Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 2: Audit of cash and cash equivalents Case 2 - Cash and cash equivalents presentation The following data were obtained from the unadjusted

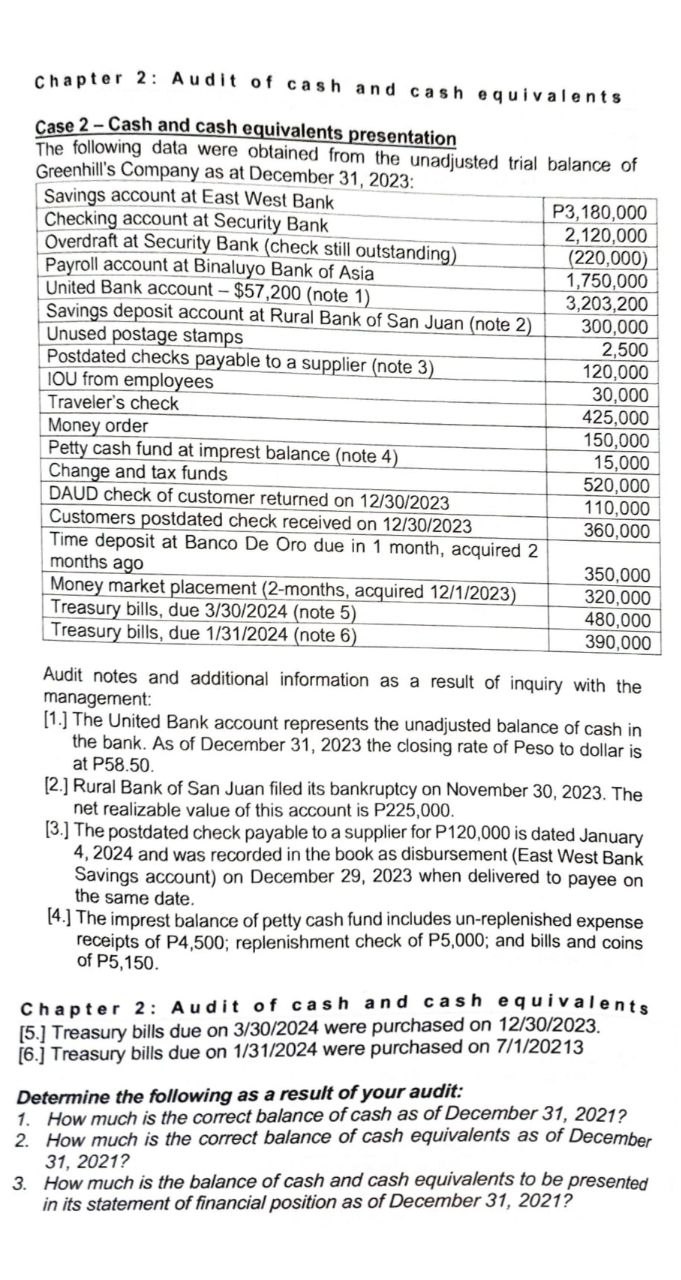

Chapter 2: Audit of cash and cash equivalents Case 2 - Cash and cash equivalents presentation The following data were obtained from the unadjusted trial balance of Greenhill's Company as at December 31, 2023: Savings account at East West Bank Checking account at Security Bank Overdraft at Security Bank (check still outstanding) Payroll account at Binaluyo Bank of Asia United Bank account - $57,200 (note 1) Savings deposit account at Rural Bank of San Juan (note 2) Unused postage stamps Postdated checks payable to a supplier (note 3) IOU from employees Traveler's check Money order Petty cash fund at imprest balance (note 4) Change and tax funds DAUD check of customer returned on 12/30/2023 Customers postdated check received on 12/30/2023 Time deposit at Banco De Oro due in 1 month, acquired 2 months ago Money market placement (2-months, acquired 12/1/2023) Treasury bills, due 3/30/2024 (note 5) Treasury bills, due 1/31/2024 (note 6) P3,180,000 2,120,000 (220,000) 1,750,000 3,203,200 300,000 2,500 120,000 30,000 425,000 150,000 15,000 520,000 110,000 360,000 350,000 320,000 480,000 390,000 Audit notes and additional information as a result of inquiry with the management: [1.] The United Bank account represents the unadjusted balance of cash in the bank. As of December 31, 2023 the closing rate of Peso to dollar is at P58.50. [2.] Rural Bank of San Juan filed its bankruptcy on November 30, 2023. The net realizable value of this account is P225,000. [3.] The postdated check payable to a supplier for P120,000 is dated January 4, 2024 and was recorded in the book as disbursement (East West Bank Savings account) on December 29, 2023 when delivered to payee on the same date. [4.] The imprest balance of petty cash fund includes un-replenished expense receipts of P4,500; replenishment check of P5,000; and bills and coins of P5,150. Chapter 2: Audit of cash and cash equivalents [5.] Treasury bills due on 3/30/2024 were purchased on 12/30/2023. [6.] Treasury bills due on 1/31/2024 were purchased on 7/1/20213 Determine the following as a result of your audit: 1. How much is the correct balance of cash as of December 31, 2021? 2. How much is the correct balance of cash equivalents as of December 31, 2021? 3. How much is the balance of cash and cash equivalents to be presented in its statement of financial position as of December 31, 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the correct balance of cash and cash equivalents for Greenhills Company as of December 31 2023 we need to adjust the unadjusted trial bal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started