Chapter 20 & 21 of Intermediate Accounting

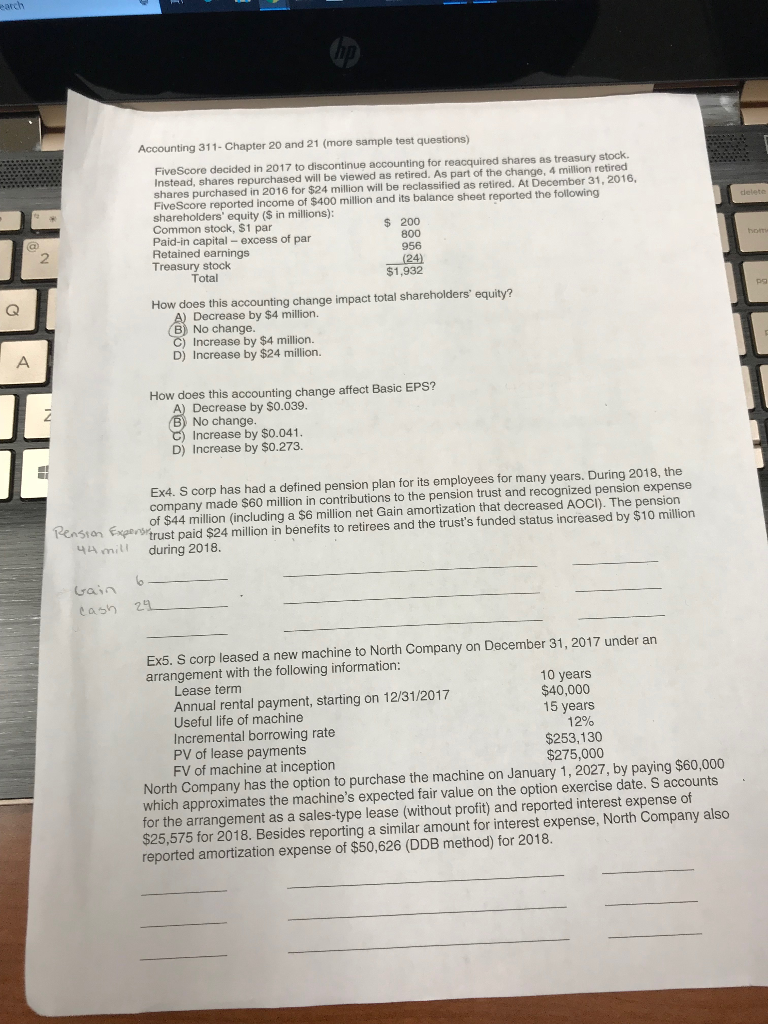

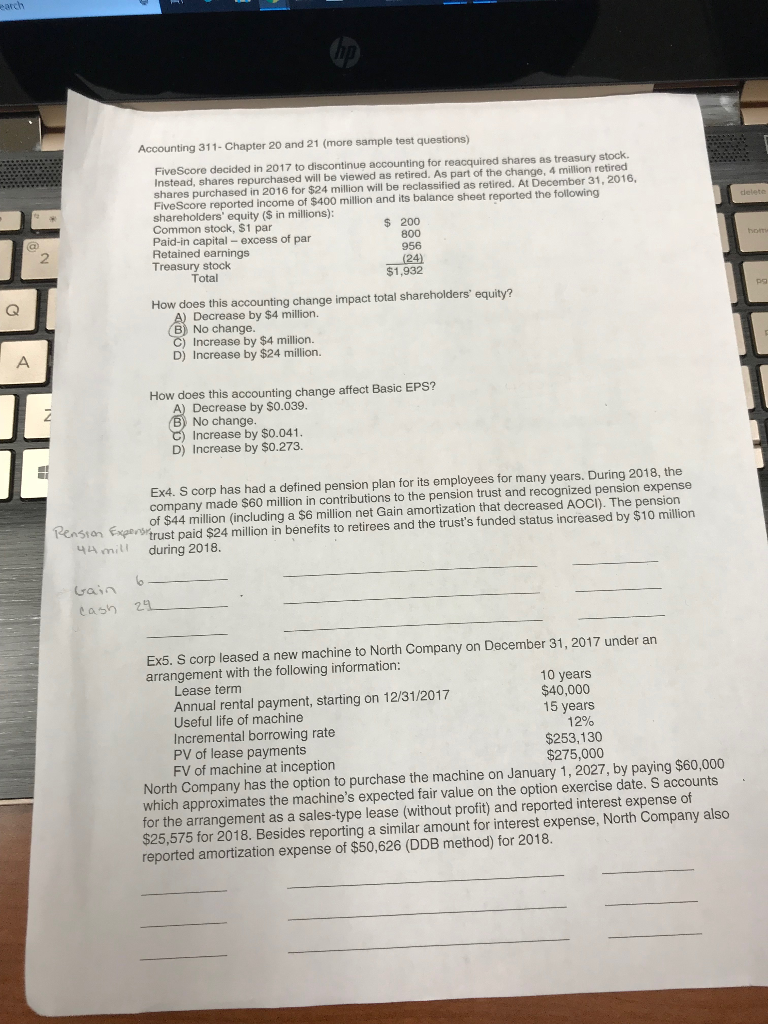

earch Accounting 311- Chapter 20 and 21 (more sample test questions) FiveScore decided in 2017 to discontinue accounting for reacquired shares as treasury stock Instead, shares repurchased will be viewed as retired. As part of the change, 4 million retired shares purchased in 2016 for $24 million will be reclassified as retired. At December 31, 2016, FiveScore reported income of $400 million and its balance sheet reported the following shareholders' equity ($ in millions) Common stock, $1 par Paid-in capital- excess of par Retained earnings Treasury stock $200 800 956 (24) $1,932 2 Total How does this accounting change impact total shareholders' equity? Decrease by $4 million. B) No change ) Increase by $4 million. D) Increase by $24 million. How does this accounting change affect Basic EPS? A) Decrease by $0.039 No change Increase by $0.041. D) Increase by $0.273. Ex4. S corp has had a defined pension plan for its employees for many years. During 2018, the company made $60 million in contributions to the pension trust and recognized pension expense of $44 million (including a $6 million net Gain amortization that decreased AOCI). The pension nsian prust paid $24 million in benefits to retirees and the trust's funded status increased by $10 million 4Amill during 2018. Gain ash 2 Ex5. S corp leased a new machine to North Company on December 31, 2017 under an arrangement with the following information: 10 years $40,000 15 years Lease term Annual rental payment, starting on 12/31/2017 Useful life of machine Incremental borrowing rate PV of lease payments FV of machine at inception 12% $253,130 $275,000 North Company has the option to purchase the machine on January 1, 2027, by paying $60,000 which approximates the machine's expected fair value on the option exercise date. S accounts for the arrangement as a sales-type lease (without profit) and reported interest expense of $25,575 for 2018. Besides reporting a similar amount for interest expense, North Company also reported amortization expense of $50,626 (DDB method) for 2018. earch Accounting 311- Chapter 20 and 21 (more sample test questions) FiveScore decided in 2017 to discontinue accounting for reacquired shares as treasury stock Instead, shares repurchased will be viewed as retired. As part of the change, 4 million retired shares purchased in 2016 for $24 million will be reclassified as retired. At December 31, 2016, FiveScore reported income of $400 million and its balance sheet reported the following shareholders' equity ($ in millions) Common stock, $1 par Paid-in capital- excess of par Retained earnings Treasury stock $200 800 956 (24) $1,932 2 Total How does this accounting change impact total shareholders' equity? Decrease by $4 million. B) No change ) Increase by $4 million. D) Increase by $24 million. How does this accounting change affect Basic EPS? A) Decrease by $0.039 No change Increase by $0.041. D) Increase by $0.273. Ex4. S corp has had a defined pension plan for its employees for many years. During 2018, the company made $60 million in contributions to the pension trust and recognized pension expense of $44 million (including a $6 million net Gain amortization that decreased AOCI). The pension nsian prust paid $24 million in benefits to retirees and the trust's funded status increased by $10 million 4Amill during 2018. Gain ash 2 Ex5. S corp leased a new machine to North Company on December 31, 2017 under an arrangement with the following information: 10 years $40,000 15 years Lease term Annual rental payment, starting on 12/31/2017 Useful life of machine Incremental borrowing rate PV of lease payments FV of machine at inception 12% $253,130 $275,000 North Company has the option to purchase the machine on January 1, 2027, by paying $60,000 which approximates the machine's expected fair value on the option exercise date. S accounts for the arrangement as a sales-type lease (without profit) and reported interest expense of $25,575 for 2018. Besides reporting a similar amount for interest expense, North Company also reported amortization expense of $50,626 (DDB method) for 2018