Question

Chapter 1 Homework - 10 points 1. See the double taxation structure and determine which pay structure is applicable to before / after 2003 regulations.

Chapter 1 Homework - 10 points

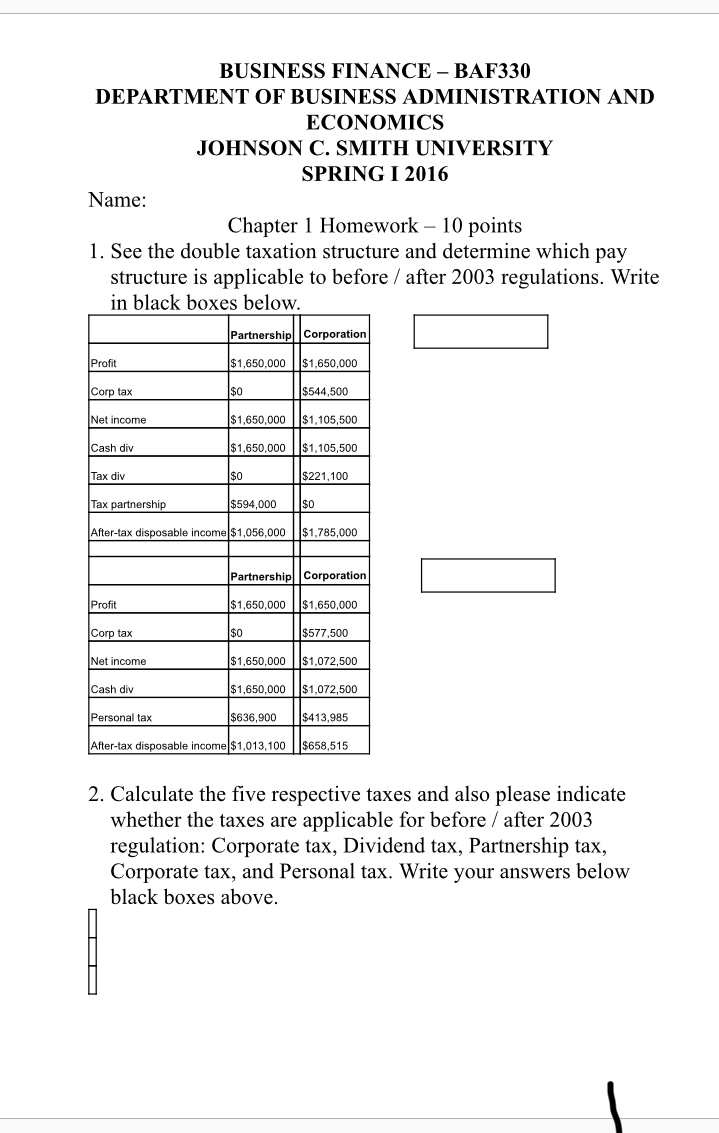

1. See the double taxation structure and determine which pay structure is applicable to before / after 2003 regulations. Write in black boxes below.

Partnership

Corporation

Profit

$1,650,000

$1,650,000

Corp tax

$0

$544,500

Net income

$1,650,000

$1,105,500

Cash div

$1,650,000

$1,105,500

Tax div

$0

$221,100

Tax partnership

$594,000

$0

After-tax disposable income

$1,056,000

$1,785,000

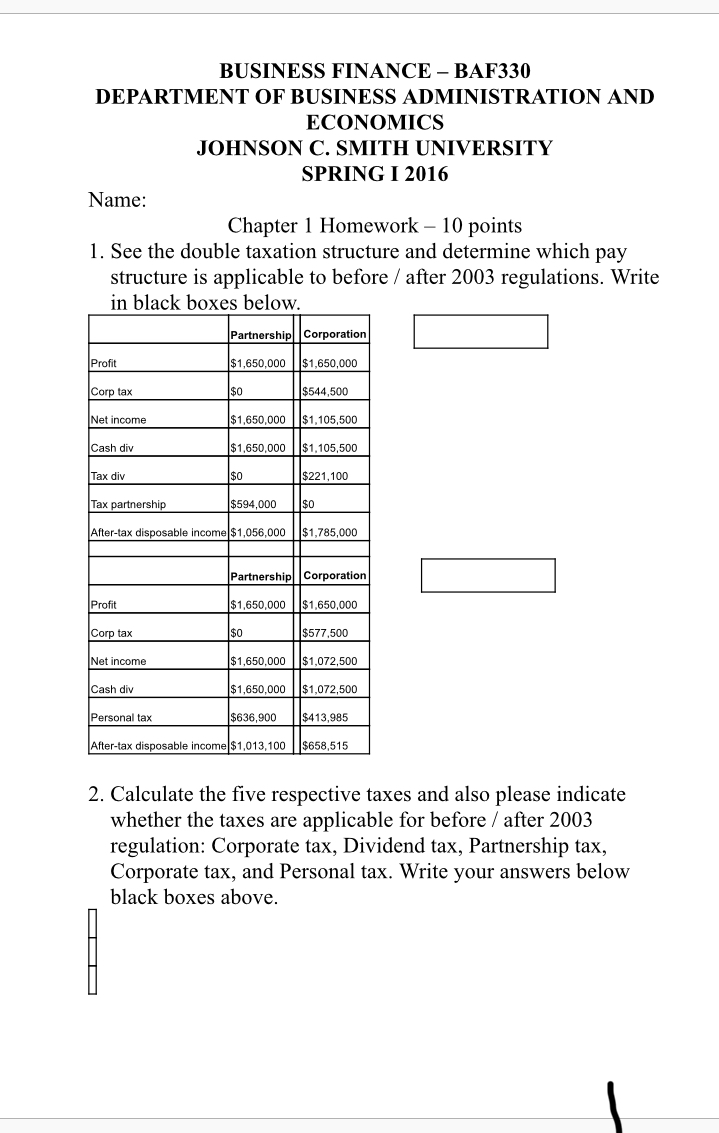

Partnership

Corporation

Profit

$1,650,000

$1,650,000

Corp tax

$0

$577,500

Net income

$1,650,000

$1,072,500

Cash div

$1,650,000

$1,072,500

Personal tax

$636,900

$413,985

After-tax disposable income

$1,013,100

$658,515

2. Calculate the five respective taxes and also please indicate whether the taxes are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started