Question

Chapter 2 Entre Company The following activities pertain to Entre Co. for the current year. Prepare the journal entry that should be made on Entre's

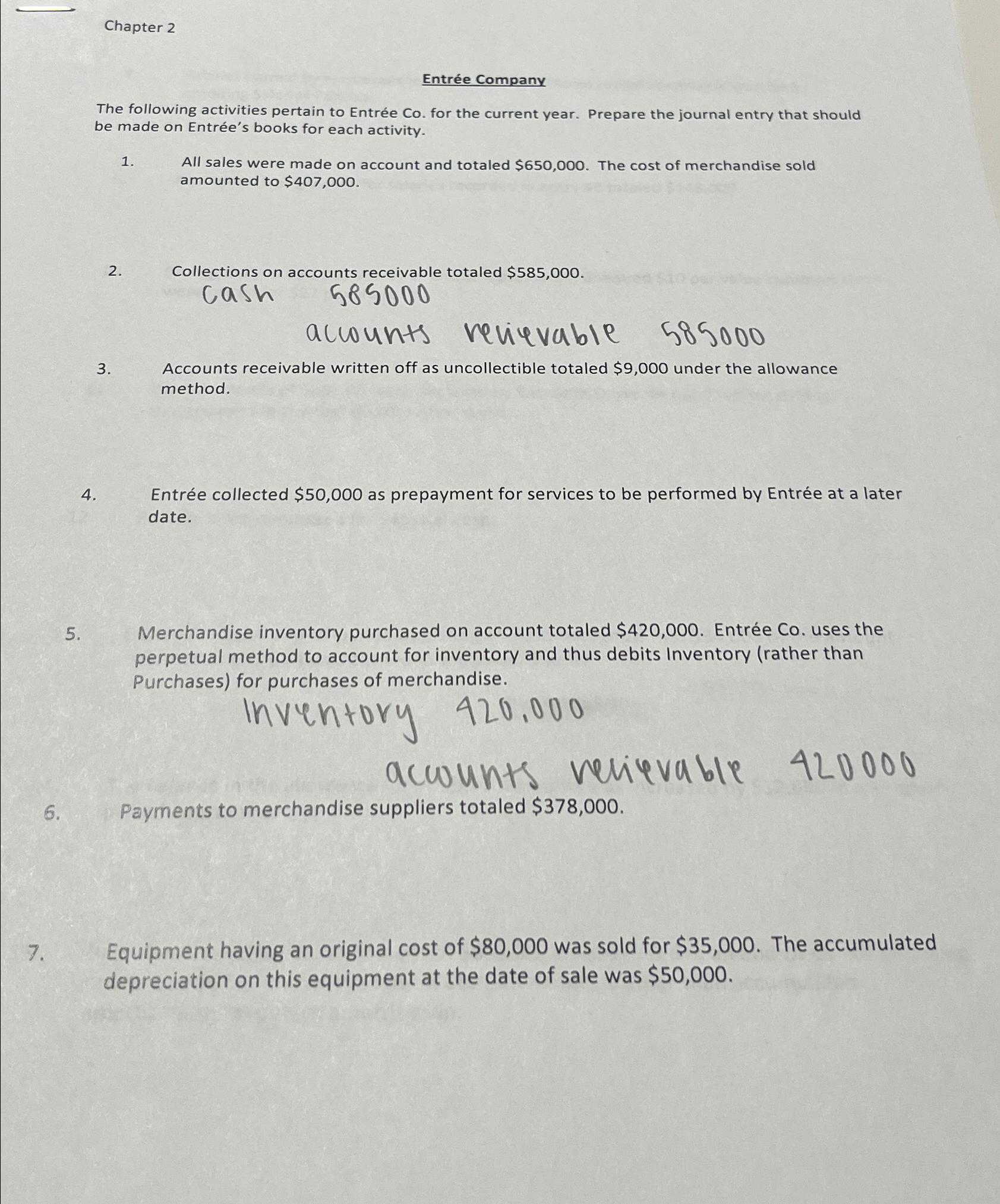

Chapter 2\ Entre Company\ The following activities pertain to Entre Co. for the current year. Prepare the journal entry that should be made on Entre's books for each activity.\ All sales were made on account and totaled

$650,000. The cost of merchandise sold amounted to

$407,000.\ Collections on accounts receivable totaled

$585,000.\ cash 585000\ accounts relievable 585000\ Accounts receivable written off as uncollectible totaled

$9,000under the allowance method.\ Entre collected

$50,000as prepayment for services to be performed by Entre at a later date.\ Merchandise inventory purchased on account totaled

$420,000. Entre Co. uses the perpetual method to account for inventory and thus debits Inventory (rather than Purchases) for purchases of merchandise.\

Inventory 420,000\ accounts velievable\ 420000\ 6. Payments to merchandise suppliers totaled

$378,000.\ 7. Equipment having an original cost of

$80,000was sold for

$35,000. The accumulated depreciation on this equipment at the date of sale was

$50,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started