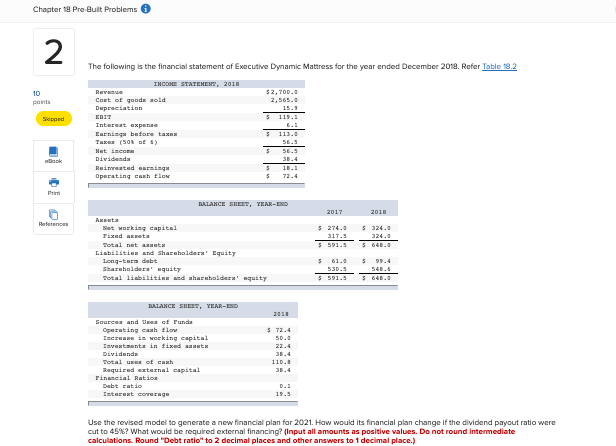

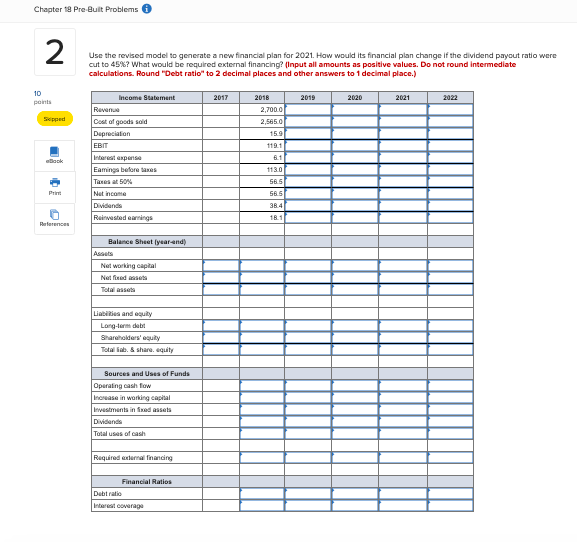

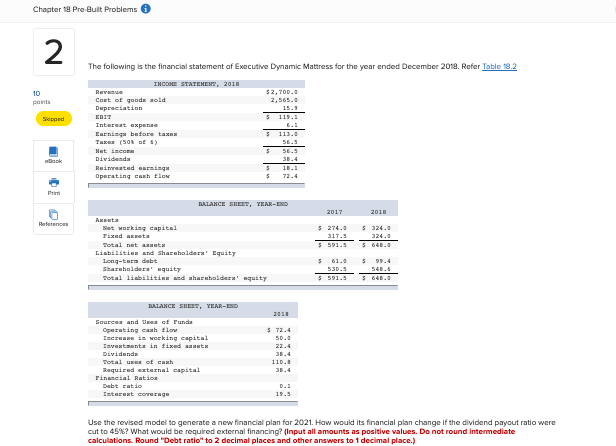

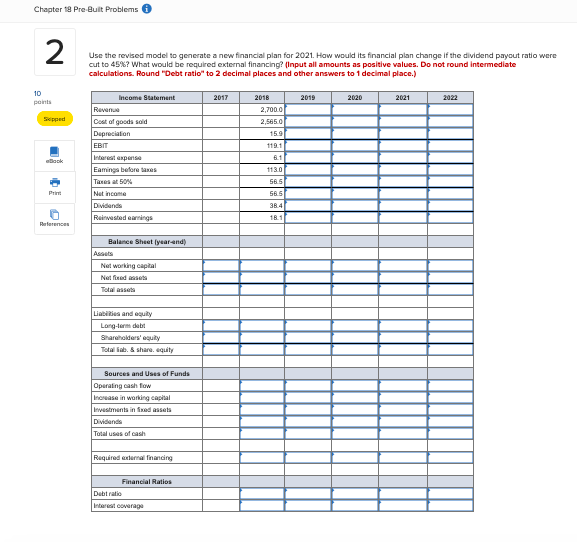

Chapter 18 Pre-Built Problems Sarved 2 The following is the financial statement of Executive Dynamic Mattress for the year ended December 2018. Refer Table 18.2 10 points INCOME STATEMENT, 2018 Revenue Cost of goods sold Depreciation EBIT Interest expense Earnings before taxes Taxes (50% of 6) Net income Dividends Reinvented earnings Operating cash flow $2,700.0 2,565.0 15.9 $ 119.1 6.1 $ 113.0 56.5 $ 56.5 eBook $ $ 18.1 72.4 Print BALANCE SHEET, YEAR-END References 2017 2018 $ 274.0 317.5 $ 591.5 $ 324.0 324.0 $ 648.0 Asset Net working capital Fixed assets Total net assets Liabilities and Shareholders' Equity Long-term debt Shareholders' equity Total liabilities and shareholders' equity $ 61.0 530.5 $ 591.5 548.6 $ 648.0 BALANCE SHEET, YEAR-END 2018 Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets Dividends Total uses of cash Required external capital Financial Ratio Debt ratio Interest coverage $ 72.4 50.0 22.4 38.4 110.8 38.4 0.1 19.5 Chapter 18 Pre-Built Problems Saved 2 Use the revised model to generate a new financial plan for 2021. How would its financial plan change if the dividend payout ratio were cut to 45%? What would be required external financing? (Input all amounts as positive values. Do not round intermediate calculations. Round "Debt ratio" to 2 decimal places and other answers to 1 decimal place.) 10 points 2017 2019 2020 2021 2022 Income Statement Revenue Cost of goods sold Depreciation EBIT Interest expense Eamings before taxes Taxes at 50% Net income Dividends Reinvested earnings 2018 2,700.0 2,565.0 15.9 119.1 6.1 cBook Print 113.0 56.5 56.5 38.4 References 18.1 Balance Sheet (year-end) Assets Net working capital Net fixed assets Total assets Liabilities and equity Long-term debt Shareholders' equity Total liab. & share, equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets 2 119.1 6.1 EBIT Interest expense Eamings before taxes Taxes at 50% Net income Dividends Reinvested earnings 113.0 56.5 10 points 56.5 38.4 18.1 Skipped cBook Balance Sheet (year-end) Assets Networking capital Net fixed assets Total assets Print References Liabilities and equity Long-term debt Shareholders' equity Total liab. & share, equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets Dividends Total uses of cash Required external financing Financial Ratios Debt ratio Interest coverage Chapter 19 Pre-Built Problems 2 Use the revised model to generate a new financial plan for 2021. How would its financial plan change if the dividend payout ratio were cut to 45%? What would be required external financing? (Input all amounts as positive values. Do not round Intermediate calculations. Round "Debt ratio" to 2 decimal places and other answers to 1 decimal place.) 10 points 2017 2018 2019 2020 2021 2022 Skipped 2,700.0 2,5650 15.9 119.1 Back Income Statement Revenue Cost of goods sold Depreciation EBIT Interest asper Eaming before les Taxes at 50% Net income Dividends Reinvested earnings 6.1 113.0 56.5 Print 56.5 384 18.1 Pferences Balance Sheet year and Ats Networking capital Nat fiend Total assets , Liabies and equity Long-term diebt Shareholders' equity Total & share equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in med assets Dividende Total use of cash Required cernal financing Financial Ratios Debratio Interest coverage Chapter 19 Pre-Bult Problems 2 10 points Skipped The following is the financial statement of Executive Dynamic Mattress for the year ended December 2018. Refer Table 18.2 INCORE STATEMENE, 2018 Revenue $2,700.0 Cost of goods sold 2,565.. Depreciation 15.1 EDIT $ 119.1 Interest experte Earning before taxes 5 113.0 Taxe (502 DE 5) 56.3 Net 5 56.5 Dividenda Reimated earniaga 5 Operating cash flow 72. book Print 2013 References BALANCE SHEET, YEAR-END Ata Het working capital Tixed annet Total net Liabilities and Shareholders' Equity Long-term debt Shareholders' equity Total liabilities and shareholders' equity 2017 $ 274.. 317.5 5 591.5 5 324.0 324.0 5 640.0 599. 530.5 $ 591.3 MALANCE SH, YEAR-END Sources and Uses of runde Operating cash flow Increase is working capital Investments in fixed nuts Dividende Total use of cash Required external capital Tincial Ratio Debt ratio Internet corecage 5 72.4 SD. 22.4 38.4 110. Use the revised model to generate a new financial plan for 2021. How would its financial plan change if the dividend payout ratio were cut to 45%? What would be required external financing? (Input all amounts as positive values. Do not round Intermediate calculations. Round "Debt ratio" to 2 decimal places and other answers to 1 decimal place.) Chapter 18 Pre-Built Problems Sarved 2 The following is the financial statement of Executive Dynamic Mattress for the year ended December 2018. Refer Table 18.2 10 points INCOME STATEMENT, 2018 Revenue Cost of goods sold Depreciation EBIT Interest expense Earnings before taxes Taxes (50% of 6) Net income Dividends Reinvented earnings Operating cash flow $2,700.0 2,565.0 15.9 $ 119.1 6.1 $ 113.0 56.5 $ 56.5 eBook $ $ 18.1 72.4 Print BALANCE SHEET, YEAR-END References 2017 2018 $ 274.0 317.5 $ 591.5 $ 324.0 324.0 $ 648.0 Asset Net working capital Fixed assets Total net assets Liabilities and Shareholders' Equity Long-term debt Shareholders' equity Total liabilities and shareholders' equity $ 61.0 530.5 $ 591.5 548.6 $ 648.0 BALANCE SHEET, YEAR-END 2018 Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets Dividends Total uses of cash Required external capital Financial Ratio Debt ratio Interest coverage $ 72.4 50.0 22.4 38.4 110.8 38.4 0.1 19.5 Chapter 18 Pre-Built Problems Saved 2 Use the revised model to generate a new financial plan for 2021. How would its financial plan change if the dividend payout ratio were cut to 45%? What would be required external financing? (Input all amounts as positive values. Do not round intermediate calculations. Round "Debt ratio" to 2 decimal places and other answers to 1 decimal place.) 10 points 2017 2019 2020 2021 2022 Income Statement Revenue Cost of goods sold Depreciation EBIT Interest expense Eamings before taxes Taxes at 50% Net income Dividends Reinvested earnings 2018 2,700.0 2,565.0 15.9 119.1 6.1 cBook Print 113.0 56.5 56.5 38.4 References 18.1 Balance Sheet (year-end) Assets Net working capital Net fixed assets Total assets Liabilities and equity Long-term debt Shareholders' equity Total liab. & share, equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets 2 119.1 6.1 EBIT Interest expense Eamings before taxes Taxes at 50% Net income Dividends Reinvested earnings 113.0 56.5 10 points 56.5 38.4 18.1 Skipped cBook Balance Sheet (year-end) Assets Networking capital Net fixed assets Total assets Print References Liabilities and equity Long-term debt Shareholders' equity Total liab. & share, equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in fixed assets Dividends Total uses of cash Required external financing Financial Ratios Debt ratio Interest coverage Chapter 19 Pre-Built Problems 2 Use the revised model to generate a new financial plan for 2021. How would its financial plan change if the dividend payout ratio were cut to 45%? What would be required external financing? (Input all amounts as positive values. Do not round Intermediate calculations. Round "Debt ratio" to 2 decimal places and other answers to 1 decimal place.) 10 points 2017 2018 2019 2020 2021 2022 Skipped 2,700.0 2,5650 15.9 119.1 Back Income Statement Revenue Cost of goods sold Depreciation EBIT Interest asper Eaming before les Taxes at 50% Net income Dividends Reinvested earnings 6.1 113.0 56.5 Print 56.5 384 18.1 Pferences Balance Sheet year and Ats Networking capital Nat fiend Total assets , Liabies and equity Long-term diebt Shareholders' equity Total & share equity Sources and Uses of Funds Operating cash flow Increase in working capital Investments in med assets Dividende Total use of cash Required cernal financing Financial Ratios Debratio Interest coverage Chapter 19 Pre-Bult Problems 2 10 points Skipped The following is the financial statement of Executive Dynamic Mattress for the year ended December 2018. Refer Table 18.2 INCORE STATEMENE, 2018 Revenue $2,700.0 Cost of goods sold 2,565.. Depreciation 15.1 EDIT $ 119.1 Interest experte Earning before taxes 5 113.0 Taxe (502 DE 5) 56.3 Net 5 56.5 Dividenda Reimated earniaga 5 Operating cash flow 72. book Print 2013 References BALANCE SHEET, YEAR-END Ata Het working capital Tixed annet Total net Liabilities and Shareholders' Equity Long-term debt Shareholders' equity Total liabilities and shareholders' equity 2017 $ 274.. 317.5 5 591.5 5 324.0 324.0 5 640.0 599. 530.5 $ 591.3 MALANCE SH, YEAR-END Sources and Uses of runde Operating cash flow Increase is working capital Investments in fixed nuts Dividende Total use of cash Required external capital Tincial Ratio Debt ratio Internet corecage 5 72.4 SD. 22.4 38.4 110. Use the revised model to generate a new financial plan for 2021. How would its financial plan change if the dividend payout ratio were cut to 45%? What would be required external financing? (Input all amounts as positive values. Do not round Intermediate calculations. Round "Debt ratio" to 2 decimal places and other answers to 1 decimal place.)