Answered step by step

Verified Expert Solution

Question

1 Approved Answer

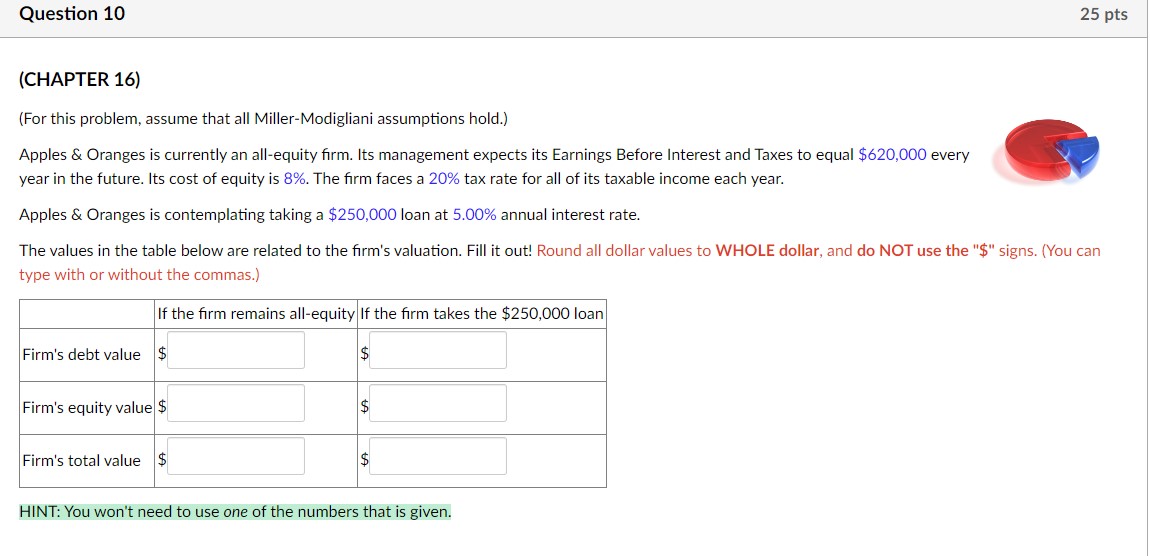

(CHAPTER 16) (For this problem, assume that all Miller-Modigliani assumptions hold.) Apples & Oranges is currently an all-equity firm. Its management expects its Earnings Before

(CHAPTER 16) (For this problem, assume that all Miller-Modigliani assumptions hold.) Apples \& Oranges is currently an all-equity firm. Its management expects its Earnings Before Interest and Taxes to equal \$620,000 every year in the future. Its cost of equity is 8%. The firm faces a 20% tax rate for all of its taxable income each year. Apples \& Oranges is contemplating taking a $250,000 loan at 5.00% annual interest rate. The values in the table below are related to the firm's valuation. Fill it out! Round all dollar values to WHOLE dollar, and do NOT use the "\$" signs. (You car type with or without the commas.) HINT: You won't need to use one of the numbers that is given

(CHAPTER 16) (For this problem, assume that all Miller-Modigliani assumptions hold.) Apples \& Oranges is currently an all-equity firm. Its management expects its Earnings Before Interest and Taxes to equal \$620,000 every year in the future. Its cost of equity is 8%. The firm faces a 20% tax rate for all of its taxable income each year. Apples \& Oranges is contemplating taking a $250,000 loan at 5.00% annual interest rate. The values in the table below are related to the firm's valuation. Fill it out! Round all dollar values to WHOLE dollar, and do NOT use the "\$" signs. (You car type with or without the commas.) HINT: You won't need to use one of the numbers that is given Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started