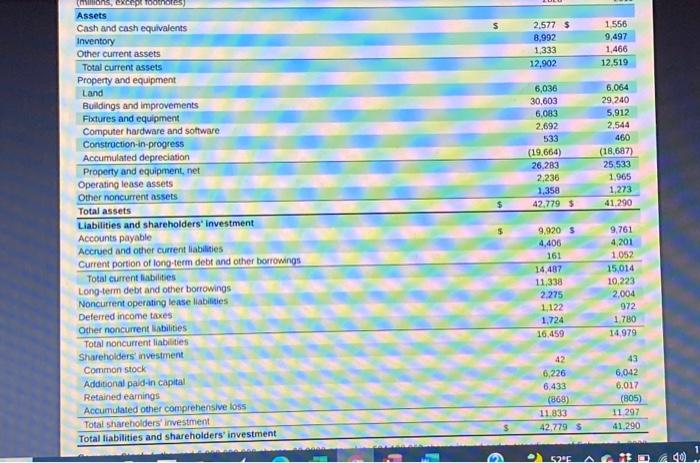

Chapter 13 Financial Statement Case Go to the link provided on the left menu, Target Corporation Once there, scroll to table of contents: Select Item 8 financial statements Now find the Consolidated Statement of Financial Position Find the Stockholders Equity Section 1. Did Target have any Preferred stock? 2. Now look at the bottom of the statement of financial position, Is Target authorized to issue preferred stock? How much? 3. How much common stock was outstanding ? (look at the bottom note again) Go to the Statement of Cash Flows 4. Did Target pay any cash dividends for the year ending February 2020 ? 2.577 $ 8,992 1,333 12,902 1556 9,497 1,466 12,519 6,036 30,603 6,083 2,692 533 (19.664) 26,283 2.236 1,358 42.779 $ 6,064 29.240 5,912 2,544 460 (18.687) 25,533 1.905 1,273 41.290 (milions, Cx100 Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets Liabilities and shareholders Investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent abilities Total noncurrent liabilities Shareholders investment Common stock Additional pald.in capital Retained earnings Accumulated other comprehensive loss Total shareholders investment Total liabilities and shareholders' investment 9.920 $ 4,406 161 14,487 11,338 2.275 1122 1,724 16.459 9,761 4,201 1,052 15.014 10,223 2,004 972 1.780 14.979 42 6,226 6.433 (868) 11.833 42.779 $ 43 6,042 6,017 (805) 11.297 41,290 52 AM Chapter 13 Financial Statement Case Go to the link provided on the left menu, Target Corporation Once there, scroll to table of contents: Select Item 8 financial statements Now find the Consolidated Statement of Financial Position Find the Stockholders Equity Section 1. Did Target have any Preferred stock? 2. Now look at the bottom of the statement of financial position, Is Target authorized to issue preferred stock? How much? 3. How much common stock was outstanding ? (look at the bottom note again) Go to the Statement of Cash Flows 4. Did Target pay any cash dividends for the year ending February 2020 ? 2.577 $ 8,992 1,333 12,902 1556 9,497 1,466 12,519 6,036 30,603 6,083 2,692 533 (19.664) 26,283 2.236 1,358 42.779 $ 6,064 29.240 5,912 2,544 460 (18.687) 25,533 1.905 1,273 41.290 (milions, Cx100 Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets Liabilities and shareholders Investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent abilities Total noncurrent liabilities Shareholders investment Common stock Additional pald.in capital Retained earnings Accumulated other comprehensive loss Total shareholders investment Total liabilities and shareholders' investment 9.920 $ 4,406 161 14,487 11,338 2.275 1122 1,724 16.459 9,761 4,201 1,052 15.014 10,223 2,004 972 1.780 14.979 42 6,226 6.433 (868) 11.833 42.779 $ 43 6,042 6,017 (805) 11.297 41,290 52 AM