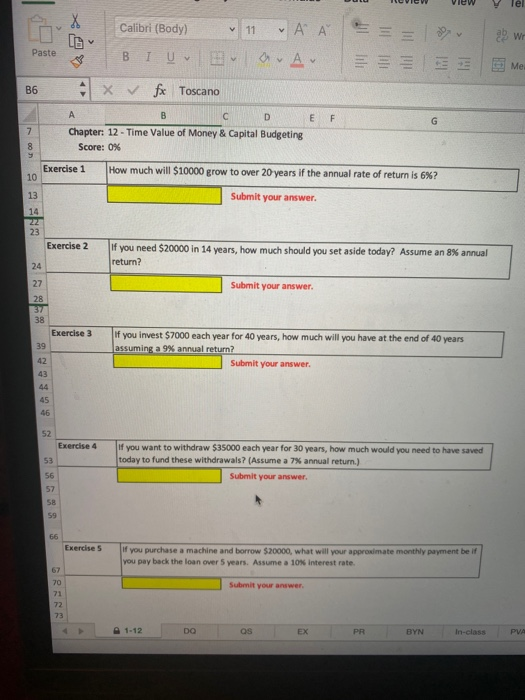

chapter 12, managerial accounting: time value of money & capital budgeting

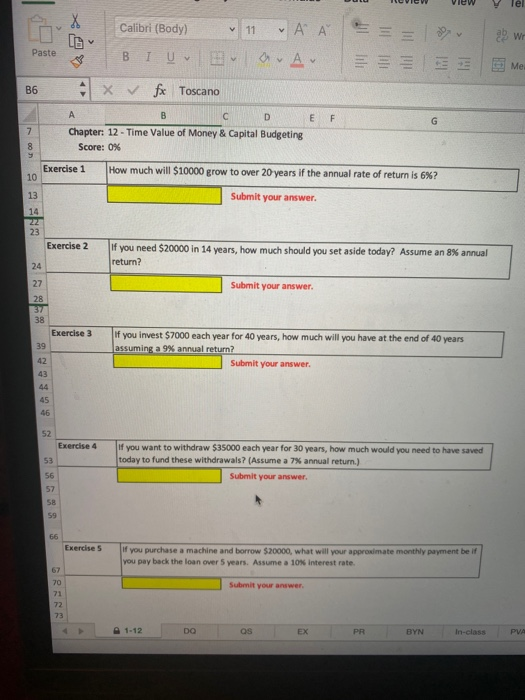

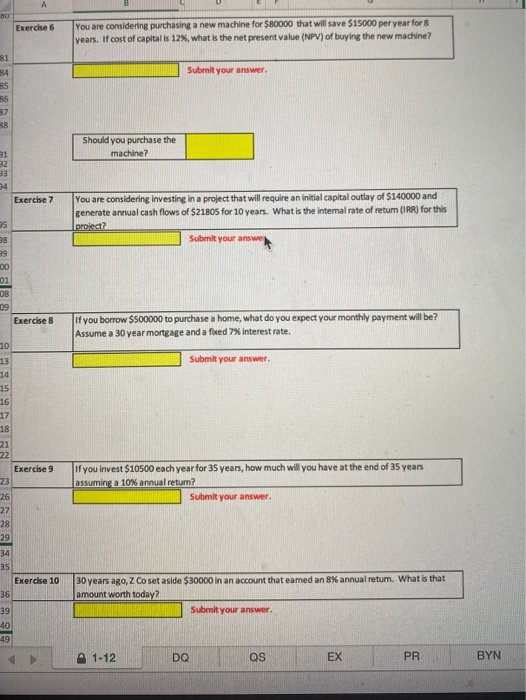

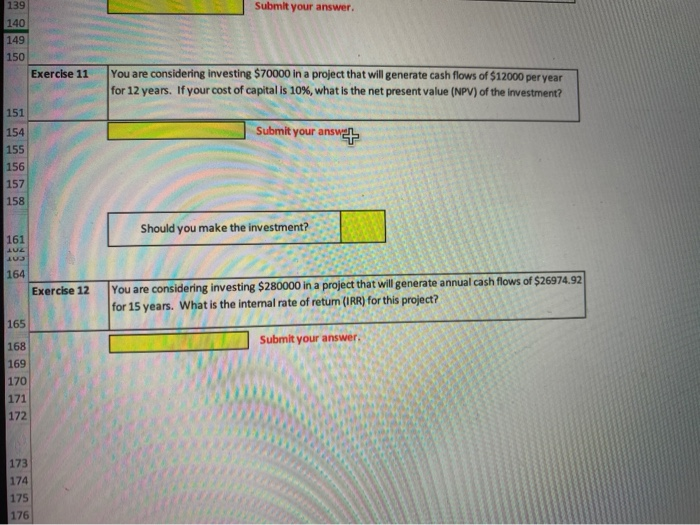

VIEW Tel INT X [G li Calibri (Body) 11 A A I U v Ban Av. a wr Paste Me + B6 Xfx Toscano E F G In oor D Chapter: 12 - Time Value of Money & Capital Budgeting Score: 0% Exercise 1 10 How much will $10000 grow to over 20 years if the annual rate of return is 6%? Submit your answer. 13 14 22 23 Exercise 2 If you need $20000 in 14 years, how much should you set aside today? Assume an 8% annual return? 24 Submit your answer. 27 28 337 38 Exercise 3 39 42 43 44 45 46 If you invest $7000 each year for 40 years, how much will you have at the end of 40 years assuming a 9% annual return? Submit your answer. 52 Exercise 4 53 If you want to withdraw $35000 each year for 30 years, how much would you need to have saved today to fund these withdrawals? (Assume a 7% annual return.) Submit your answer. 56 57 58 59 66 Exercises If you purchase a machine and borrow $20000, what will your approximate monthly payment be if you pay back the loan over 5 years. Assume a 10% interest rate 67 70 Submit your answer. 73 1-12 DO QS EX PR BYN In-class PVA 00 Exercise 6 You are considering purchasing a new machine for $80000 that will save $15000 per year for 8 years. If cost of capitalis 12%, what is the net present value (NPV) of buying the new machine? Submit your answer. 81 84 85 86 37 Should you purchase the machine? 31 az 33 Exercise 7 05 You are considering investing in a project that will require an initial capital outlay of $140000 and generate annual cash flows of $21805 for 10 years. What is the internal rate of return (IRR) for this project Submit your answe 38 39 00 01 08 09 Exercise 8 If you borrow $500000 to purchase a home, what do you expect your monthly payment will be? Assume a 30 year mortgage and a foed 7% interest rate. Submit your answer. 10 13 14 15 16 17 18 21 22 Exercise 9 23 26 27 28 29 If you invest $10500 each year for 35 years, how much will you have at the end of 35 years assuming a 10% annual return? Submit your answer. 34 35 Exercise 10 36 30 years ago, z Co set aside $30000 in an account that eamed an 8% annual return. What is that amount worth today? Submit your answer. 39 40 49 1-12 DQ QS EX PR BYN 139 Submit your answer. 140 149 150 Exercise 11 You are considering investing $70000 in a project that will generate cash flows of $12000 per year for 12 years. If your cost of capital is 10%, what is the net present value (NPV) of the investment? 151 Submit your ansvit 154 155 156 157 158 Should you make the investment? 161 402 164 Exercise 12 You are considering investing $280000 in a project that will generate annual cash flows of $26974.92 for 15 years. What is the internal rate of retum (IRR) for this project? 165 Submit your answer. 168 169 170 171 172 173 174 175 176