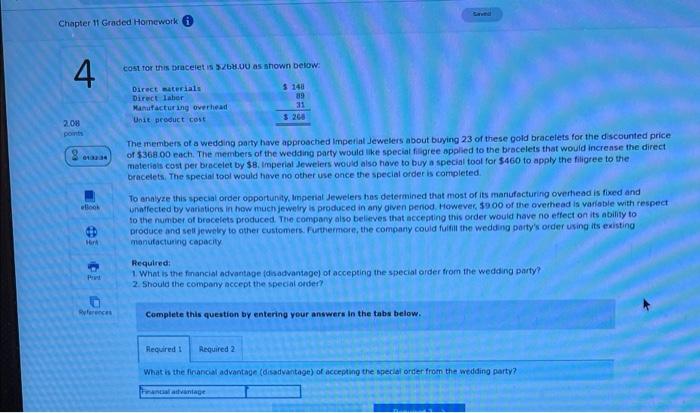

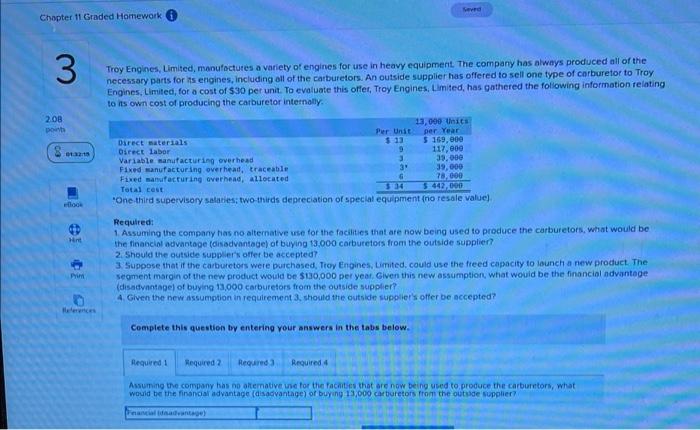

Chapter 11 Graded Homework COSL Tor this tracelets ZOU as shown below: 4 Direct iterials Direct labor Manufacturing overhead Unit product cost $ 140 89 31 320 2.08 points 8 The members of a wedding party have approached Imperial Jewelers about buying 23 of these gold bracelets for the discounted price of $36800 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $8. Imperial Jewelers would also have to buy a special tool for $460 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed ook To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However $9.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing manufacturing capacity Required 1 What is the financial advantage din advantage of accepting the special order from the wedding party? 2. Should the company accept the special ordet? ferences Complete this question by entering your answers in the tabs below. Required Required 2 What is the financial advantage (disadvantage) of accepting the special order from the wedding party? cavanlage ve Chapter 11 Graded Homework 3 Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $30 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally 2.08 13,000 Units Per Unit per Year Direct materials $ 13 $ 169,00 Direct labor 117,00 Variable manufacturing over head 3 39.000 Fixed manufacturing overhead, traceable 39 39,000 Fixed manufacturing overhead, allocated G 78.000 Total cost 34 5 442,000 "One third supervisory statiestwo thirds depreciation of special equipment no resale value) Required: 1. Assuming the company has no alternative use for the facilities that are now being used produce the carburetors, what would be the financial advantage (disadvantage of buying 13.000 carburetors from the outside supplier? 2. Should the outside suppler's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Limited, could use the freed capacity to launch a new product. The Segment margin of the new product would be $100,000 per year. Given this new assumption, what would be the financial advantage (disadvantage of buying 13,000 carburetors from the outside supplier? 4 Given the new assumption in requirement 3. should the outside suppliers offer be accepted? Prim Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 Assuming the company has no alternative und for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage of buying 13,000 carburetors from the outside Supplier