Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 16 Jane Ramirez owns shares in the Touchstone Small Cap fund that have a current value of $12,400. The fund charges an annual 12b-1

Chapter 16

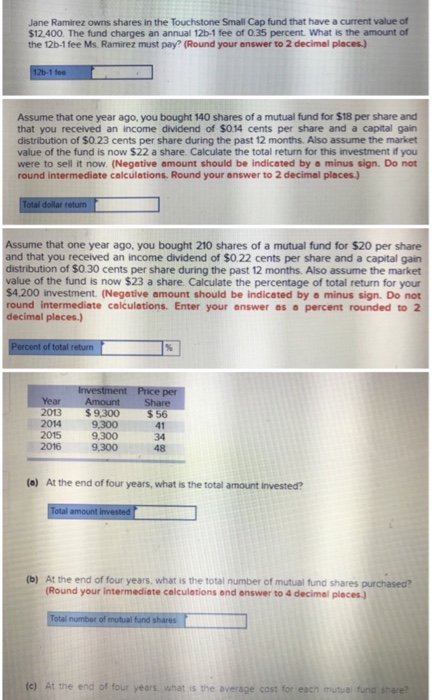

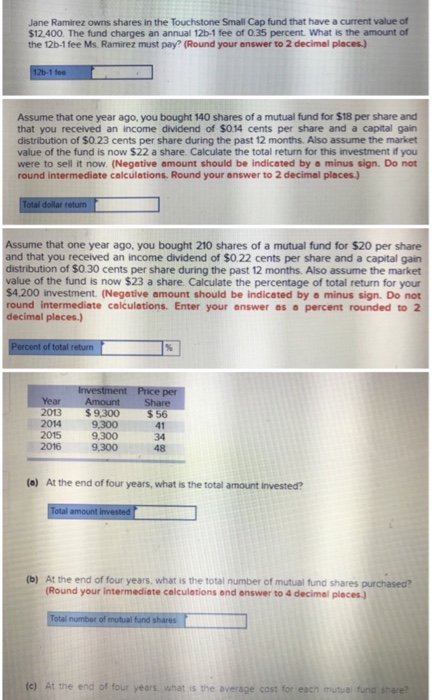

Jane Ramirez owns shares in the Touchstone Small Cap fund that have a current value of $12,400. The fund charges an annual 12b-1 fee of 0.35 percent. What is the amount of the 12b-1 fee Ms. Ramirez must pa? (Round your answer to 2 decimal places) Assume that one year ago, you bought 140 shares of a mutual fund for $18 per share and that you received an income dividend of $014 cents per share and a capital gain distribution of $0.23 cents per share during the past 12 months. Also assume the market value of the fund is now $22 a share. Calculate the total return for this investment if you were to sell it now. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your onswer to 2 decimal places) Assume that one year ago, you bought 210 shares of a mutual fund for $20 per share and that you received an income dividend of $0.22 cents per share and a capital gain distribution of $0.30 cents per share during the past 12 months. Also assume the market value of the fund is now $23 a share. Calculate the percentage of total return for your $4,200 investment. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) cent of total r Year 2013 $ 9,300 2014 9,300 s 56 41 34 48 2015 2016 9,300 9,300 (a) At the end of four years, what is the total amount invested? (b) At the end of four years, what is the total number of mutual fund shares purchased? (Round your intermediate calculations and answer to 4 decimal places.) number of mutual fund shares (c) At the end of four years what is the average cost for eacn mutual fund share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started