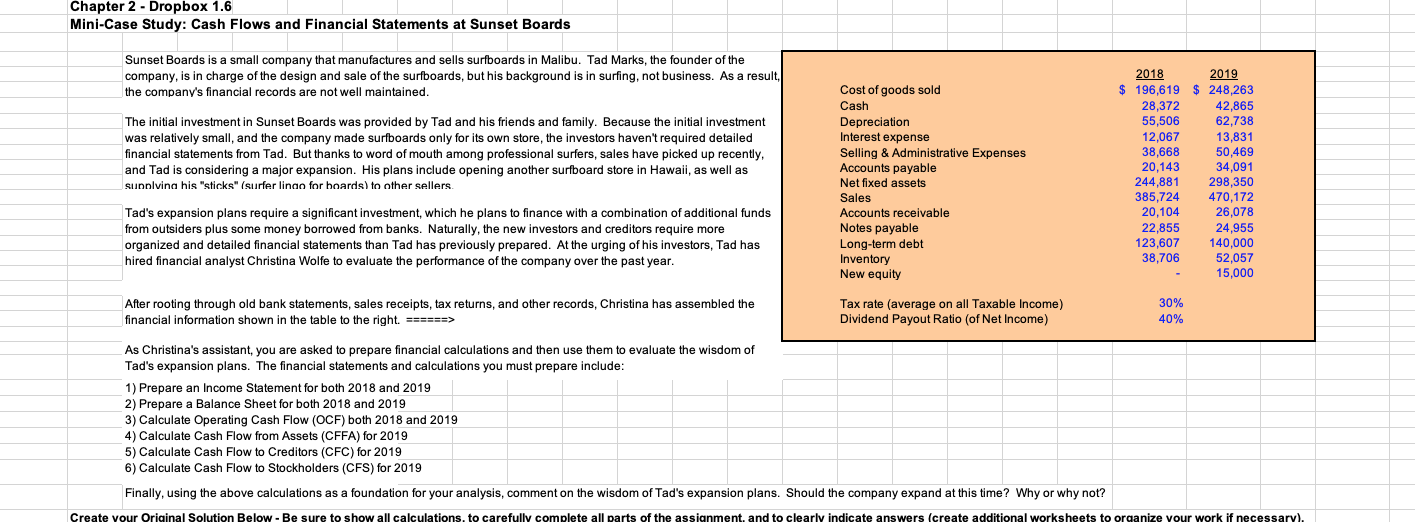

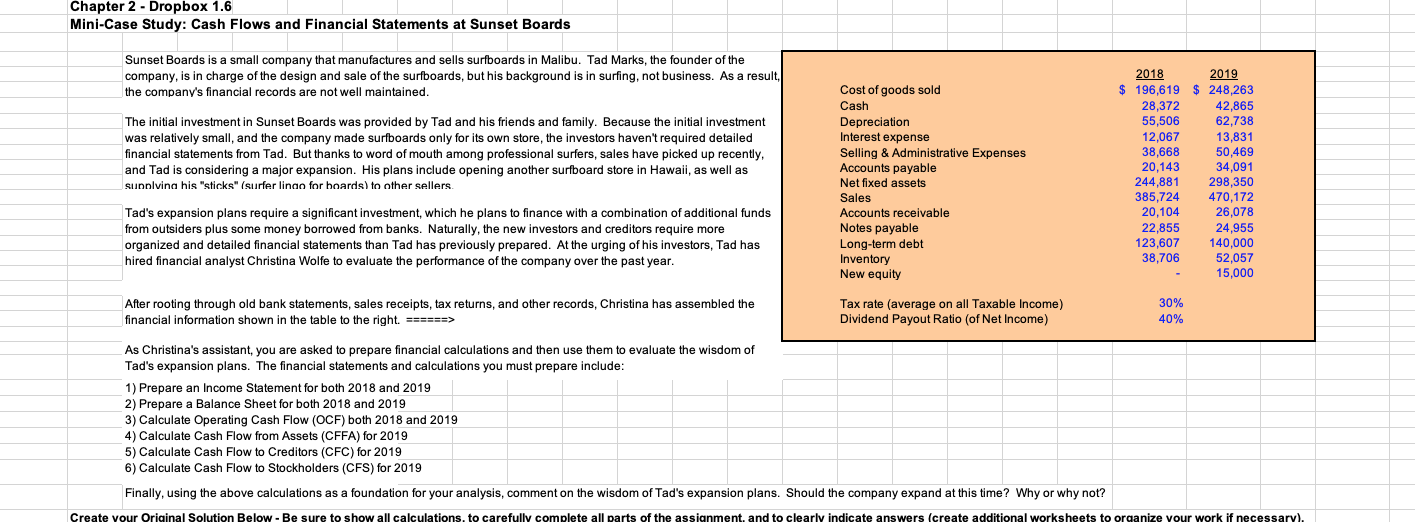

Chapter 2 - Dropbox 1.6 Mini-Case Study: Cash Flows and Financial Statements at Sunset Boards Sunset Boards is a small company that manufactures and sells surfboards in Malibu. Tad Marks, the founder of the company, is in charge of the design and sale of the surfboards, but his background is in surfing, not business. As a result, the company's financial records are not well maintained. The initial investment in Sunset Boards was provided by Tad and his friends and family. Because the initial investment was relatively small, and the company made surfboards only for its own store, the investors haven't required detailed financial statements from Tad. But thanks to word of mouth among professional surfers, sales have picked up recently, and Tad is considering a major expansion. His plans include opening another surfboard store in Hawaii, as well as supolving his "sticks" (surferlingo for boards) to other sellers. Cost of goods sold Cash Depreciation Interest expense Selling & Administrative Expenses Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 2018 2019 $ 196,619 $ 248,263 28,372 42,865 55,506 62,738 12,067 13,831 38,668 50,469 20,143 34,091 244,881 298,350 385,724 470,172 20,104 26,078 22,855 24,955 123,607 140,000 38,706 52,057 15,000 Tad's expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. Naturally, the new investors and creditors require more organized and detailed financial statements than Tad has previously prepared. At the urging of his investors, Tad has hired financial analyst Christina Wolfe evaluate the performance of the company over the past year. After rooting through old bank statements, sales receipts, tax returns, and other records, Christina has assembled the financial information shown in the table to the right. ======> Tax rate (average on all Taxable income) Dividend Payout Ratio (of Net Income) 30% 40% As Christina's assistant, you are asked to prepare financial calculations and then use them evaluate the wisdom of Tad's expansion plans. The financial statements and calculations you must prepare include: 1) Prepare an Income Statement for both 2018 and 2019 2) Prepare a Balance Sheet for both 2018 and 2019 3) Calculate Operating Cash Flow (OCF) both 2018 and 2019 4) Calculate Cash Flow from Assets (CFFA) for 2019 5) Calculate Cash Flow to Creditors (CFC) for 2019 6) Calculate Cash Flow to Stockholders (CFS) for 2019 Finally, using the above calculations as a foundation for your analysis, comment on the wisdom of Tad's expansion plans. Should the company expand at this time? Why or why not? Create your Original Solution Below - Be sure to show all calculations, to carefully complete all parts of the assignment, and to clearly indicate answers (create additional worksheets to organize your work if necessary). Chapter 2 - Dropbox 1.6 Mini-Case Study: Cash Flows and Financial Statements at Sunset Boards Sunset Boards is a small company that manufactures and sells surfboards in Malibu. Tad Marks, the founder of the company, is in charge of the design and sale of the surfboards, but his background is in surfing, not business. As a result, the company's financial records are not well maintained. The initial investment in Sunset Boards was provided by Tad and his friends and family. Because the initial investment was relatively small, and the company made surfboards only for its own store, the investors haven't required detailed financial statements from Tad. But thanks to word of mouth among professional surfers, sales have picked up recently, and Tad is considering a major expansion. His plans include opening another surfboard store in Hawaii, as well as supolving his "sticks" (surferlingo for boards) to other sellers. Cost of goods sold Cash Depreciation Interest expense Selling & Administrative Expenses Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 2018 2019 $ 196,619 $ 248,263 28,372 42,865 55,506 62,738 12,067 13,831 38,668 50,469 20,143 34,091 244,881 298,350 385,724 470,172 20,104 26,078 22,855 24,955 123,607 140,000 38,706 52,057 15,000 Tad's expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. Naturally, the new investors and creditors require more organized and detailed financial statements than Tad has previously prepared. At the urging of his investors, Tad has hired financial analyst Christina Wolfe evaluate the performance of the company over the past year. After rooting through old bank statements, sales receipts, tax returns, and other records, Christina has assembled the financial information shown in the table to the right. ======> Tax rate (average on all Taxable income) Dividend Payout Ratio (of Net Income) 30% 40% As Christina's assistant, you are asked to prepare financial calculations and then use them evaluate the wisdom of Tad's expansion plans. The financial statements and calculations you must prepare include: 1) Prepare an Income Statement for both 2018 and 2019 2) Prepare a Balance Sheet for both 2018 and 2019 3) Calculate Operating Cash Flow (OCF) both 2018 and 2019 4) Calculate Cash Flow from Assets (CFFA) for 2019 5) Calculate Cash Flow to Creditors (CFC) for 2019 6) Calculate Cash Flow to Stockholders (CFS) for 2019 Finally, using the above calculations as a foundation for your analysis, comment on the wisdom of Tad's expansion plans. Should the company expand at this time? Why or why not? Create your Original Solution Below - Be sure to show all calculations, to carefully complete all parts of the assignment, and to clearly indicate answers (create additional worksheets to organize your work if necessary)