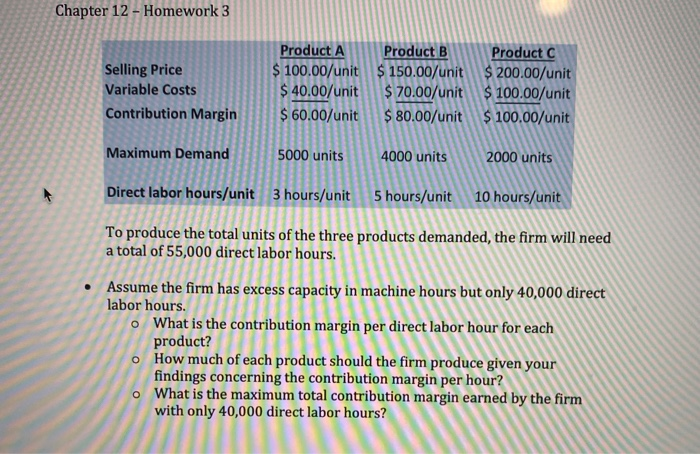

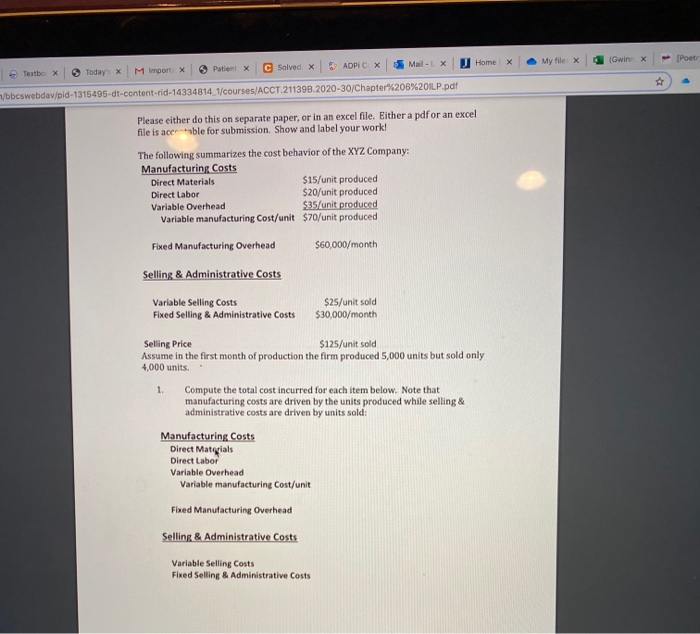

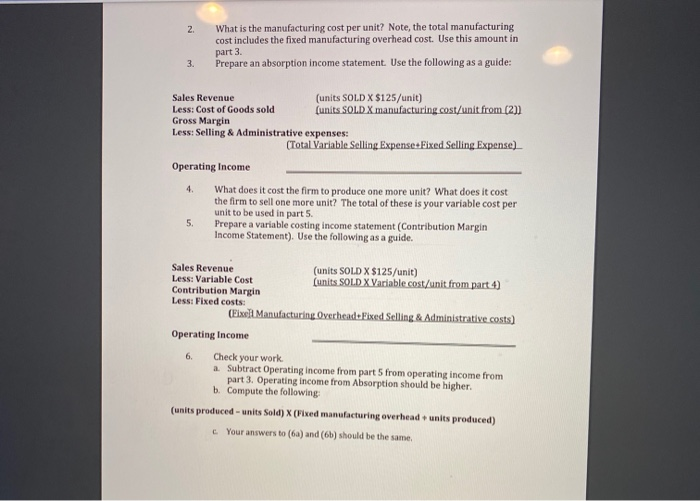

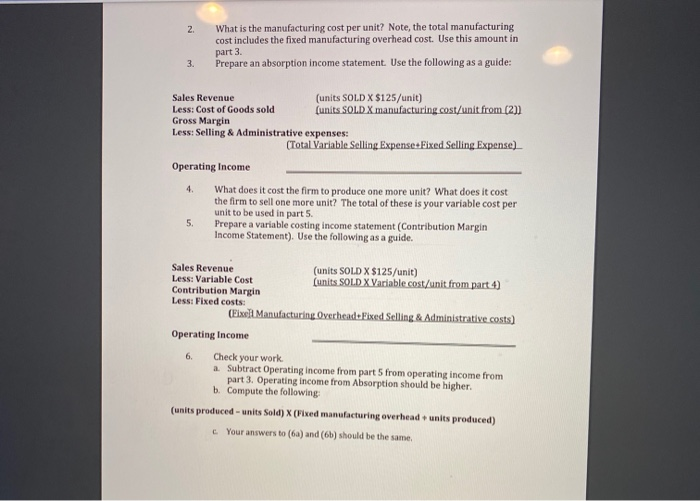

Chapter 12 - Homework 3 Selling Price Variable Costs Contribution Margin Product A Product B Product C $ 100.00/unit $ 150.00/unit $ 200.00/unit $ 40.00/unit $ 70.00/unit $ 100.00/unit $ 60.00/unit $ 80.00/unit $ 100.00/unit Maximum Demand 5000 units 4000 units 2000 units Direct labor hours/unit 3 hours/unit 5 hours/unit 10 hours/unit To produce the total units of the three products demanded, the firm will need a total of 55,000 direct labor hours. Assume the firm has excess capacity in machine hours but only 40,000 direct labor hours. o What is the contribution margin per direct labor hour for each product? o How much of each product should the firm produce given your findings concerning the contribution margin per hour? o What is the maximum total contribution margin earned by the firm with only 40,000 direct labor hours? Home X [Poetr Gwinnx My file X . 6 Textbox Today x M Import Patient X Solved. X ADPIC X Mail-LX /bbcswebdav/pid-1315495-dt-content-rid-143348141/courses/ACCT 211398.2020-30/Chapter%206%20ILP pdf Please either do this on separate paper, or in an excel file. Either a pdf or an excel file is acetable for submission. Show and label your work! The following summarizes the cost behavior of the XYZ Company: Manufacturing Costs Direct Materials $15/unit produced Direct Labor $20/unit produced Variable Overhead $35/unit produced Variable manufacturing Cost/unit $70/unit produced $60,000/month Fixed Manufacturing Overhead Selling & Administrative Costs Variable Selling Costs Fixed Selling & Administrative Costs $25/unit sold $30,000/month 1. Selling Price $125/unit sold Assume in the first month of production the firm produced 5,000 units but sold only 4,000 units. Compute the total cost incurred for each item below. Note that manufacturing costs are driven by the units produced while selling & administrative costs are driven by units sold: Manufacturing Costs Direct Materials Direct Labor Variable Overhead Variable manufacturing Cost/unit Fixed Manufacturing Overhead Selling & Administrative Costs Variable Selling Costs Fixed Selling & Administrative Costs 2 What is the manufacturing cost per unit? Note, the total manufacturing cost includes the fixed manufacturing overhead cost. Use this amount in part 3 Prepare an absorption income statement. Use the following as a guide: 3. Sales Revenue (units SOLD X $125/unit) Less: Cost of Goods sold (units SOLD X manufacturing cost/unit from (2) Gross Margin Less: Selling & Administrative expenses: (Total Variable Selling Expense+Fixed Selling Expense) Operating Income What does it cost the firm to produce one more unit? What does it cost the firm to sell one more unit? The total of these is your variable cost per unit to be used in part 5 Prepare a variable costing income statement (Contribution Margin Income Statement). Use the following as a guide. 4. 5. Sales Revenue (units SOLD X $125/unit) Less: Variable Cost (units SOLD X Variable cost/unit from part 4) Contribution Margin Less: Fixed costs: (Exel Manufacturing Overhead+Fixed Selling & Administrative costs) Operating Income 6. Check your work a Subtract Operating income from parts from operating income from part 3. Operating income from Absorption should be higher. b. Compute the following (units produced-units Sold) x (Fixed manufacturing overhead units produced) Your answers to (64) and (6b) should be the same Chapter 12 - Homework 3 Selling Price Variable Costs Contribution Margin Product A Product B Product C $ 100.00/unit $ 150.00/unit $ 200.00/unit $ 40.00/unit $ 70.00/unit $ 100.00/unit $ 60.00/unit $ 80.00/unit $ 100.00/unit Maximum Demand 5000 units 4000 units 2000 units Direct labor hours/unit 3 hours/unit 5 hours/unit 10 hours/unit To produce the total units of the three products demanded, the firm will need a total of 55,000 direct labor hours. Assume the firm has excess capacity in machine hours but only 40,000 direct labor hours. o What is the contribution margin per direct labor hour for each product? o How much of each product should the firm produce given your findings concerning the contribution margin per hour? o What is the maximum total contribution margin earned by the firm with only 40,000 direct labor hours? Home X [Poetr Gwinnx My file X . 6 Textbox Today x M Import Patient X Solved. X ADPIC X Mail-LX /bbcswebdav/pid-1315495-dt-content-rid-143348141/courses/ACCT 211398.2020-30/Chapter%206%20ILP pdf Please either do this on separate paper, or in an excel file. Either a pdf or an excel file is acetable for submission. Show and label your work! The following summarizes the cost behavior of the XYZ Company: Manufacturing Costs Direct Materials $15/unit produced Direct Labor $20/unit produced Variable Overhead $35/unit produced Variable manufacturing Cost/unit $70/unit produced $60,000/month Fixed Manufacturing Overhead Selling & Administrative Costs Variable Selling Costs Fixed Selling & Administrative Costs $25/unit sold $30,000/month 1. Selling Price $125/unit sold Assume in the first month of production the firm produced 5,000 units but sold only 4,000 units. Compute the total cost incurred for each item below. Note that manufacturing costs are driven by the units produced while selling & administrative costs are driven by units sold: Manufacturing Costs Direct Materials Direct Labor Variable Overhead Variable manufacturing Cost/unit Fixed Manufacturing Overhead Selling & Administrative Costs Variable Selling Costs Fixed Selling & Administrative Costs 2 What is the manufacturing cost per unit? Note, the total manufacturing cost includes the fixed manufacturing overhead cost. Use this amount in part 3 Prepare an absorption income statement. Use the following as a guide: 3. Sales Revenue (units SOLD X $125/unit) Less: Cost of Goods sold (units SOLD X manufacturing cost/unit from (2) Gross Margin Less: Selling & Administrative expenses: (Total Variable Selling Expense+Fixed Selling Expense) Operating Income What does it cost the firm to produce one more unit? What does it cost the firm to sell one more unit? The total of these is your variable cost per unit to be used in part 5 Prepare a variable costing income statement (Contribution Margin Income Statement). Use the following as a guide. 4. 5. Sales Revenue (units SOLD X $125/unit) Less: Variable Cost (units SOLD X Variable cost/unit from part 4) Contribution Margin Less: Fixed costs: (Exel Manufacturing Overhead+Fixed Selling & Administrative costs) Operating Income 6. Check your work a Subtract Operating income from parts from operating income from part 3. Operating income from Absorption should be higher. b. Compute the following (units produced-units Sold) x (Fixed manufacturing overhead units produced) Your answers to (64) and (6b) should be the same