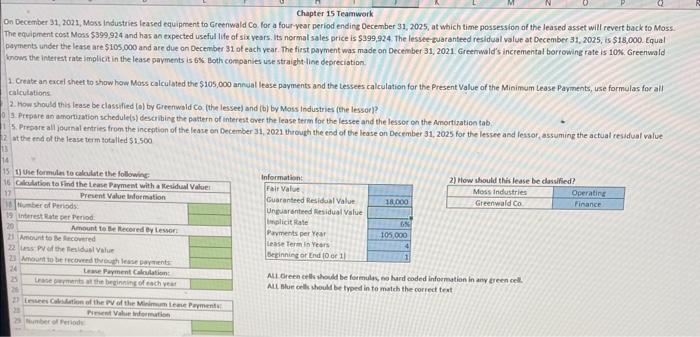

Chapter 15 Teamwork On December 31, 2021, Moss industries leased equipment to Greenwald Co. for a four-year period endine December 31,2025, at which time possession of the leased asset will revert back to Moss. The equipment cost Moss $399,924 and has an expected useful life of six vears. Its normal sales price is 5399,924 . The lesste-puaranteed residual value at December 31 , 2025, is $18,000. Equal payments under the lease are $105,000 and are due on December 31 of each vear. The first payment was made on December 31,2021 , Greenwald's incremental borrowing rate is 10k. Greenwald inows the interest rate implicit in the lease payments is 63. Both companies use straight line deprecistion. 1. Create an eacel sheet to show how Mass calculated the $105,000 annual lease payments and the Lessees calculation for the Present Value of the Minimum tease Payments, use formulas for all calculations. 2. How should this lease be classilied (o) by Greenwald Co. (the lessee) and (b) by Mois Industries (the lessor)? 1. Pripare an a morvation schedule(s) describing the partern of interest over the lease term for the lessee and the lessor on the Amortiration tab. 5. Presse all journal entries from the inception of the lease en December 31, 2021 through the end of the lease on December 31,2025 for the lessee and leasor, assuming the actual residual value at the end of the lease verm totalled 51.500 11 Uie formulen tarabidute itu inlwade. Nu dieen er lis hhoud be formules, no hard coded information in any ereen cecl. Aut nlue cells thould be typed in to match the correct trent Chapter 15 Teamwork On December 31, 2021, Moss industries leased equipment to Greenwald Co. for a four-year period endine December 31,2025, at which time possession of the leased asset will revert back to Moss. The equipment cost Moss $399,924 and has an expected useful life of six vears. Its normal sales price is 5399,924 . The lesste-puaranteed residual value at December 31 , 2025, is $18,000. Equal payments under the lease are $105,000 and are due on December 31 of each vear. The first payment was made on December 31,2021 , Greenwald's incremental borrowing rate is 10k. Greenwald inows the interest rate implicit in the lease payments is 63. Both companies use straight line deprecistion. 1. Create an eacel sheet to show how Mass calculated the $105,000 annual lease payments and the Lessees calculation for the Present Value of the Minimum tease Payments, use formulas for all calculations. 2. How should this lease be classilied (o) by Greenwald Co. (the lessee) and (b) by Mois Industries (the lessor)? 1. Pripare an a morvation schedule(s) describing the partern of interest over the lease term for the lessee and the lessor on the Amortiration tab. 5. Presse all journal entries from the inception of the lease en December 31, 2021 through the end of the lease on December 31,2025 for the lessee and leasor, assuming the actual residual value at the end of the lease verm totalled 51.500 11 Uie formulen tarabidute itu inlwade. Nu dieen er lis hhoud be formules, no hard coded information in any ereen cecl. Aut nlue cells thould be typed in to match the correct trent