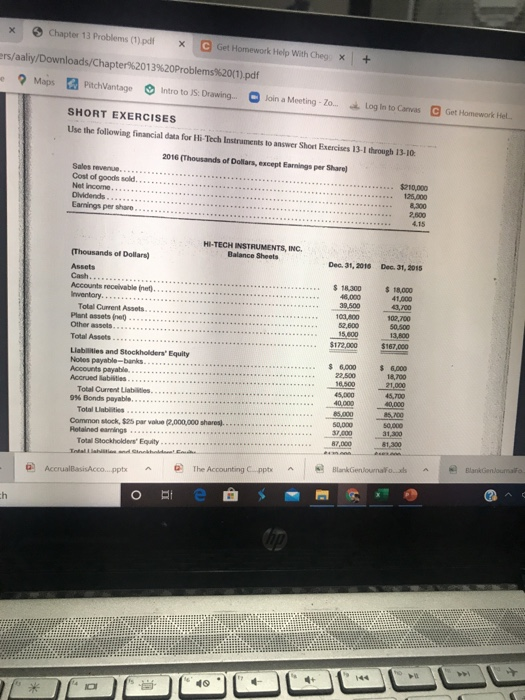

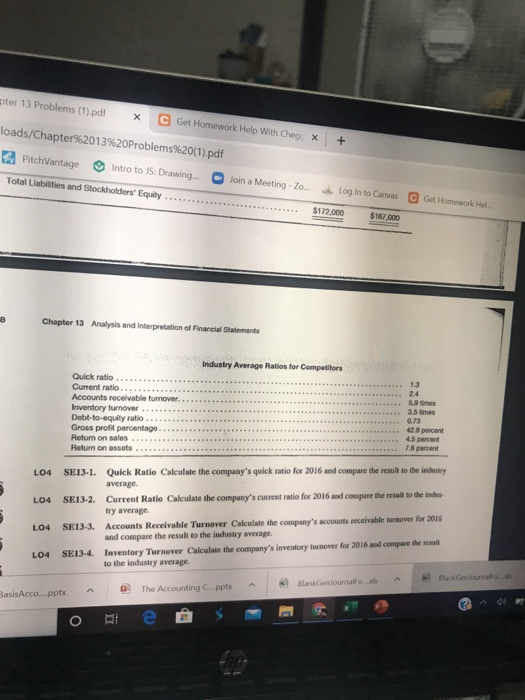

Chapter 13 Problems (1).pdf X C Get Homework Help With Cheg: X + ers/aaliy/Downloads/Chapter%2013%20Problems%20(1).pdf Maps PatchVantage Intro to S. Drawing Join a Meeting - Zo Log in to Canvas C Get Homework Hel SHORT EXERCISES Use the following facial data for Hi-Tech Instruments to answer Short Exercises 13-1 through 13-10- 2016 (Thousands of Dollars, except Earnings per Share Sales Cost of goods sold Not Income Dividends Earnings per share $210,000 8,300 2.600 4.15 (Thousands of Dollars Assets HI-TECH INSTRUMENTS, INC. Balance Sheets Dec 31, 2016 Dec 31, 2015 $ 18.000 41.000 43,700 $ 1.300 48.000 39.500 100.00 52.000 15,600 $172,000 100.700 50,500 13,800 $167.000 Accounts receivable et Inventory Total Current Assets Plant assets Other assets Total Assets Liabilities and Stockholders' Equity Notes payable-banks Accounts payable Accrued abilities Total Current Liabilities 9% Bonds payable Total Limbili Common stock, $25 par value 2,000,000 shares Retained earnings Total Stockholders' Equity Total and Chat Accrual BasisAcco....pptx The Accounting Cpptx $ 6.000 22,500 16.500 45,000 40,000 85.000 50,000 37.000 87,000 $ 6,000 18,700 21.000 45.700 40,000 45.700 50.000 31,300 81,300 Blankenjournalfo Blank Gendumalo ch o BI 140 Q pter 13 Problems (1).pdf X C Get Homework Help With Chegex + loads/Chapter%2013%20Problems%20(1).pdf PitchVantage Intro to IS: Drawing... Join a Meeting - Zo. Log in to Canvas Total Liabilities and Stockholders' Equity .... $172.000 $167.000 C Get Homework Hel 8 Chapter 13 Analysis and interpretation of Financial Statements Industry Average Ratios for Competitors Quick ratio Current ratio 1.3 2.4 Accounts receivable turnover. Inventory turnover 5.9 Simes 3.5 times Debt-to-equity ratio 0.73 Gross profit percentage 12.3 percent Return on sales 4.5 percent Return on assets 7.8 percent LO4 SE13-1. Quick Ratio Calculate the company's quick ratio for 2016 and compare the result to the industry average. LO4 SE13-2. Current Ratio Calculate the company's current ratio for 2016 and compare the result to the indus try average LO4 SE13-3. Accounts Receivable Turnover Calculate the company's accounts receivable turnover for 2016 and compare the result to the industry average LO4 SE13-4. Inventory Turnover Calculate the company's inventory turnover for 2016 and compare the real to the industry average Bankenos BlankGerulournalios BasisAcco....pptx The Accounting Cpptx $ O T e