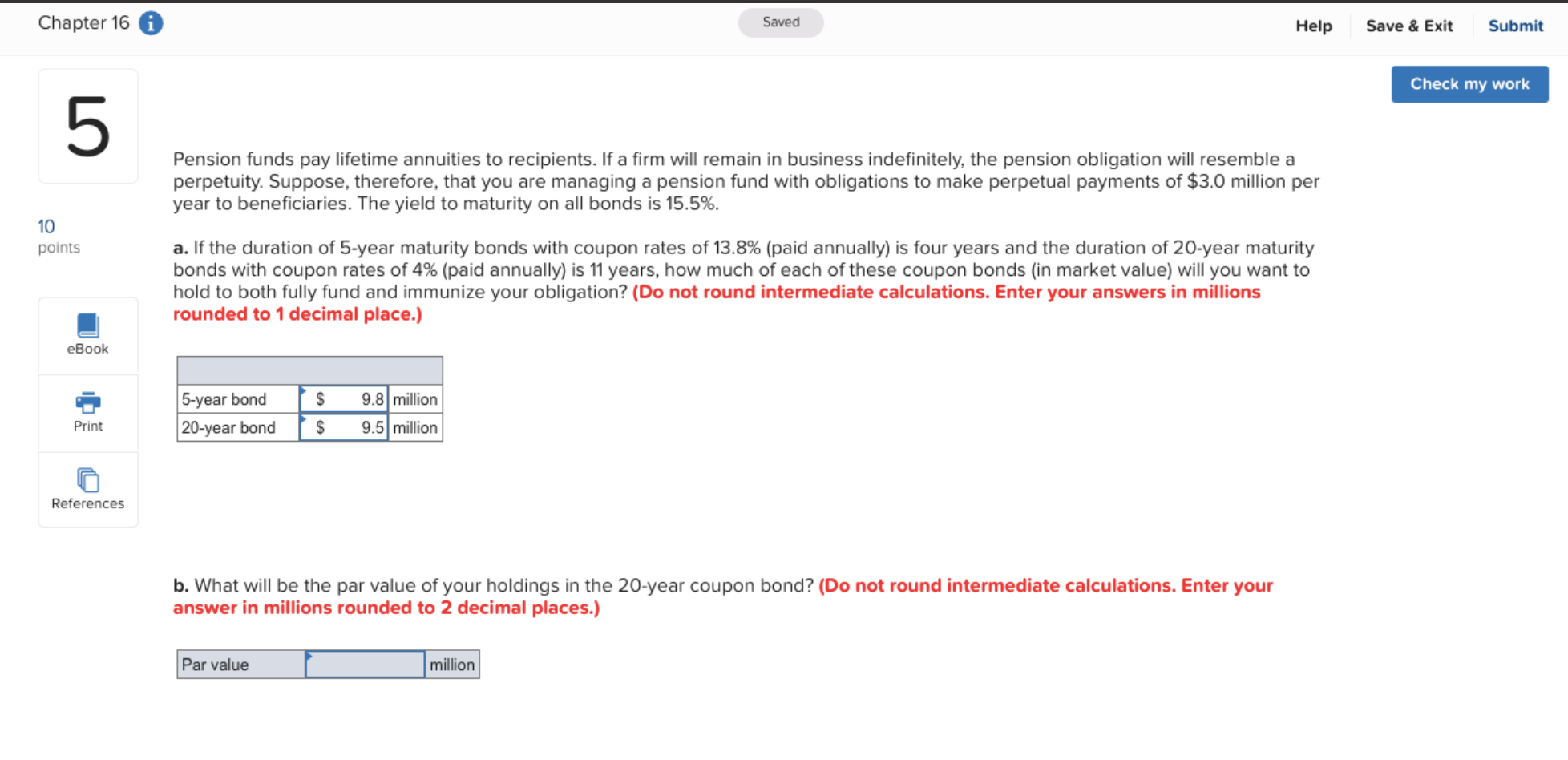

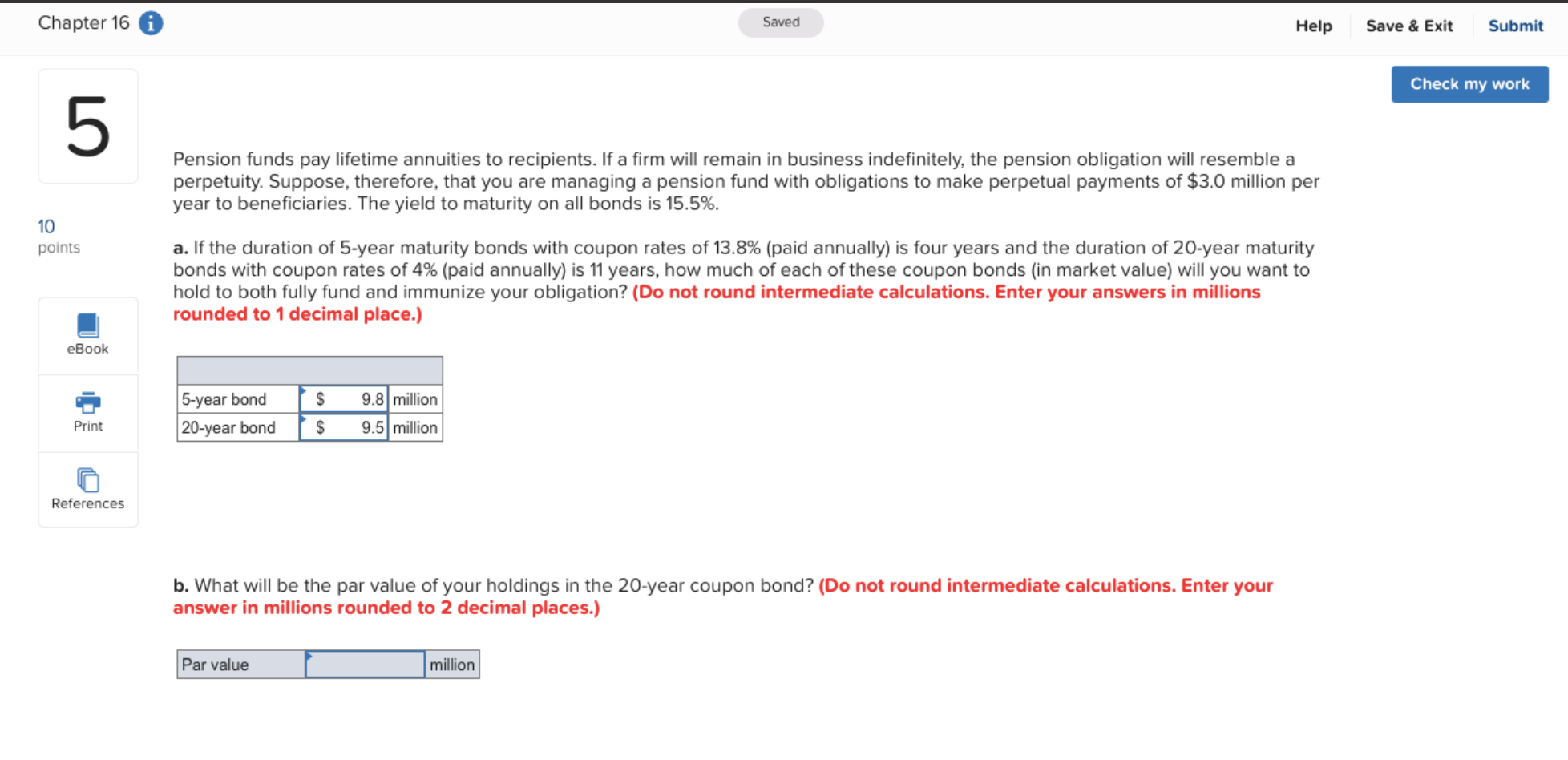

Chapter 16 6 Saved Help Save & Exit Submit Check my work Pension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $3.0 million per year to beneficiaries. The yield to maturity on all bonds is 15.5%. 10 points a. If the duration of 5-year maturity bonds with coupon rates of 13.8% (paid annually) is four years and the duration of 20-year maturity bonds with coupon rates of 4% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) eBook 5-year bond 20-year bond $ $ 9.8 million 9.5 million Print References b. What will be the par value of your holdings in the 20-year coupon bond? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Par value million Chapter 16 6 Saved Help Save & Exit Submit Check my work Pension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $3.0 million per year to beneficiaries. The yield to maturity on all bonds is 15.5%. 10 points a. If the duration of 5-year maturity bonds with coupon rates of 13.8% (paid annually) is four years and the duration of 20-year maturity bonds with coupon rates of 4% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) eBook 5-year bond 20-year bond $ $ 9.8 million 9.5 million Print References b. What will be the par value of your holdings in the 20-year coupon bond? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Par value million