Answered step by step

Verified Expert Solution

Question

1 Approved Answer

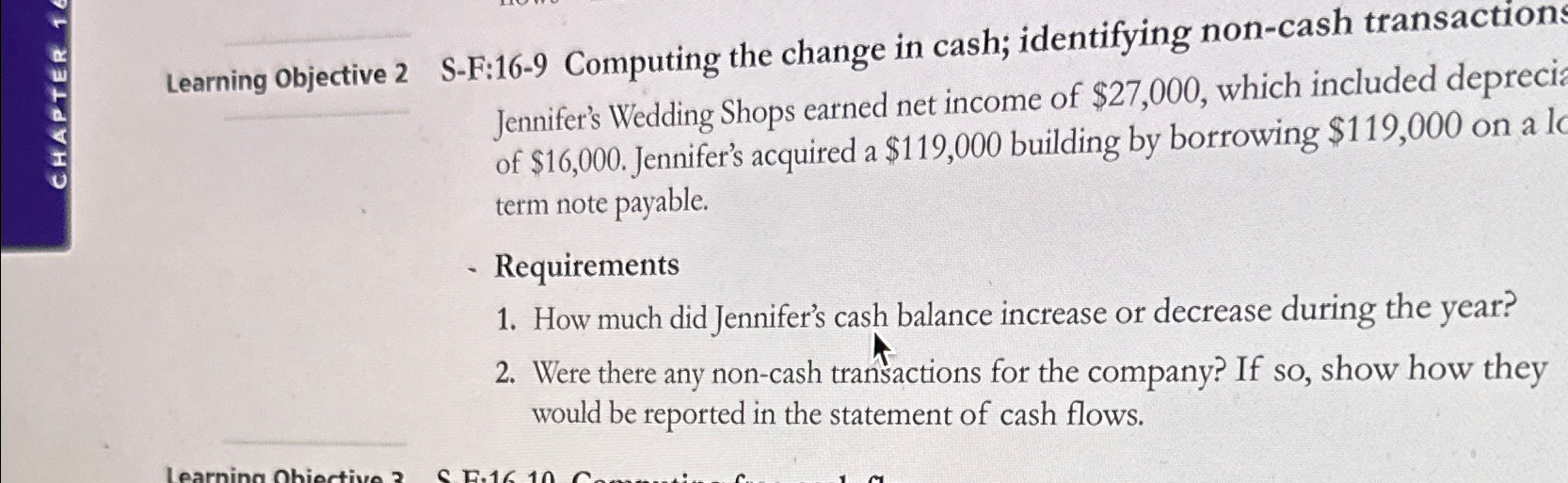

CHAPTER 16 Learning Objective 2 S-F:16-9 Computing the change in cash; identifying non-cash transactions Jennifer's Wedding Shops earned net income of $27,000, which included

CHAPTER 16 Learning Objective 2 S-F:16-9 Computing the change in cash; identifying non-cash transactions Jennifer's Wedding Shops earned net income of $27,000, which included deprecia of $16,000. Jennifer's acquired a $119,000 building by borrowing $119,000 on a lo term note payable. Requirements 1. How much did Jennifer's cash balance increase or decrease during the year? 2. Were there any non-cash transactions for the company? If so, show how they would be reported in the statement of cash flows. Learning Obiective 3 SF.16.10 Com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 To determine how Jennifers cash balance changed during the year we need to consider the net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d6123411b1_967569.pdf

180 KBs PDF File

663d6123411b1_967569.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started