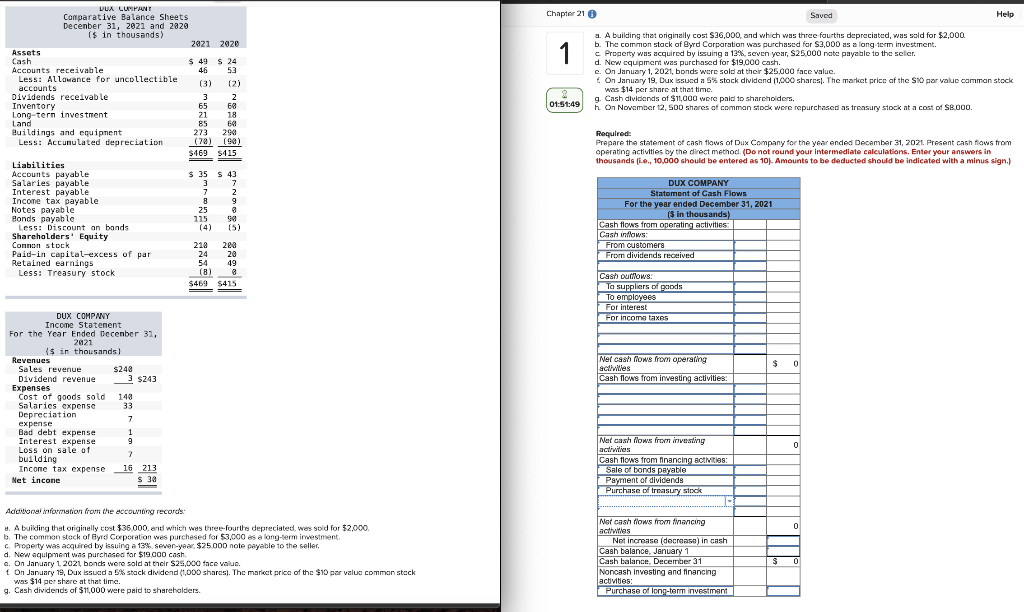

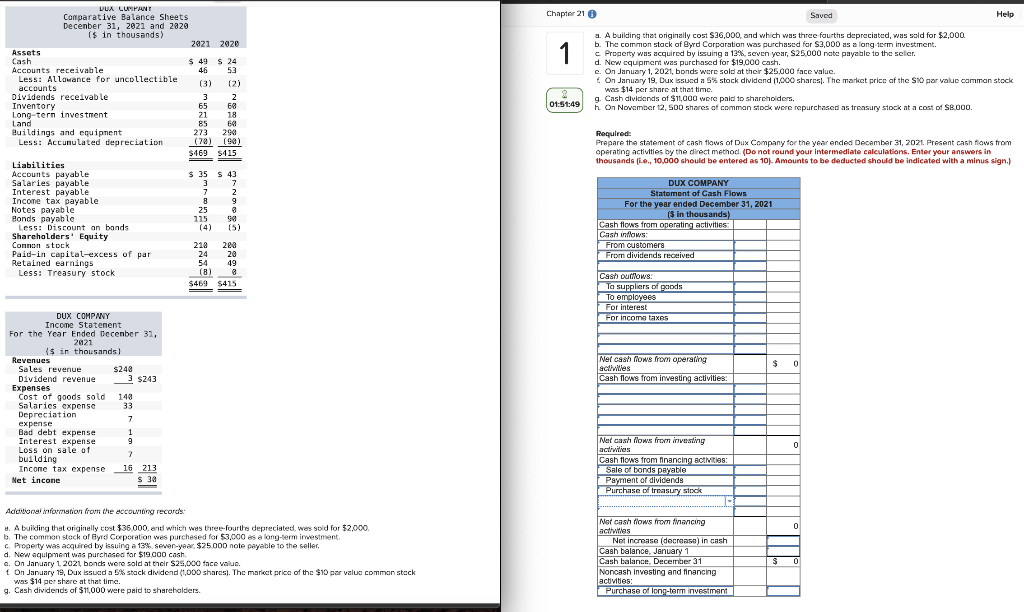

Chapter 21 Saved Help 1 a. A building that originally cost $36,000, and which was three fourths depreciated, was sold for $2,000. b. The common stock of Byrd Corporation was purchased for S2,000 as a long term investment. c Property was acquired by issuing a 13%, seven year, S25,000 nate payable to the scler d. Ncw equipment was purchased for $19,000 cash. c. On January 1, 2021, bonds were sold at their $25,000 face valuc. 6. On January 19, Dux ssued a 5% stock dividend 1,000 shares. The market price of the Stopar value common stock was $14 per share at that time. g. Cash dividends of $11,000 were paid to shareholders. h On November 12, 500 shares of common stock were repurchased as treasury stock at a cost of $8.000 01:51:49 DUX LUMPAN Comparative Balance Sheets December 31, 2021 and 2920 ($ in thousands) 2021 2020 Assets Cash $ 49 S 24 Accounts receivable 46 53 Less: Allowance for uncollectible (3) (2) accounts Dividends receivable 3 2 Inventory 65 68 Long-tern investment 21 18 Land 85 ta Buildings and equipment 273 200 Less: Accumulated depreciation (78) (90) $469 $415 Liabilities Accounts payable $ 35 $ 43 Salaries payable 3 7 Interest payable 7 g 8 Income tax payable 8 Notes payable 25 3 Bonds payable 115 50 Less: Discount on bonds (4) (5) ) Shareholders' Equity Connon stock 210 289 Paid-in capital-excess of par 24 20 Retained earnings 54 49 Less: Treasury stock (8) 8 8 $469 $415 Required: Prepare the statement of cash flows of Dux Company for the year ended December 31, 2021. Present cash flows from operating activities by the direct method (Do not round your intermediate calculations. Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a minus sign.) ** 6 mois see on es| a @ mgangalal mnogo garela DUX COMPANY Statement of Cash Flows For the year ended December 31, 2021 ($ in thousands) Cash flows from operating activities: Cashindows From customers From dividends received Cash outflows: To suppliers of goods To employees For interest For income taxes $ 0 Ner cash flows from operating act willes Cash flows from investing activities: DUX COMPANY Income Statement For the Year Ended Decenber 31, 2021 ($ in thousands) Revenues Sales revenue $240 Dividend revenue 3 3 $243 Expenses Cost of goods sold 140 Salaries expense 33 Depreciation 7 expense 1 Interest expense 9 Loss on sale of 2 building Income tax expense 16 213 Net incone s 30 Bad debt expense 0 Nel cash flows from investing activities Cash flows from financing activities: Sale of bonds payable Payment of dividends Purchase of treasury sick 0 Additional information from the accounting records: 3. A building that originally cost $35.000. and which was three-fourths depreciated, wes sold for $2,000. b. The common stock of Eyre Corporation was purchased for $3.000 as a long-term investment C Property was acquired by issuing a 13% sever-year $25.000 note payable to the seller d. New equipment was purchased for $19.000 cash. e. On January 1, 2021, bonck were sold at their $25,000 face value. t On January 19, Dux issued a 5% stack dividend (1,000 shares). The market price of the $10 par value common stock was $14 per share at that time. g. Cash dividends of $11,000 were paid to shareholders Nor cash flows from varicing actwtes Not increase (decrease) in cash Cash balance, January 1 Cash balance, December 31 Noncash investing and financing activities: Purchase of long-term investment $ 0