Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 1 Assignment Investing Money FM30.1 Demonstrate understanding of financial decision making including compound interest and investment portfolios. A = P + Prt I =

Chapter 1 Assignment Investing Money

FM30.1 Demonstrate understanding of financial decision making including compound interest and investment portfolios.

A = P + Prt I = Prt

Alex is 22 and would like to utilize her current investment portfolio towards the purchase of a house. Her investments are as follows:

When she was 5 her grandma bought her a $6000 Canada Savings Bond which earned 5.4% simple interest.

When she was 11 she was given a $7000 GIC which earned 4.8% interest compounded quarterly.

What is the current value of each of these investments?

What total amount does she have to put towards a down payment on a home?

When Katie was 8 her grandparents bought her a $2500 CSB that earned simple interest

When she turned 20 her CSB was worth $4420. What was the interest rate on the CSB?

Heidi is looking to make a large purchase in the next few years but only has half of the amount that she needs. Approximately how long will it take for her to double her money if she is investing in an account that earns 11.1% interest compounded semi-annually?

Don and his son Matthew opened accounts at the same time. Each account earned 7.2% interest compounded semi-annually.

Don kept his account for 18 years and how was $147 000 in the account

Matthew kept his account for 24 years and now has $162 000 in the account.

Who invested the greater principal?

How much more did he invest?

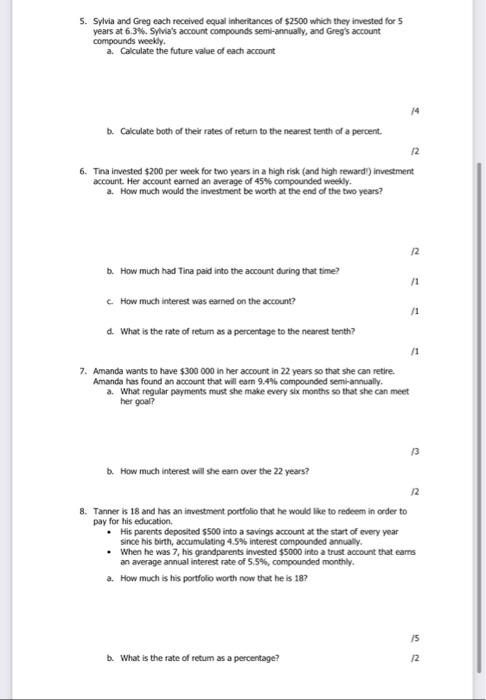

Sylvia and Greg each received equal inheritances of $2500 which they invested for 5 years at 6.3%. Sylvias account compounds semi-annually, and Gregs account compounds weekly.

Calculate the future value of each account

Calculate both of their rates of return to the nearest tenth of a percent.

Tina invested $200 per week for two years in a high risk (and high reward!) investment account. Her account earned an average of 45% compounded weekly.

How much would the investment be worth at the end of the two years?

How much had Tina paid into the account during that time?

How much interest was earned on the account?

What is the rate of return as a percentage to the nearest tenth?

Amanda wants to have $300 000 in her account in 22 years so that she can retire. Amanda has found an account that will earn 9.4% compounded semi-annually.

What regular payments must she make every six months so that she can meet her goal?

How much interest will she earn over the 22 years?

Tanner is 18 and has an investment portfolio that he would like to redeem in order to pay for his education.

His parents deposited $500 into a savings account at the start of every year since his birth, accumulating 4.5% interest compounded annually.

When he was 7, his grandparents invested $5000 into a trust account that earns an average annual interest rate of 5.5%, compounded monthly.

How much is his portfolio worth now that he is 18?

What is the rate of return as a percentage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started