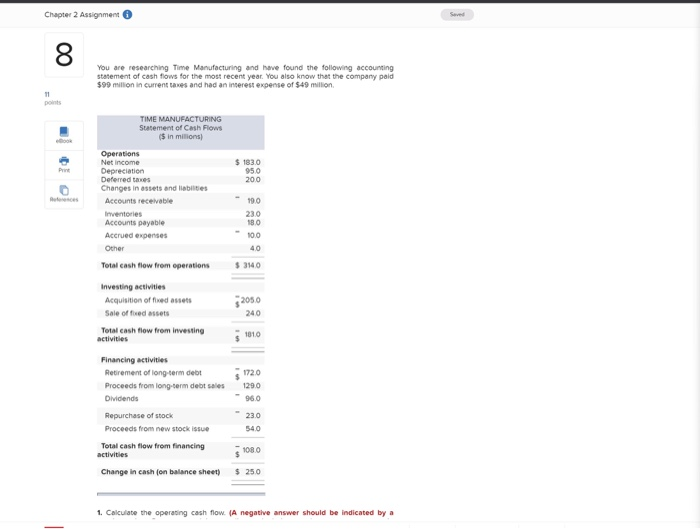

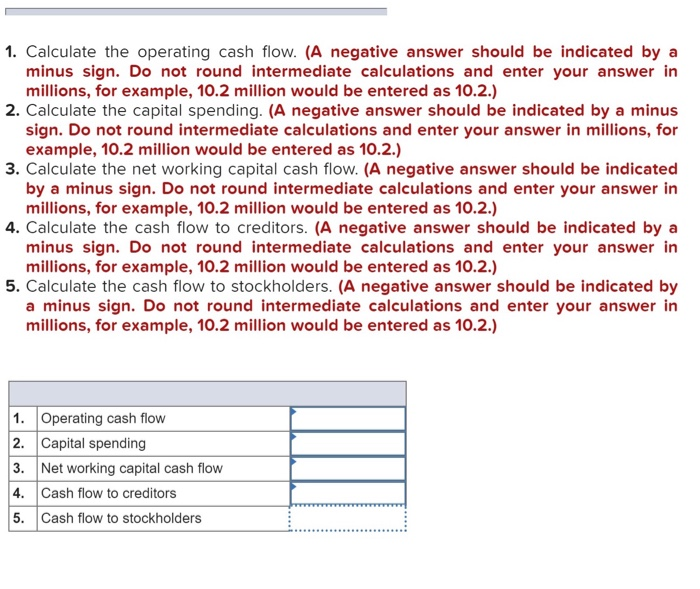

Chapter 2 Assignment Save 8 You are researching Time Manufacturing and leave found the following accounting statement of cash flows for the most recent year. You also know that the company paid $99 million in Current taxes and had an interest expense of $49 million 11 $ 1830 950 200 TIME MANUFACTURING Statement of Cash Flows (5 in milions Operations Net income Depreciation Deferred taxes Changes in assets and tables Accounts receivable Inventories Accounts payable Accrued expenses Other Total cash flow from operations -190 23.0 180 100 40 $ 3140 Investing activities Acquisition of fixed assets Sale of fired assets Total cash flow from Investing activities 2050 240 100 Financing activities Retirement of long-term debt Proceeds from long-term debt sales Dividends Repurchase of stock Proceeds from new stock Total cash flow from financing activities Change in cash (on balance sheet) 51720 1290 96.0 23.0 540 1080 $ 250 1. Calculate the operating cash flow. (A negative answer should be indicated by a 1. Calculate the operating cash flow. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 2. Calculate the capital spending. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 3. Calculate the net working capital cash flow. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 4. Calculate the cash flow to creditors. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 5. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, for example, 10.2 million would be entered as 10.2.) 1. Operating cash flow 2. Capital spending 3. Net working capital cash flow 4. Cash flow to creditors 5. Cash flow to stockholders