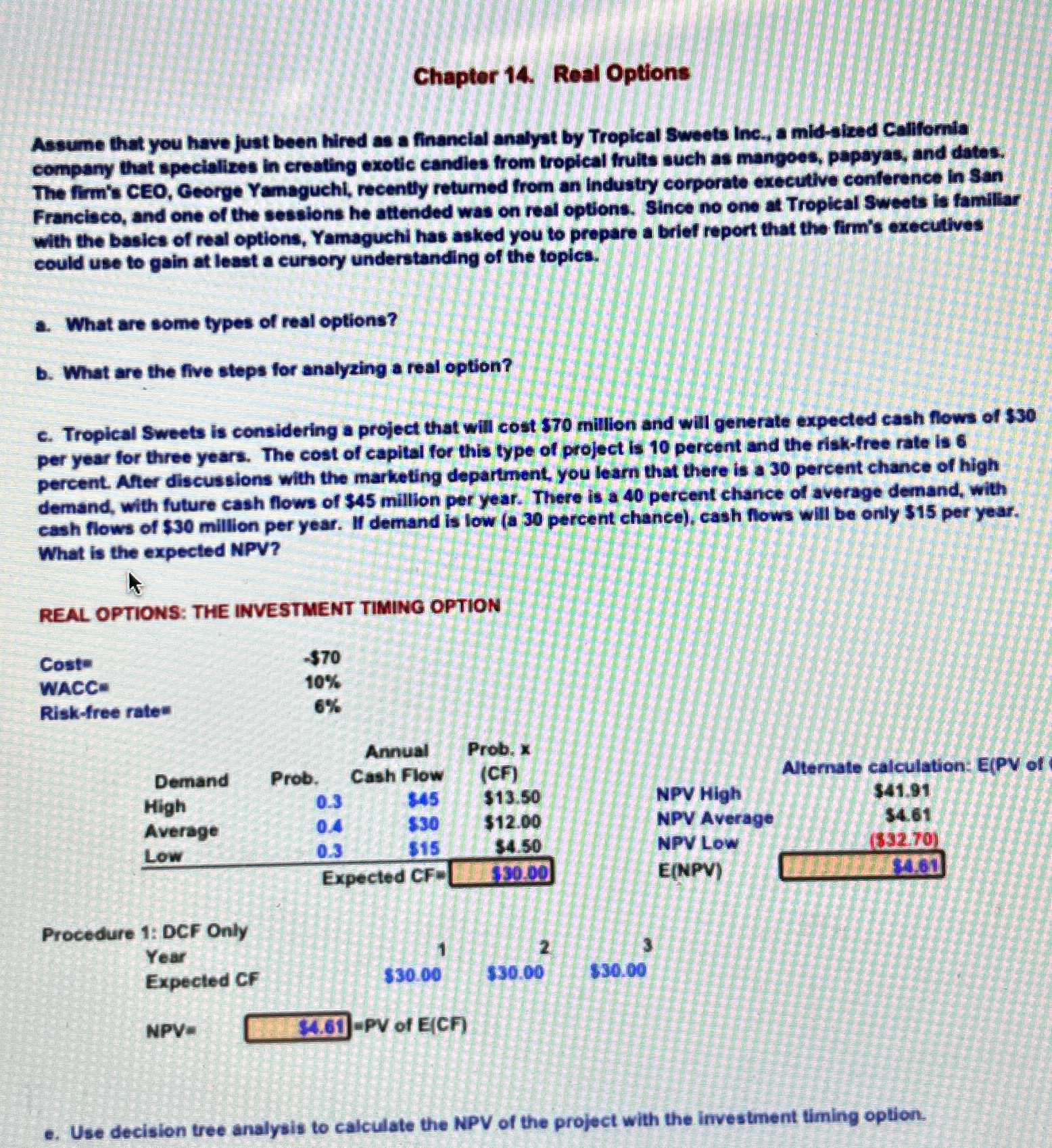

Assume that you have just been hired as a financial analyst by Tropical Sweets Inc., a midalized Callitornia company that specializes in creating exotic candies from tropical fruits such as mangoes, papayas, and dates. The firm's CEO, George Yamaguchi, recently returned trom an industry corporate executlve conference in San Francisco, and one of the sessions he attended was on real options. Since ne one at Tropical Sweets is familiar with the basies of real options, Yamaguchi has asked you to prepare a brief report that the firm's executives could use to gain at least a cursory understanding of the topics.

a What are some types of real options?

b What are the five steps for analyzing a real option?

c Tropical Sweets is considering a project that will cost $ million and will generate expected cash flows of $ per year for three years. The cost of capital for this type of project is percent and the riskfree rate is percent. After discussions with the marketing department, you learn that there is a percent chance of high demand, with future cash flows of $ million per year. There is a percent chance of average demand, with cash flows of $ million per year. If demand is low a percent chance cash flows will be only $ per year. What is the expected NPV

REAL OPTIONS: THE INVESTMENT TIMING OPTION

tableCoste$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started