Answered step by step

Verified Expert Solution

Question

1 Approved Answer

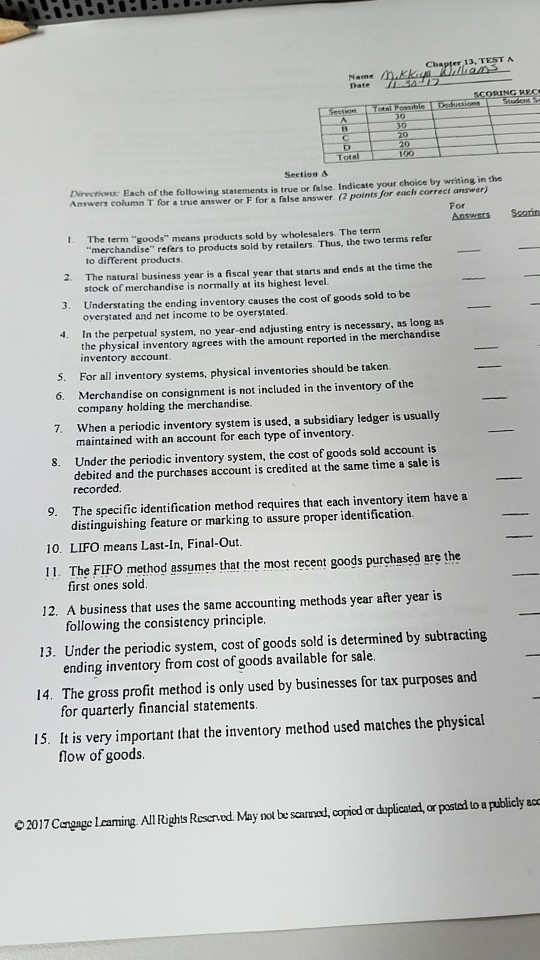

Chapter 13, TEST A Date ORING REC 10 20 20 Settin Dinechiovss: Each of the following statements is true or false. Indicate your choice by

Chapter 13, TEST A Date ORING REC 10 20 20 Settin Dinechiovss: Each of the following statements is true or false. Indicate your choice by writing in the Answers column T for a true answer or F for a false answer. (2 points for each correct answer) For Answers Scorin 1. The term "goods" means products sold by wholesalers. The term merchandise" refers to products sold by retailers. Thus, the two terms refer to different products 2 The natural business year is a fiscal year that starts and ends at the time the stock of merchandise is normally at its highest level. 3. Understating the ending inventory causes the cost of goods sold to be overstated and net income to be oyerstated 4. In the perpetual system, no year-end adjusting entry is necessary, as long as the physical inventory agrees with the amount reported in the merchandise inventory account 5. For all inventory systems, physical inventories should be taken Merchandise on consignment is not included in the inventory of the company holding the merchandise. 6. 7. When a periodic inventory system is used, a subsidiary ledger is usually maintained with an account for each type of inventory. Under the periodic inventory system, the cost of goods sold account is debited and the purchases account is credited at the same time a sale is recorded 8. The specific identification method requires that each inventory item have a distinguishing feature or marking to assure proper identification. 9. 10. LIFO means Last-In, Final-Out. 11. The FIFO method assumes that the most recent goods purchased are the first ones sold 12. A business that uses the same accounting methods year after year is following the consistency principle Under the periodic system, cost of goods sold is determined by subtracting 13. ending inventory from cost of goods available for sale. The gross profit method is only used by businesses for tax purposes and for quarterly financial statements. 14. 15. It is very important that the inventory method used matches the physical flow of goods. 2017 Cenage Leaming. All Rights Reservud. May not be sarod, copicd or duplicated or postad to a publicly aor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started