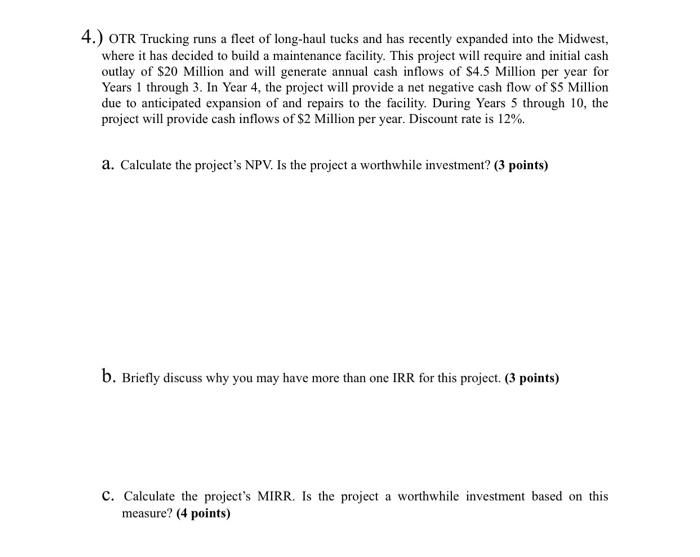

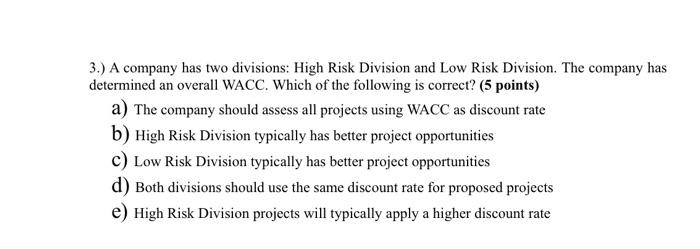

Chapter 11 1.) Emily's soccer Mania is considering building a new indoor soccer facility for local soccer clubs to rent and has narrowed its options down to 2 projects. The first one, Project A, will require an initial cash outlay of $46,000 today and generate annual cash inflows of $17,000 per Years 1 through 3. In Year 4, the project will provide a cash inflow of $19,500. Project B will cost $50,000 today and will generate $15,000 for the first 2 years, then generate $14.000 and S24,000 for Years 3 and 4. Emily's require a 10% return for both projects. a. Determine which project Emily will choose if two projects are independent. (5 points) b. Which project will Emily choose if the two are mutually exclusive? (5 points) 2.) You are considering a capital investment project that is estimated to have the following after- tax cash flows. The project requires an initial cash outlay of $60,000, and the appropriate discount rate for the project is 9% Year 0 1 2 3 4 5 - $60,000 20,000 16,000 16,000 18,000 20,000 a. What is the payback period? (3 points) b. What is the discounted payback period? (4 points) C. Calculate the project's NPV and PL. (3 points cach) 3.) Microwave Oven Programming, Inc. is considering the construction of a new plant The plant will have an initial cash outlay of $7 Million and will produce cash flows of $3 million at the end of Year I, S4 million at the end of Year 2, and $2 Million at the end of Years 3 through 5. What is the IRR for this new plant? (5 points) 4.) OTR Trucking runs a fleet of long-haul tucks and has recently expanded into the Midwest, where it has decided to build a maintenance facility. This project will require and initial cash outlay of $20 Million and will generate annual cash inflows of $4.5 Million per year for Years 1 through 3. In Year 4, the project will provide a net negative cash flow of $5 Million due to anticipated expansion of and repairs to the facility. During Years 5 through 10, the project will provide cash inflows of $2 Million per year. Discount rate is 12%. a. Calculate the project's NPV. Is the project a worthwhile investment? (3 points) b. Briefly discuss why you may have more than one IRR for this project. (3 points) C. Calculate the project's MIRR. Is the project a worthwhile investment based on this measure? (4 points) 3.) A company has two divisions: High Risk Division and Low Risk Division. The company has determined an overall WACC. Which of the following is correct? (5 points) a) The company should assess all projects using WACC as discount rate b) High Risk Division typically has better project opportunities c) Low Risk Division typically has better project opportunities d) Both divisions should use the same discount rate for proposed projects e) High Risk Division projects will typically apply a higher discount rate