Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 11: Management of transaction exposure (pages 423 and 424) - case description Blades plc has recently decided to expand its international trade relationship

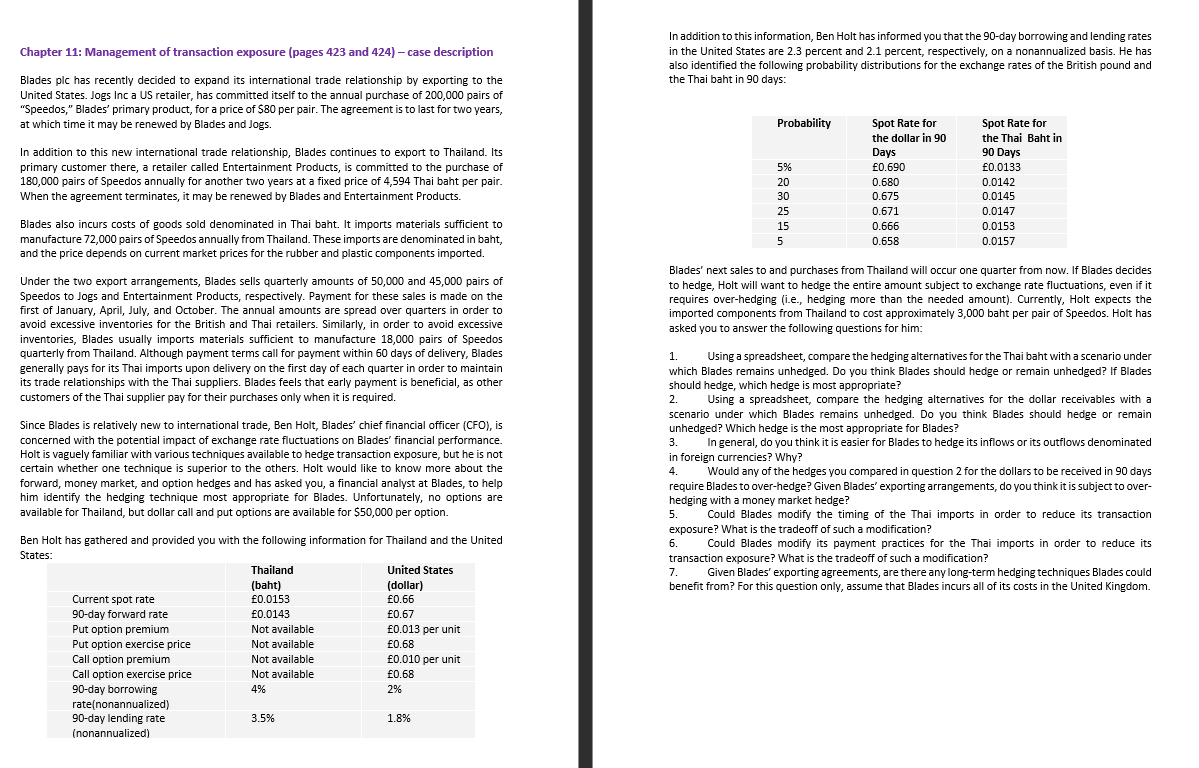

Chapter 11: Management of transaction exposure (pages 423 and 424) - case description Blades plc has recently decided to expand its international trade relationship by exporting to the United States. Jogs Inc a US retailer, has committed itself to the annual purchase of 200,000 pairs of "Speedos," Blades' primary product, for a price of $80 per pair. The agreement is to last for two years, at which time it may be renewed by Blades and Jogs. In addition to this new international trade relationship, Blades continues to export to Thailand. Its primary customer there, a retailer called Entertainment Products, is committed to the purchase of 180,000 pairs of Speedos annually for another two years at a fixed price of 4,594 Thai baht per pair. When the agreement terminates, it may be renewed by Blades and Entertainment Products. Blades also incurs costs of goods sold denominated in Thai baht. It imports materials sufficient to manufacture 72,000 pairs of Speedos annually from Thailand. These imports are denominated in baht, and the price depends on current market prices for the rubber and plastic components imported. Under the two export arrangements, Blades sells quarterly amounts of 50,000 and 45,000 pairs of Speedos to Jogs and Entertainment Products, respectively. Payment for these sales is made on the first of January, April, July, and October. The annual amounts are spread over quarters in order to avoid excessive inventories for the British and Thai retailers. Similarly, in order to avoid excessive inventories, Blades usually imports materials sufficient to manufacture 18,000 pairs of Speedos quarterly from Thailand. Although payment terms call for payment within 60 days of delivery, Blades generally pays for its Thai imports upon delivery on the first day of each quarter in order to maintain its trade relationships with the Thai suppliers. Blades feels that early payment is beneficial, as other customers of the Thai supplier pay for their purchases only when it is required. Since Blades is relatively new to international trade, Ben Holt, Blades' chief financial officer (CFO), is concerned with the potential impact of exchange rate fluctuations on Blades' financial performance. Holt is vaguely familiar with various techniques available to hedge transaction exposure, but he is not certain whether one technique is superior to the others. Holt would like to know more about the forward, money market, and option hedges and has asked you, a financial analyst at Blades, to help him identify the hedging technique most appropriate for Blades. Unfortunately, no options are available for Thailand, but dollar call and put options are available for $50,000 per option. Ben Holt has gathered and provided you with the following information for Thailand and the United States: Current spot rate 90-day forward rate Put option premium Thailand (baht) 0.0153 0.0143 Not available United States (dollar) 0.66 0.67 0.013 per unit 0.68 0.010 per unit Put option exercise price Not available Call option premium Not available Call option exercise price Not available 0.68 90-day borrowing 4% 2% rate(nonannualized) 90-day lending rate 3.5% 1.8% In addition to this information, Ben Holt has informed you that the 90-day borrowing and lending rates in the United States are 2.3 percent and 2.1 percent, respectively, on a nonannualized basis. He has also identified the following probability distributions for the exchange rates of the British pound and the Thai baht in 90 days: Probability Spot Rate for the dollar in 90 Days Spot Rate for the Thai Baht in 90 Days 5% 0.690 0.0133 20 0.680 0.0142 30 0.675 0.0145 25 0.671 0.0147 15 0.666 0.0153 5 0.658 0.0157 Blades' next sales to and purchases from Thailand will occur one quarter from now. If Blades decides to hedge, Holt will want to hedge the entire amount subject to exchange rate fluctuations, even if it requires over-hedging (i.e., hedging more than the needed amount). Currently, Holt expects the imported components from Thailand to cost approximately 3,000 baht per pair of Speedos. Holt has asked you to answer the following questions for him: 1. Using a spreadsheet, compare the hedging alternatives for the Thai baht with a scenario under which Blades remains unhedged. Do you think Blades should hedge or remain unhedged? If Blades should hedge, which hedge is most appropriate? 2. Using a spreadsheet, compare the hedging alternatives for the dollar receivables with a scenario under which Blades remains unhedged. Do you think Blades should hedge or remain unhedged? Which hedge is the most appropriate for Blades? 3. In general, do you think it is easier for Blades to hedge its inflows or its outflows denominated in foreign currencies? Why? 4. Would any of the hedges you compared in question 2 for the dollars to be received in 90 days require Blades to over-hedge? Given Blades' exporting arrangements, do you think it is subject to over- hedging with a money market hedge? 5. Could Blades modify the timing of the Thai imports in order to reduce its transaction exposure? What is the tradeoff of such a modification? 6. Could Blades modify its payment practices for the Thai imports in order to reduce its transaction exposure? What is the tradeoff of such a modification? 7. Given Blades' exporting agreements, are there any long-term hedging techniques Blades could benefit from? For this question only, assume that Blades incurs all of its costs in the United Kingdom. (nonannualized)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started