Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 1 Section 1.6 Present Value The two sets of grandparents for a newborn baby wish to invest enough money immediately to pay $10,000 per

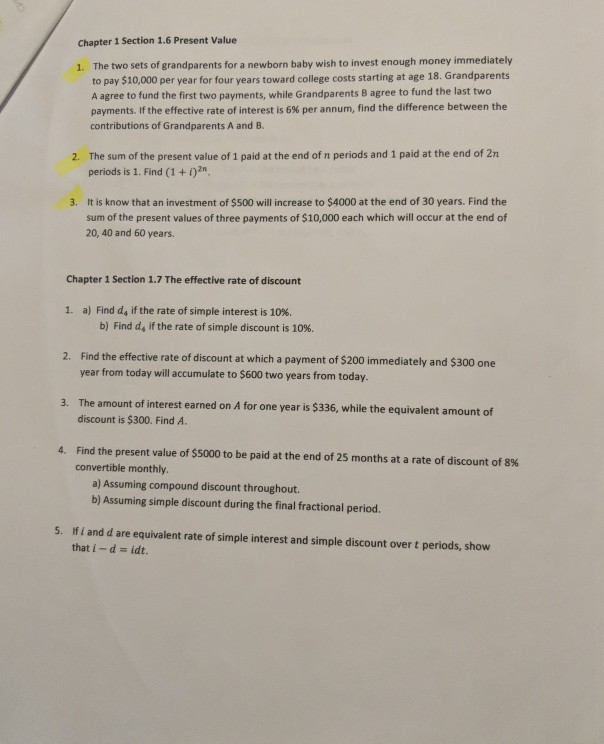

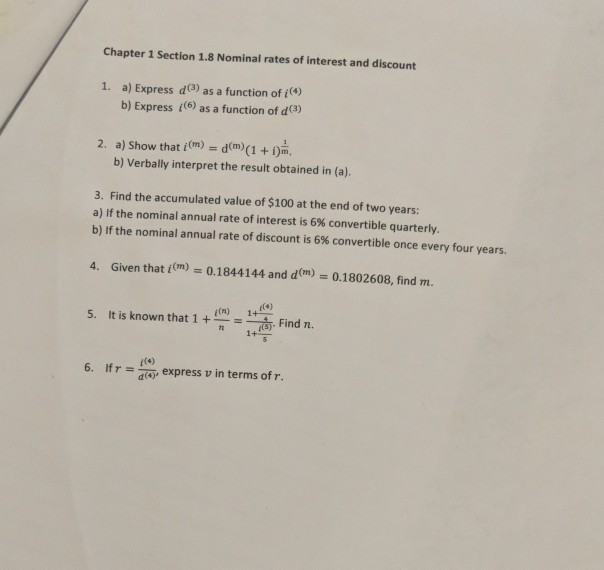

Chapter 1 Section 1.6 Present Value The two sets of grandparents for a newborn baby wish to invest enough money immediately to pay $10,000 per year for four years toward college costs starting at age 18. Grandparents A agree to fund the first two payments, while Grandparents B agree to fund the last two payments. If the effective rate of interest is 6% per annum, find the difference between the contributions of Grandparents A and B. The sum of the present value of 1 paid at the end of n periods and 1 paid at the end of 2n periods is 1. Find (1 + 1)2n 3. It is know that an investment of $500 will increase to $4000 at the end of 30 years. Find the sum of the present values of three payments of $10,000 each which will occur at the end of 20,40 and 60 years. Chapter 1 Section 1.7 The effective rate of discount 1. a) Find de if the rate of simple interest is 10% b) Find d, if the rate of simple discount is 10% 2. Find the effective rate of discount at which a payment of $200 immediately and $300 one year from today will accumulate to $600 two years from today. 3. The amount of interest earned on A for one year is $336, while the equivalent amount of discount is $300. Find A. 4. Find the present value of $5000 to be paid at the end of 25 months at a rate of discount of 8% convertible monthly. a) Assuming compound discount throughout. b) Assuming simple discount during the final fractional period. 5. If I and d are equivalent rate of simple interest and simple discount over t periods, show that i-d = idt. Chapter 1 Section 1.8 Nominal rates of interest and discount 1. a) Express dC) as a function of (4) b) Express (6) as a function of d(3) 2. a) Show that i(m) = a(m) (1 + i). b) Verbally interpret the result obtained in (a). 3. Find the accumulated value of $100 at the end of two years: a) If the nominal annual rate of interest is 6% convertible quarterly. b) if the nominal annual rate of discount is 6% convertible once every four years. 4. Given that i(m) = 0.1844144 and d(m) = 0.1802608, find m. 5. It is known that 1+ 200 14 known that 1 = 11 8Find n. 6. Ifr = express v in terms ofr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started