Question

Chapter 16 covers Financial Statement Analysis. As you noted in the chapter, there are 3 common analytical techniques used to analyze a company's financial statements:

Chapter 16 covers Financial Statement Analysis. As you noted in the chapter, there are 3 common analytical techniques used to analyze a company's financial statements:

1) Horizontal Analysis

2) Vertical Analysis

3) Ratio Analysis

Each technique can be used to assess the financial health and future prospects of a company.

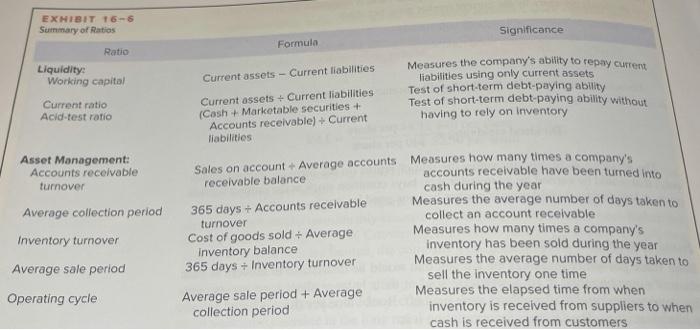

The ratios that can be used fall into the following categories (see page 752):

1) Liquidity

2) Asset Management

3) Debt Management

4) Profitability

5) Market Performance

In the text the authors state that an analyst should not rely solely on financial statement analysis when evaluating a company? Do you agree or disagree? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started