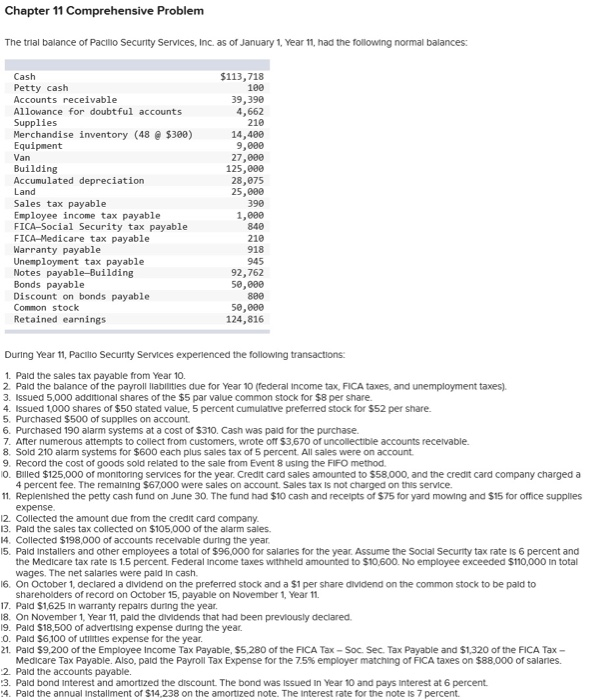

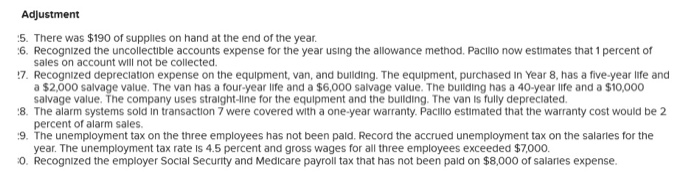

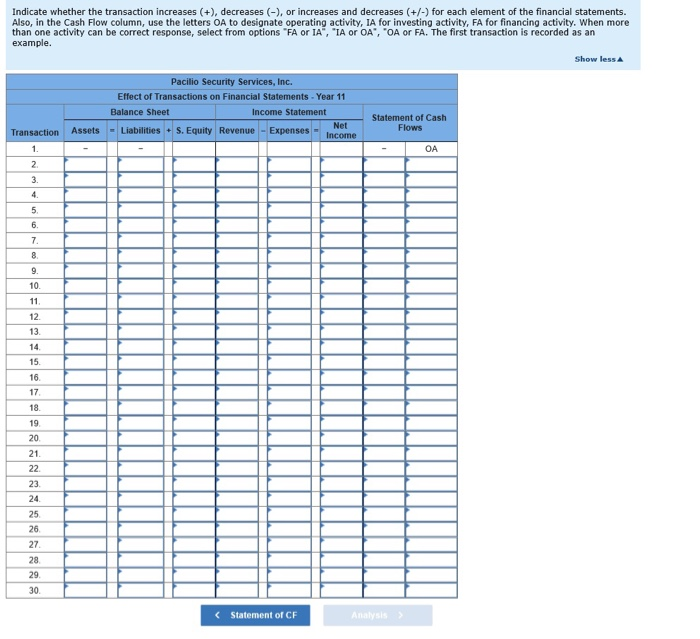

Chapter 11 Problem The trial balance of Pacilio Security Services, Inc. as of January 1, Year 11, had the following normal balances: $113,718 100 39,390 4,662 210 14,400 9,000 27,800 125,000 28,875 25,880 390 1,88e 848 218 918 945 92,762 50,800 880 50,08 124,816 Petty cash Accounts receivable Allowance for doubtful accounts Supplies Merchandise inventory (48 $300) Equipment Building Accumulated depreciation Land Sales tax payable Employee income tax payable FICA-Social Security tax payable FICA-Medicare tax payable Warranty payable Unemployment tax payable Notes payable-Building Bonds payable Discount on bonds payable Common stock Retained earnings During Year 11, Pacillo Security Services experienced the foillowing transactions 1. Pald the sales tax payable from Year 10. 2. Pald the balance of the payroll liabilities due for Year 10 (federal Income tax, FICA taxes, and unemployment taxes). 3. Issued 5,000 additional shares of the $5 par value common stock for $8 per share 4. Issued 1,000 shares of $50 stated value, 5 percent cumulative preferred stock for $52 per share. 5. Purchased $500 of supplies on account 6. Purchased 190 alarm systems at a cost of $310. Cash was paid for the purchase. 7. After numerous attempts to collect from customers, wrote off S3,670 of uncollectible accounts recevable. 8. Sold 210 alarm systems for $600 each plus sales tax of 5 percent All sales were on account 9. Record the cost of goods sold related to the sale from Event 8 using the FIFO method . Billed $125,000 of montonng services for the year. Credit card sales amounted to S58,000, and the credit card company charged a 4 percent fee. The remaining $67,000 were sales on account. Sales tax is not charged on this service 11. Replenlshed the petty cash fund on June 30. The fund had $10 cash and receipts of $75 for yard mowing and $15 for office supplies expense 2. Collected the amount due from the credit card company 13. Pald the sales tax collected on $105,000 of the alarm sales 4. Collected $198,000 of accountsrecelvable during the year I5. Pald Installers and other employees a total of $96,000 for salaries for the year Assume the Social Security tax rate Is 6 percent and the Medicare tax rate is 1.5 percent Federal Income taxes withheld amounted to $10,600. No employee exceeded $110,000 In total wages. The net salaries were pald In cash. 16. On October 1, declared a dividend on the preferred stock and a $1 per share dividend on the common stock to be pald to shareholders of record on October 15, payable on November 1, Year 11 17. Pald $1,625 In warranty repairs during the year I8. On November 1, Year 11, pald the divMdends that had been previously declared. 9. Pald S18,500 of advertising expense during the year 0. Pald $6,100 of utilities expense for the year 21. Pald $9,200 of the Employee Income Tax Payable, $5,280 of the FICA Tax-Soc. Sec. Tax Payable and $1,320 of the FICA Tax- Medicare Tax Payable. Also, paid the Payroll Tax Expense for the 75% employer matching or FICA taxes on $88,000 or salaries. 2. Pald the accounts payable. 3. Pald bond Interest and amortized the discount. The bond was issued in Year 10 and pays interest at 6 percent 4. Pald the annual Installment of $14,238 on the amortized note. The interest rate for the note is 7 percent Adjustment 5. There was $190 of supplies on hand at the end of the year 6 Recognized the uncollectible accounts expense for the year using the allowance method. now estimates that 1 percent of sales on account will not be collected 7. Recognized depreciation expense on the equipment, van, and bullding. The equipment, purchased in Year 8, has a five-year life and 8. The alarm systems sold in transaction 7 were covered with a one-year warranty. Pacillo estimated that the warranty cost would be 2 9. The unemployment tax on the three employees has not been pald. Record the accrued unemployment tax on the salares for the 0. Recognized the employer Social Security and Medicare payroll tax that has not been paid on $8,000 of salaries expense. a $2,000 salvage value. The van has a four-year life and a $6,000 salvage value. The bullding has a 40-year life and a $10,000 salvage value. The company uses straight-ine for the equipment and the bullding. The van is fully depreciated year. The unemployment tax rate Is 4.5 percent and gross wages for all three employees exceeded $7,000. Indicate whether the transaction increases (+), decreases (-), or increases and decreases (+/) for each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. When more than one activity can be correct response, select from options-FA or IA","IA or OA", "OA or FA. The first transaction is recorded as an example. Show less Pacilio Security Services, Inc. Effect of Transactions on Financial Statements Year 11 Balance Sheet Income Statement Statement of Cash Flows Assets Liabilities+S. Equity Revenue-Expenses Net 10. 12. 13. 15. 16. 18. 19 21 24. Statement of CF