Answered step by step

Verified Expert Solution

Question

1 Approved Answer

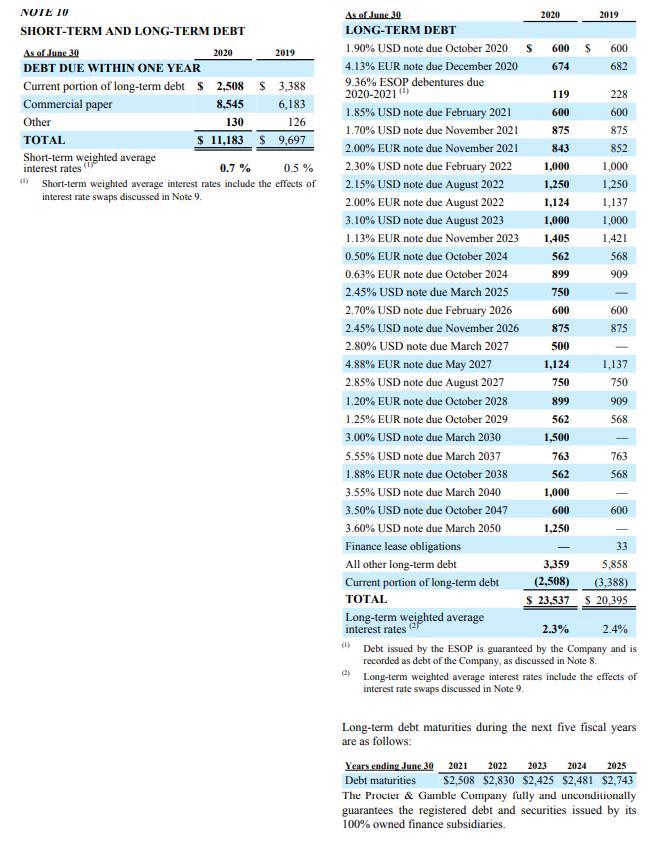

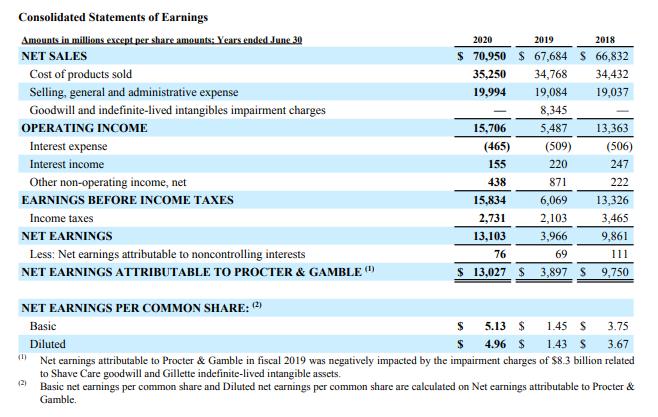

Procter & Gamble (P&G) for the year ended 6/30/20: Prepare an assessment of its liquidity, solvency, and financial flexibility using ratio analysis. NOTE 10 SHORT-TERM

Procter & Gamble (P&G) for the year ended 6/30/20: “Prepare an assessment of its liquidity, solvency, and financial flexibility using ratio analysis.”

NOTE 10 SHORT-TERM AND LONG-TERM DEBT 2020 As of June 30 DEBT DUE WITHIN ONE YEAR Current portion of long-term debt $ Commercial paper Other TOTAL Short-term weighted average interest rates ( 2019 2,508 $ 3,388 6,183 8,545 130 126 $ 11,183 $ 9,697 0.7 % 0.5% () Short-term weighted average interest rates include the effects of interest rate swaps discussed in Note 9. As of June 30 LONG-TERM DEBT 1.90% USD note due October 2020 $ 4.13% EUR note due December 2020 9.36% ESOP debentures due 2020-2021 (0) 1.85% USD note due February 2021 1.70% USD note due November 2021 2.00% EUR note due November 2021 2.30% USD note due February 2022 2.15% USD note due August 2022 2.00% EUR note due August 2022 3.10% USD note due August 2023 1.13% EUR note due November 2023 0.50% EUR note due October 2024 0.63% EUR note due October 2024 2.45% USD note due March 2025 2.70% USD note due February 2026 2.45% USD note due November 2026 2.80% USD note due March 2027 4.88% EUR note due May 2027 2.85% USD note due August 2027 1.20% EUR note due October 2028 1.25% EUR note due October 2029 3.00% USD note due March 2030 5.55% USD note due March 2037 1.88% EUR note due October 2038 3.55% USD note due March 2040 3.50% USD note due October 2047 3.60% USD note due March 2050 Finance lease obligations All other long-term debt Current portion of long-term debt TOTAL Long-term weighted average interest rates (2 (2) 2020 600 $ 674 119 600 875 843 1,000 1,250 1,124 1,000 1,405 562 899 750 600 875 500 1,124 750 899 562 1,500 763 562 1,000 600 1,250 3,359 (2,508) $ 23,537 2019 600 682 228 600 875 852 1,000 1,250 1,137 1,000 1,421 568 909 600 875 1,137 750 909 568 763 568 - 600 33 5,858 (3,388) $ 20,395 2.3% 2.4% Debt issued by the ESOP is guaranteed by the Company and is recorded as debt of the Company, as discussed in Note 8. Long-term weighted average interest rates include the effects of interest rate swaps discussed in Note 9. Long-term debt maturities during the next five fiscal years are as follows: Years ending June 30 2021 2022 2023 2024 2025 Debt maturities $2,508 $2,830 $2,425 $2,481 $2,743 The Procter & Gamble Company fully and unconditionally guarantees the registered debt and securities issued by its 100% owned finance subsidiaries.

Step by Step Solution

★★★★★

3.57 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Physical state lonic compounds are crystalline solids at room temperature 2 Electrical conductivit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started