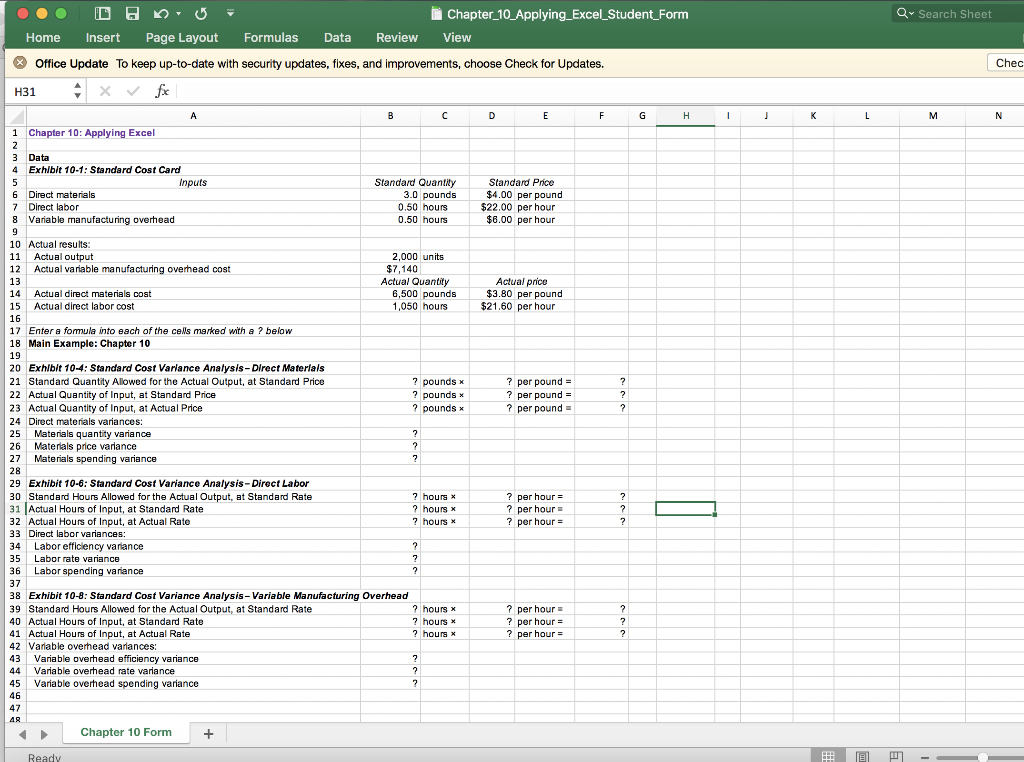

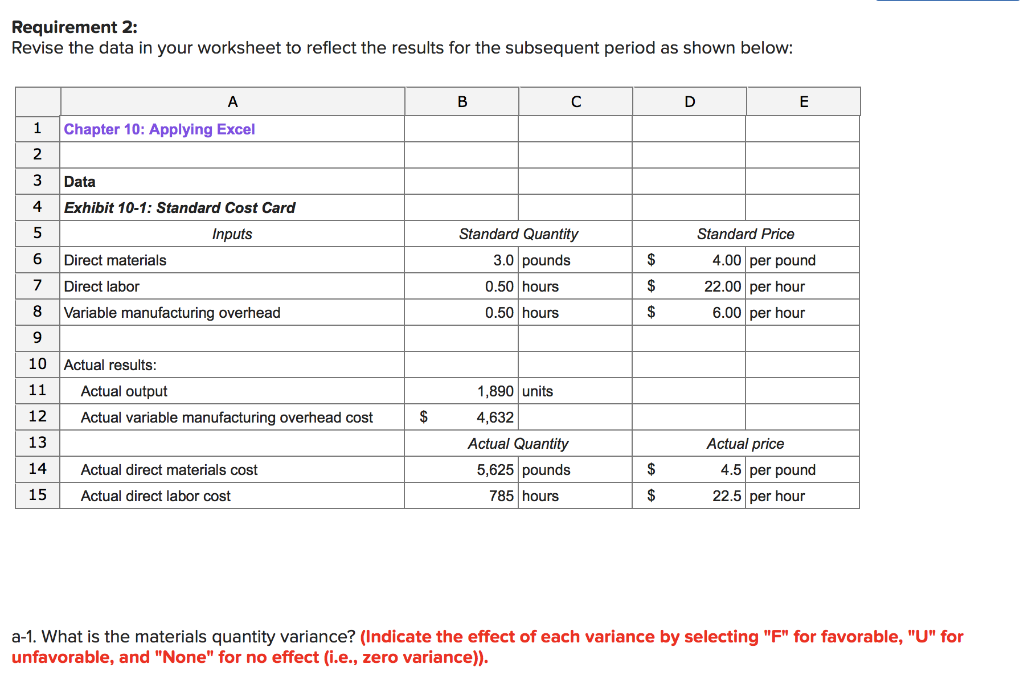

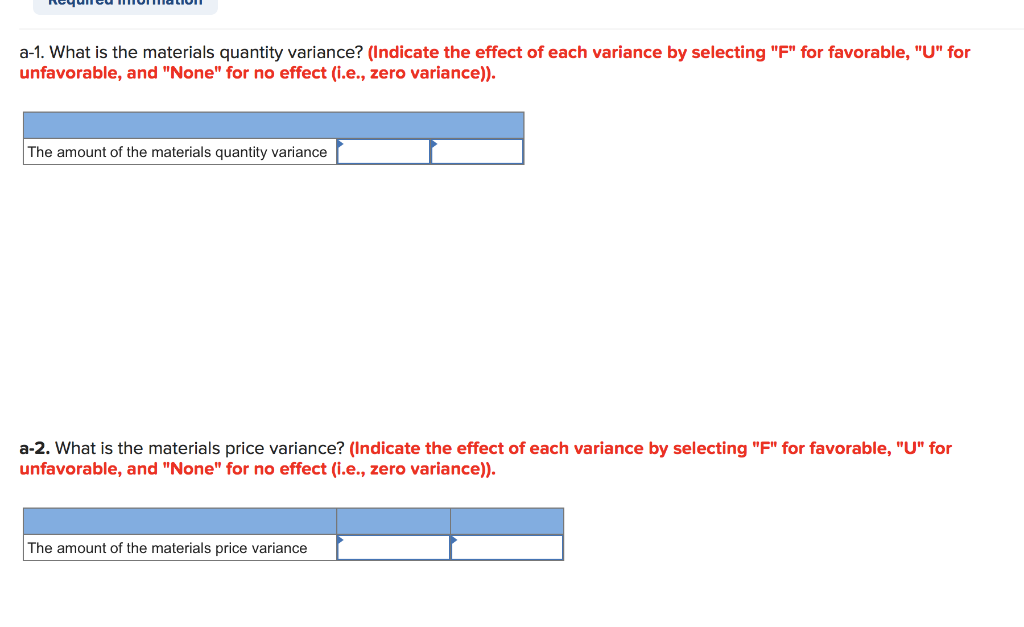

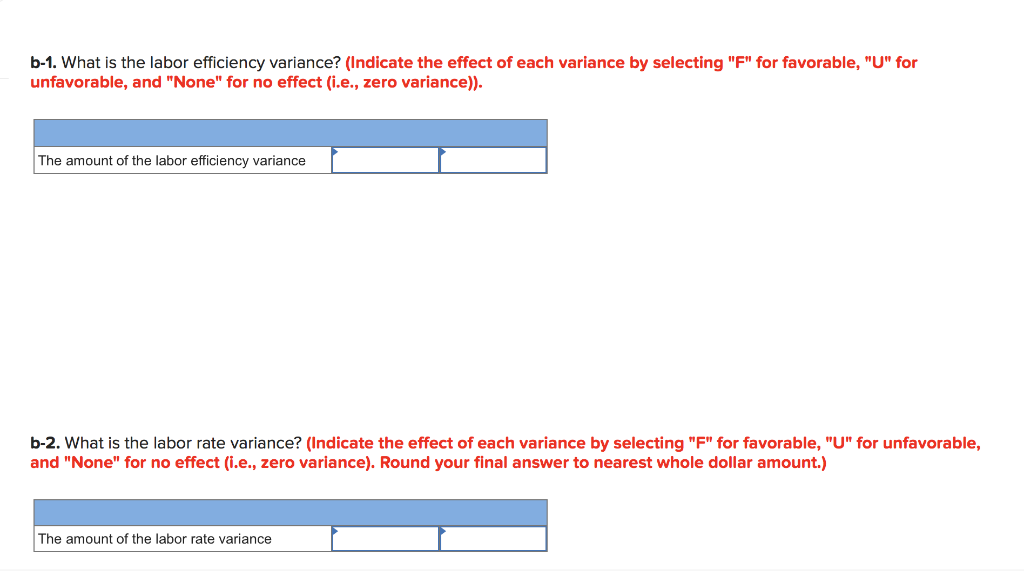

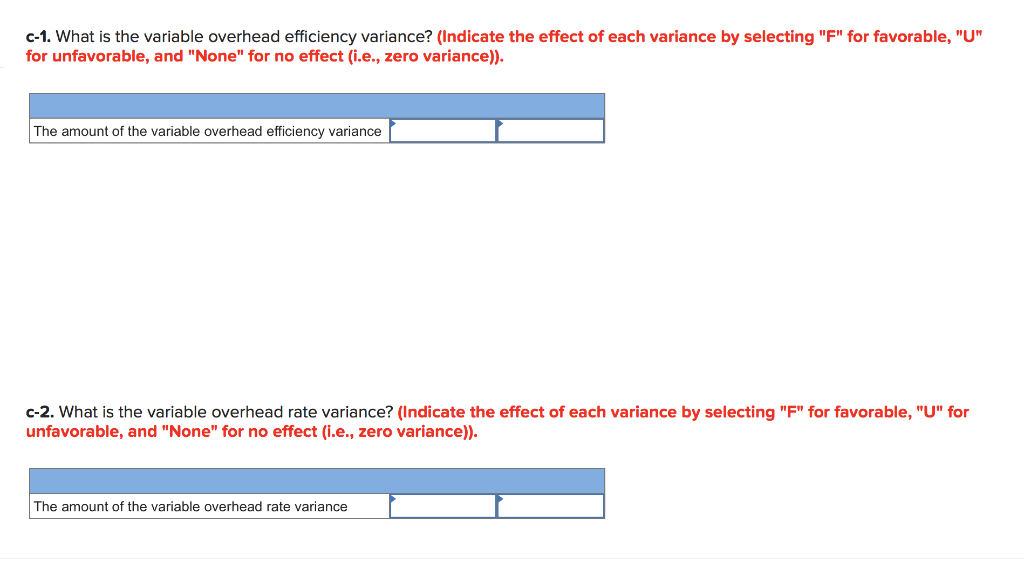

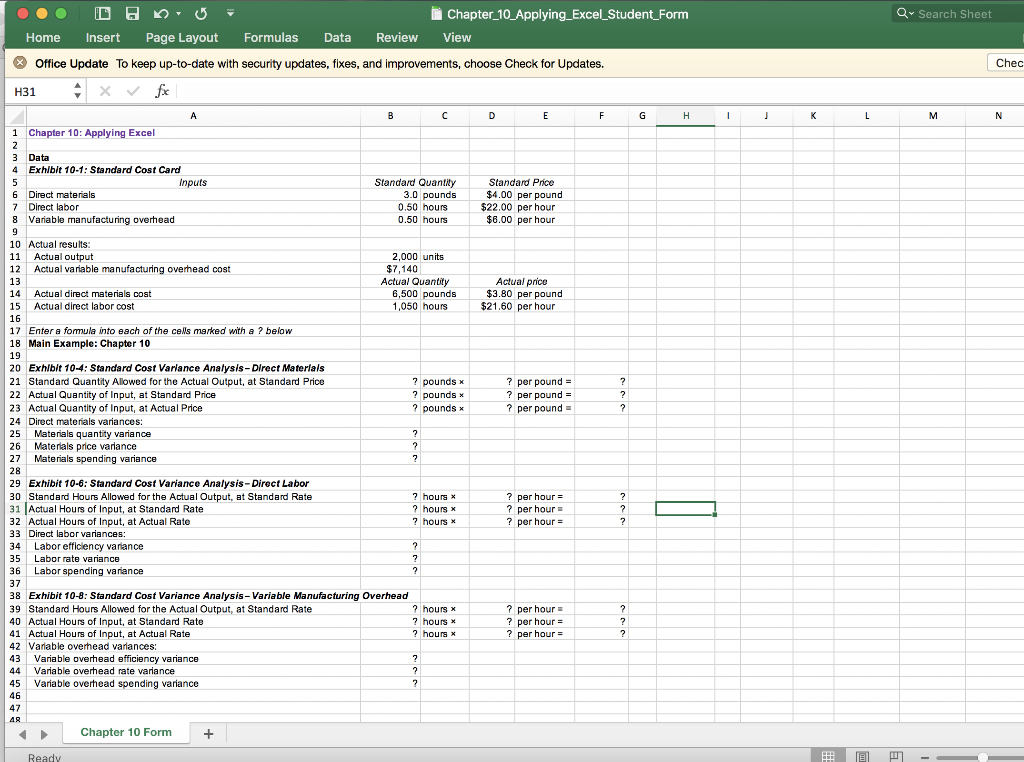

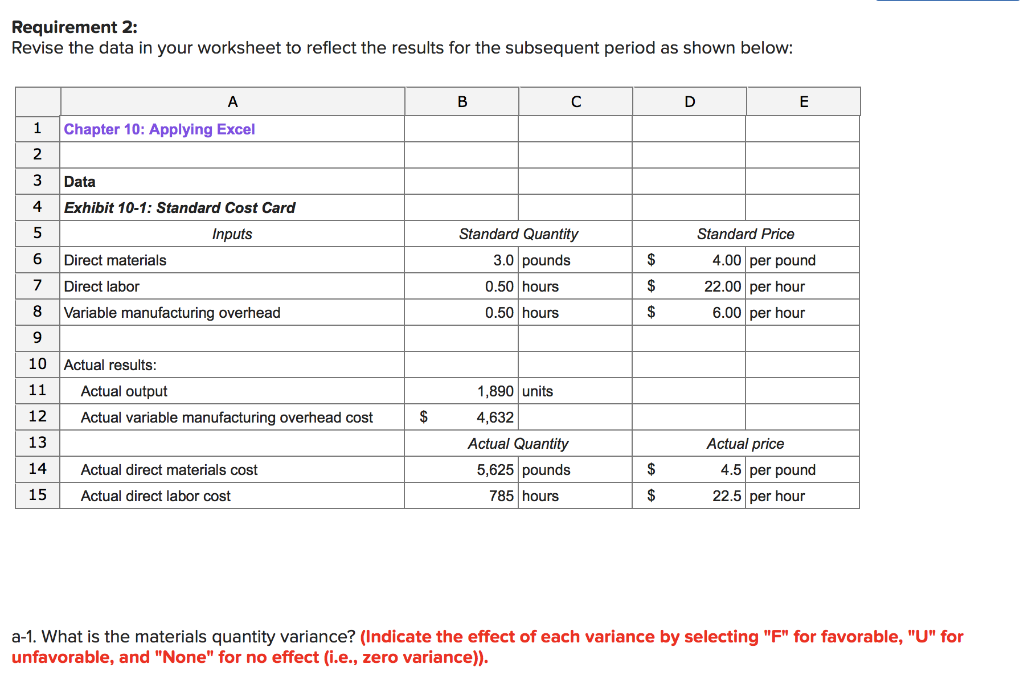

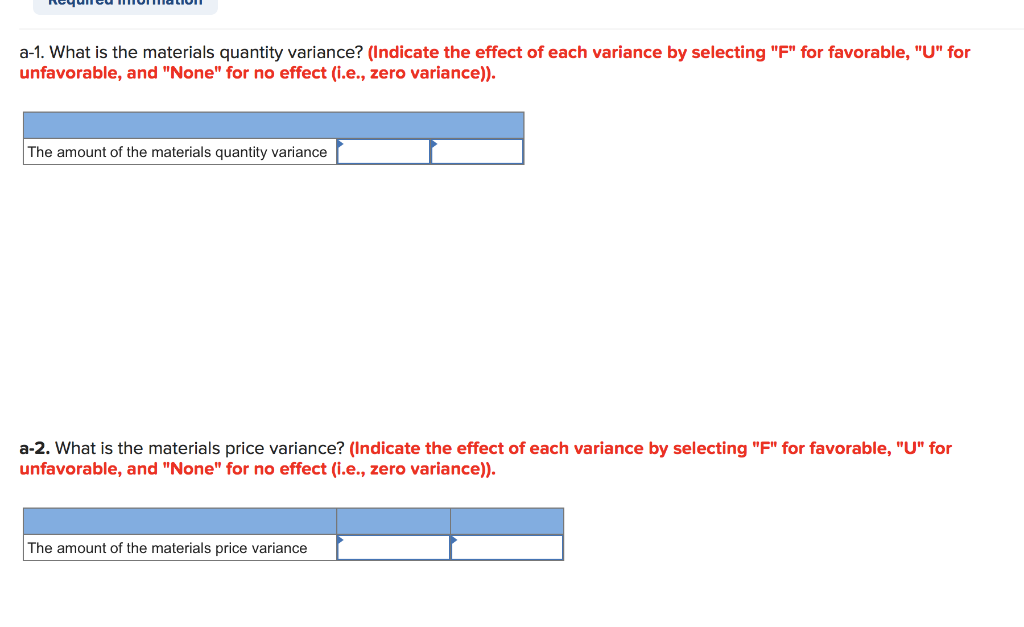

Chapter 10 Applying_Excel_Student_Form Search Sheet Home InsertPage Layout Formulas Data Review View Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Chec H31 1 Chapter 10: Applying Excel 3 4 Data Exhibit 10-1: Standard Cost Card Inputs Standard Price $4.00 per pound $22.00 per hour $6.00 per hour Standard Quantity 6 Direct materals 7Direct labor 8 Varable manufacturing overhead 3.0 pounds 0.50 hours 0.50 hours 10 Actual results: 11 Actual output 12 Actual variable manufacturing overhead cost 2,000 units $7,140 Actual Quantity Actual price $3.80 per pound $21.60 per hour 14 Actual direct materials cost 15 Actual direct labor cost 16 17 Enter a fomula into each of the cels marked with a 18 Main Example: Chapter 10 19 6,500 pounds 1,050 hours below 20 Exhibit 10-4: Standard Cost Varlance Analysis-Direct Materlals 21 Standard Quantity Allowed for the Actual Output, at Standard Price 22 Actual Quantity of Input, at Standard Price 23 Actual Quantity of Input, at Actual Price 24 Direct materials variances: 25 Materials quantity variance 26 Materials price varance 27 Materials spending variance 28 29 Exhibit 10-6: Standard Cost Variance Analysis-Direct Labor 30 Standard Hours Allowed for the Actual Output, at Standard Rate 31 Actual Hours of Input, at Standard Rate 32 Actual Hours of Input, at Actual Rate 33 Direct labor variances: ? pounds x ? poundsx ? pounds x ? per pound ? per pound ?per pound ? hours x ? hours x ? hours x ? per hour ?per hour ?per hour- 34 Labor efficlency variance 35 Labor rate variance 36 Labor spending variance 37 38 Exhibit 10-8: Standard Cost Variance Analysis-Variable Manufacturing Overhead 39 Standard Hours Allowed for the Actual Output, at Standard Rate 40 Actual Hours of Input, at Standard Rate 41 Actual Hours of Input, at Actual Rate 42 Varable overhead varlances: 3 Variable overhead efficiency variance 4 Variable overhead rate variance 45 Variable overhead spending variance 46 47 per hour ? per hour ? per hour ? hours x ? hours* ? hoursx Chapter 10 Form Requirement 2: Revise the data in your worksheet to reflect the results for the subsequent period as shown below: 1 Chapter 10: Applying Excel 2 3 Data 4 Exhibit 10-1: Standard Cost Card Standard Quantity Standard Price Inputs 6 Direct materials 7 Direct labor 3.0 pounds 0.50 hours 0.50 hours 4.00 per pound 22.00 per hour 6.00 per hour 8 Variable manufacturing overhead 10 Actual results 11 Actual output 12 Actual variable manufacturing overhead cost 13 14 Actual direct materials cost 15 Actual direct labor cost 1,890 units 4,632 Actual Quantity Actual price 4.5 per pound 22.5 per hour 5,625 pounds 785 hours a-1. What is the materials quantity variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance))