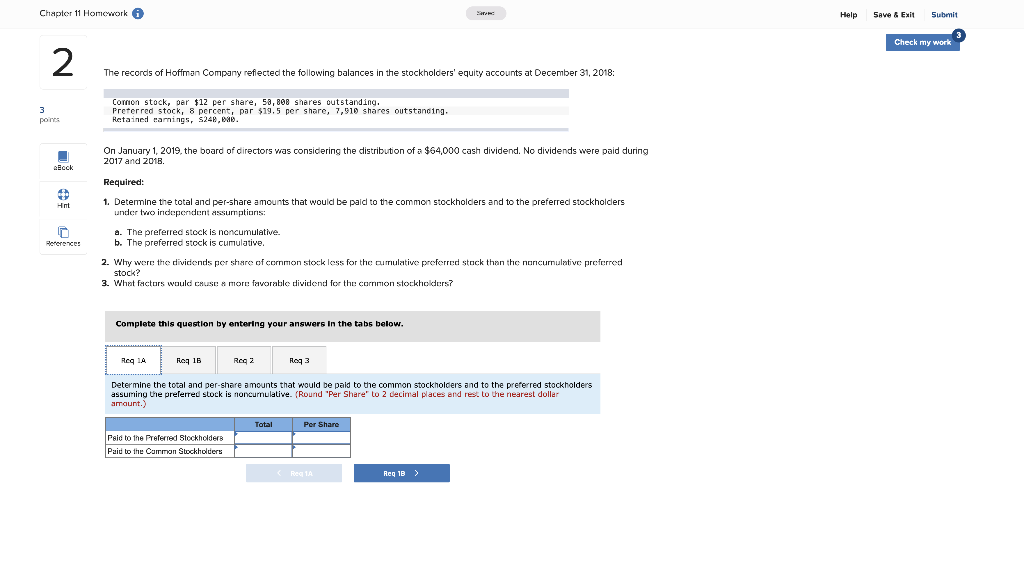

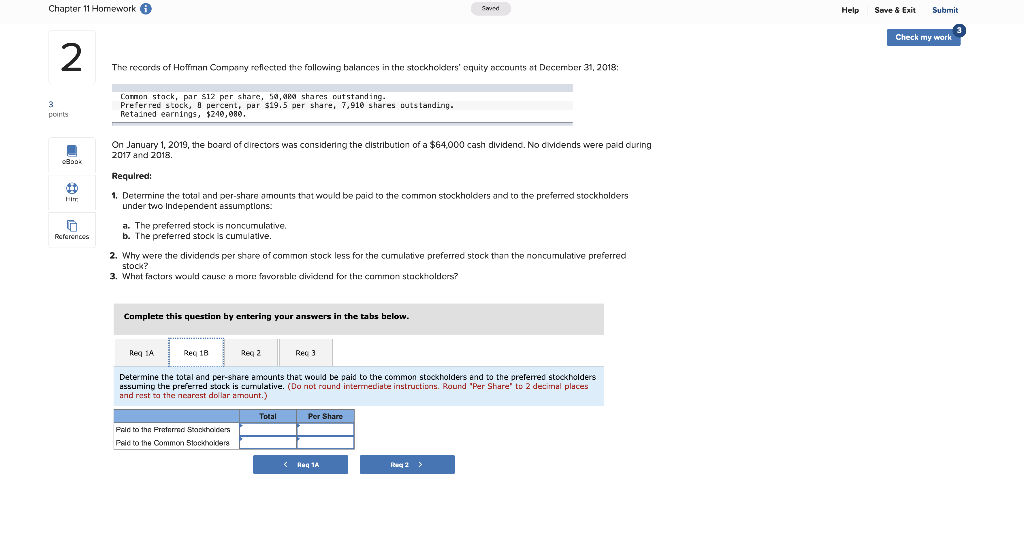

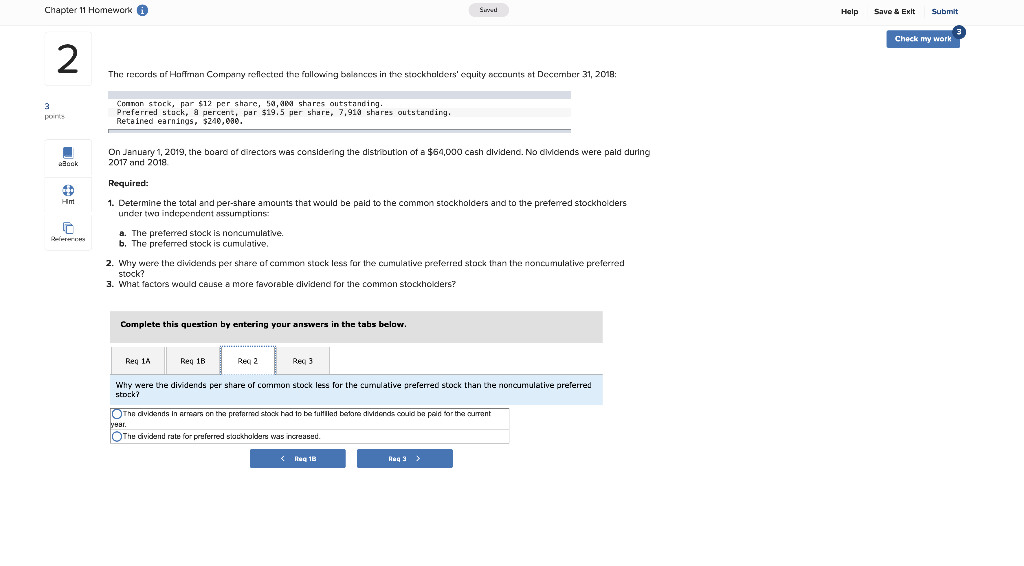

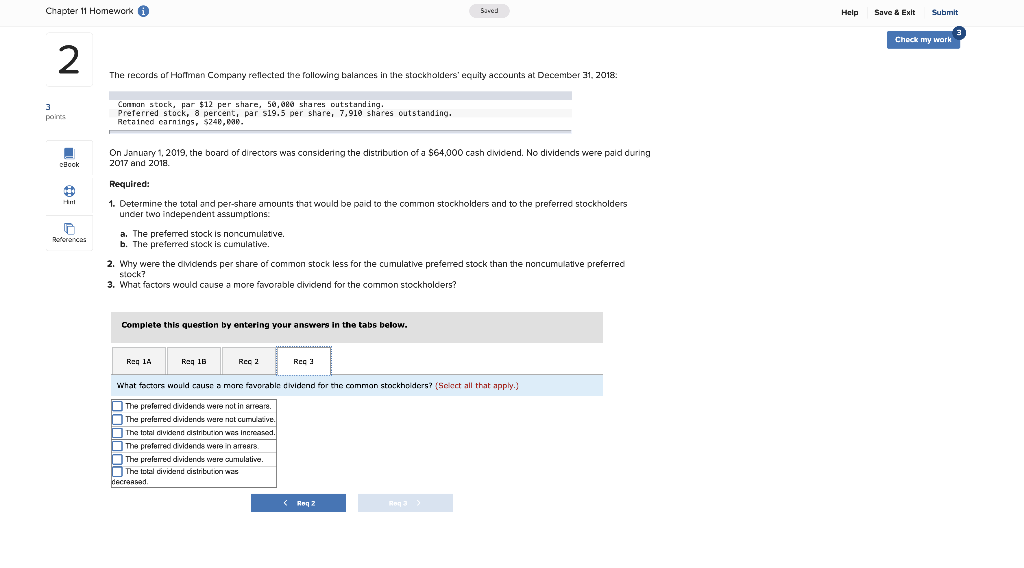

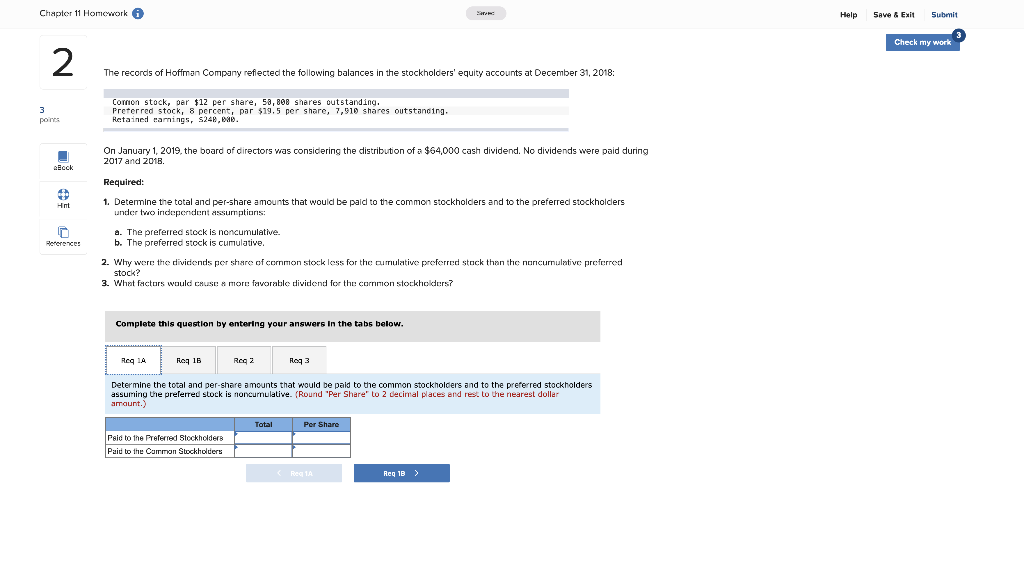

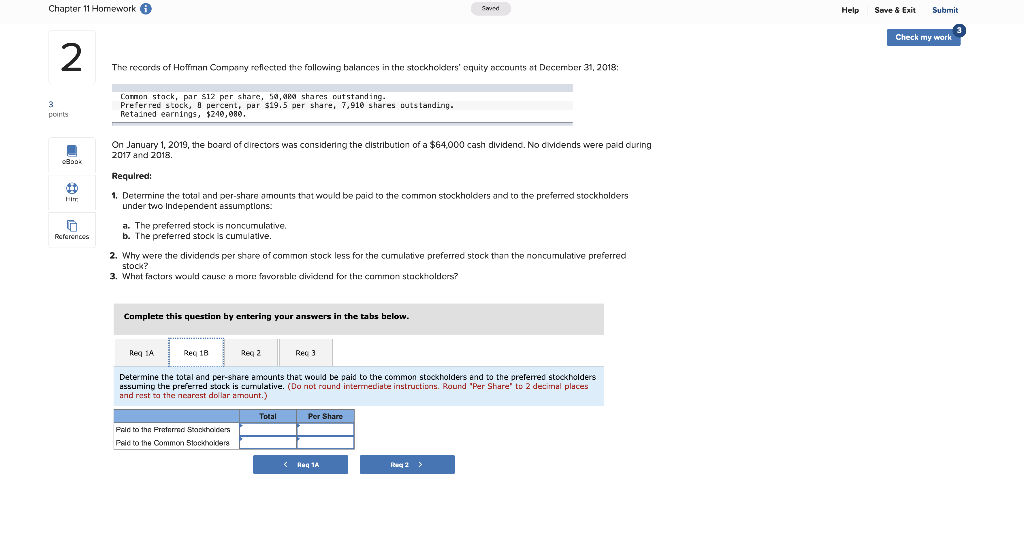

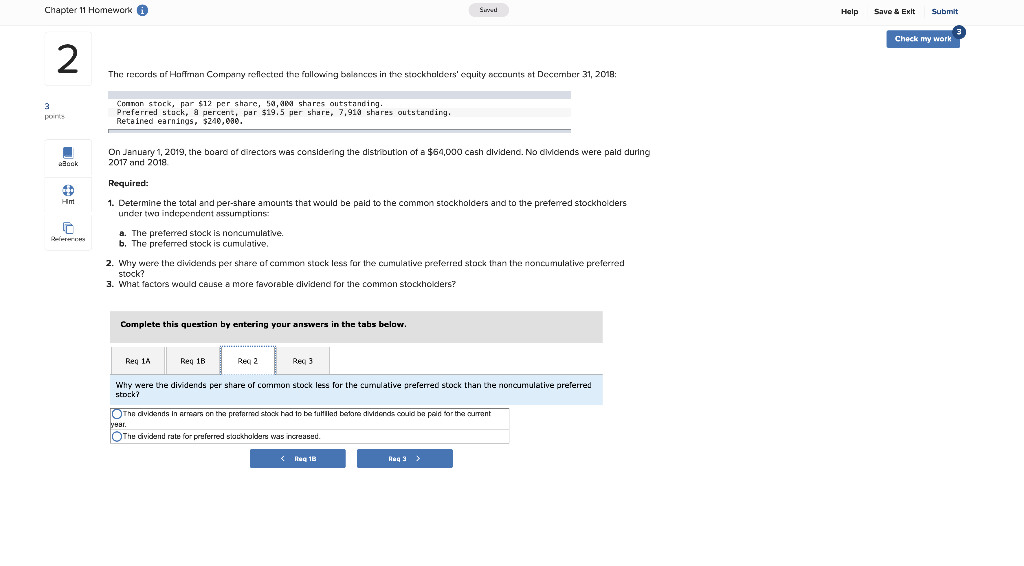

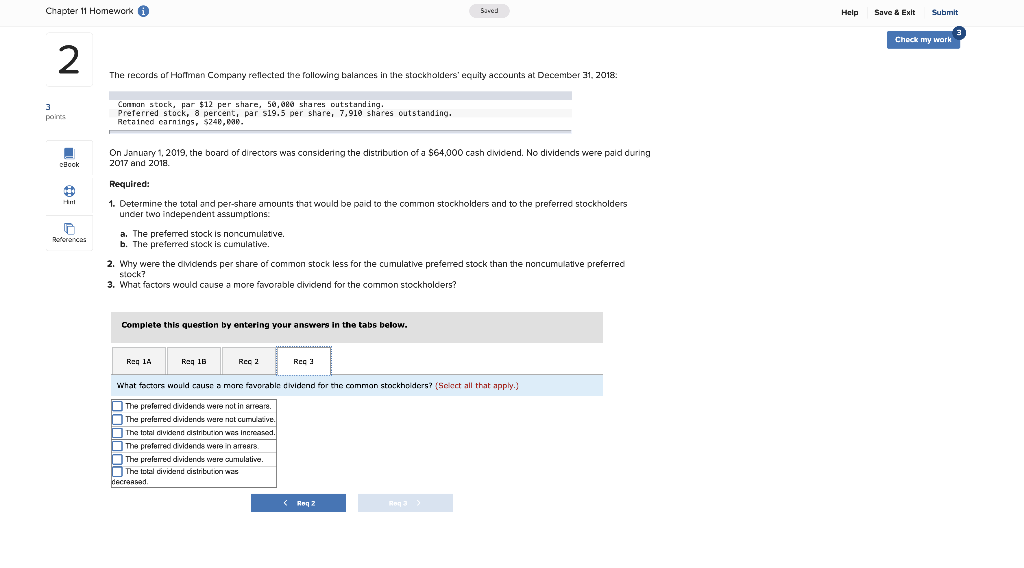

Chapter 11 Homework Help Save & Exit Submit Check my work 2 The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2018: 3 points Comon stock, Dar $12 per share, 58,808 shares outstanding. Preferred stock, 8 percent, par $19.5 per share, 7,910 shares outstanding, Retained Hamings, $248, On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dividends were paid during 2017 and 2018. Ecck 440 Hint Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the curulative preferred stack than the noncurnulative preferred stock? 3. What factors would cause a more favorable dividend for the corrmon stockholders? Peterence: Complete this question by entering your answers in the tabs below. REGLA Reg 15 Reg 2 Req3 Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders assuming the preferred stock is noncurnulative. {Round "Per Share to 2 decimal places and rest to the nearest doller amount.) Total Per Share Paid to the Preferred Stockholders Paid to the Common Stockholders Chapter 11 Homework S Help Save & Exit Submit Check my work 2 The records of Hoffrian Company reflected the following balances in the stockholders' equity accounts at December 31, 2018: 3 points Comon stack, par s12 per share, Saapa shares outstanding. Preferred stock, 8 percent, par $19.5 per share, 7,910 shares outstanding. Retained earnings, $240,080. On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dimdends were paid during 2017 and 2018. 03 Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: Hir Rcforcnicos a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favorable dividend for the common stockholders? Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2 Rec3 Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders assuring the preferred stack is curulative. (Do riot round intermediate instructions. Round "Per Share to 2 decimal places and rest to the nearest dollar amount.) Total Per Share Paid to the Preferred Searches Psic to the Common Slootroka Chapter 11 Homework Help Save & Exit Submit Check my work 2 The records of Hoffran Company reflected the following balances in the stockholders' equity scounts at December 31, 2018: Connon stock, par $12 per share, 59,4x4 shares outstanding. ports Relaterede stuches . Par $19.5 per share, 7,918 shares outstanding. On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dividends were paid during 2017 and 2018 Beck Him Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favoreble dividend for the common stockholders? Complete this question entering your answers in the tabs below. Reg 14 Reg 1B Reg 2 Req3 Why were the dividends per share of common stock less for the curulative preferred stock than the noncumulative preferred stock? The dividends in armas on the preferred stock had to be fulled before didends could be paid for the current year The dividend rule for preferred stockholders was increased Chapter 11 Homework Sanca Help Save & Exit Submit Check my work 2 The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2018 pois Connan stock, par $12 per share, 58,080 shares outstanding. Preferred stock, 8 percent, par $19.5 per share, 7,919 shares outstanding. Retained carnings, S240,290. On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dividends were paid during 2017 and 2018 cock Required: Hul Boforecas 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative, b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favorable dividend for the common stockholders? Complete this question by entering your answers in the tabs below. Reg 1A Reg 16 Rec 2 Rec What foctors would cause a more favorable dividend for the common stockholders? (Sclect all that apply.) The preferred dividends were not in erreare The prafurred dividends were not cumulative. The total dividend distribution was increased. The preferred dividends were in arrears The preferred dividerds were cumulative. The total cividend cistrusion was Acreased Chapter 11 Homework S Help Save & Exit Submit Check my work 2 The records of Hoffrian Company reflected the following balances in the stockholders' equity accounts at December 31, 2018: 3 points Comon stack, par s12 per share, Saapa shares outstanding. Preferred stock, 8 percent, par $19.5 per share, 7,910 shares outstanding. Retained earnings, $240,080. On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dimdends were paid during 2017 and 2018. 03 Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: Hir Rcforcnicos a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favorable dividend for the common stockholders? Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2 Rec3 Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders assuring the preferred stack is curulative. (Do riot round intermediate instructions. Round "Per Share to 2 decimal places and rest to the nearest dollar amount.) Total Per Share Paid to the Preferred Searches Psic to the Common Slootroka Chapter 11 Homework Help Save & Exit Submit Check my work 2 The records of Hoffran Company reflected the following balances in the stockholders' equity scounts at December 31, 2018: Connon stock, par $12 per share, 59,4x4 shares outstanding. ports Relaterede stuches . Par $19.5 per share, 7,918 shares outstanding. On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dividends were paid during 2017 and 2018 Beck Him Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favoreble dividend for the common stockholders? Complete this question entering your answers in the tabs below. Reg 14 Reg 1B Reg 2 Req3 Why were the dividends per share of common stock less for the curulative preferred stock than the noncumulative preferred stock? The dividends in armas on the preferred stock had to be fulled before didends could be paid for the current year The dividend rule for preferred stockholders was increased Chapter 11 Homework Sanca Help Save & Exit Submit Check my work 2 The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2018 pois Connan stock, par $12 per share, 58,080 shares outstanding. Preferred stock, 8 percent, par $19.5 per share, 7,919 shares outstanding. Retained carnings, S240,290. On January 1, 2019, the board of directors was considering the distribution of a $64,000 cash dividend. No dividends were paid during 2017 and 2018 cock Required: Hul Boforecas 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative, b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favorable dividend for the common stockholders? Complete this question by entering your answers in the tabs below. Reg 1A Reg 16 Rec 2 Rec What foctors would cause a more favorable dividend for the common stockholders? (Sclect all that apply.) The preferred dividends were not in erreare The prafurred dividends were not cumulative. The total dividend distribution was increased. The preferred dividends were in arrears The preferred dividerds were cumulative. The total cividend cistrusion was Acreased