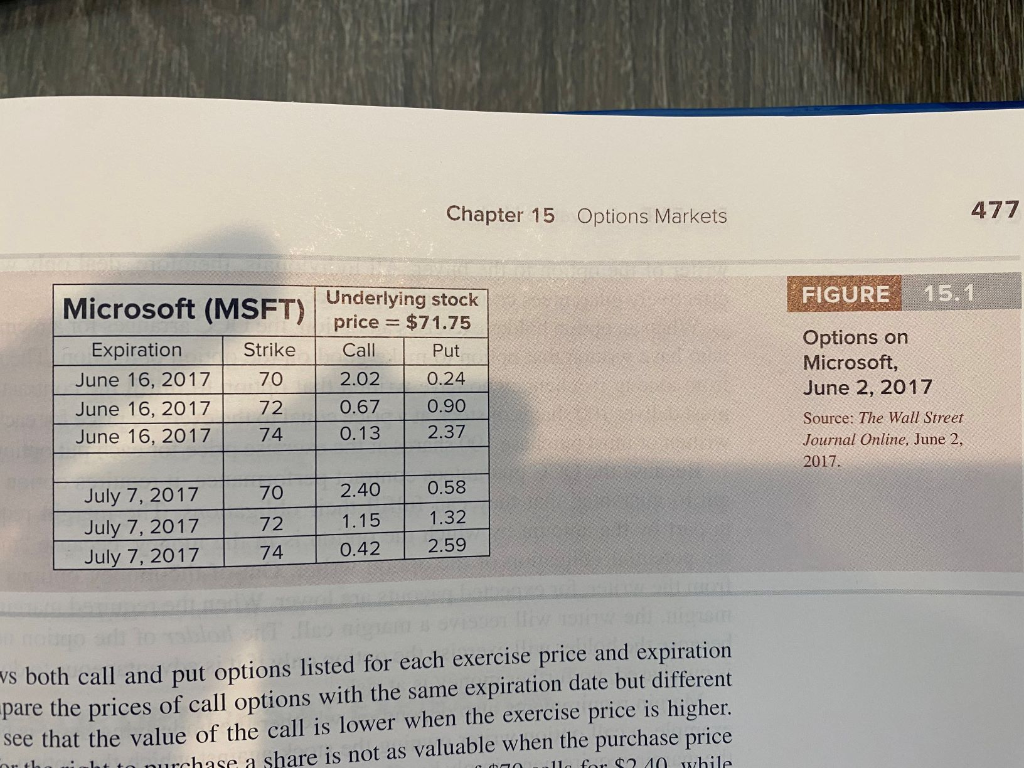

Chapter 15 Options Markets 21. An executive compensation scheme might provide a manager a bonus of $1,000 for every dollar by which the company's.stock price exceeds some cutoff level. In what way as this arrangement equivalent to issuing the manager call options on the firm's stock? (LO 15-3) 22. Consider the following options portfolio: You write a June 2017 expiration call option on Microsoft with exercise price $72. You also write a June expiration Microsoft put option with exercise price $70. (LO 15-2) a. Graph the payoff of this portfolio at option expiration as a function of the stock price at that time. b. What will be the profit/loss on this position if Microsoft is selling at $70 on the option expiration date? What if it is selling at $74? Use option prices from Figure 15.1 to answer this question. c. At what two stock prices will you just break even on your investment? d. What kind of bet" is this investor making; that is, what must this investor believe about the stock price in order to justify this position? 23. Consider the following portfolio. You write a put option with exercise price $90 and buy a pat with the same expiration date with exercise price $95. (LO 15-2) a. Plot the value of the portfolio at the expiration date of the options. b. Now, plot the profit of the portfolio. Hint: Which option must cost more? 24. A put option with strike price $60 trading on the Acme options exchange sells for $2. To your amazement, a put on the firm with the same expiration selling on the Apex options exchange but with strike price $62 also sells for $2. If you plan to hold the options position until expiration, devise a zero-net-investment arbitrage strategy to exploit the 111 Chapter 15 Options Markets 477 FIGURE 15.1 Underlying stock price = $71.75 Call Put Microsoft (MSFT) Expiration Strike June 16, 2017 70 June 16, 2017 72 June 16, 2017 74 2.02 0.67 0.13 0.24 0.90 2.37 Options on Microsoft, June 2, 2017 Source: The Wall Street Journal Online, June 2, 2017. 70 July 7, 2017 July 7, 2017 July 7, 2017 72 74 2.40 1.15 0.42 0.58 1.32 2.59 vs both call and put options listed for each exercise price and expiration pare the prices of call options with the same expiration date but different see that the value of the call is lower when the exercise price is higher. n nurchase a share is not as valuable when the purchase price I doo 119 for $2.40 while