Chapter 22

1.a  1.b

1.b

1.c

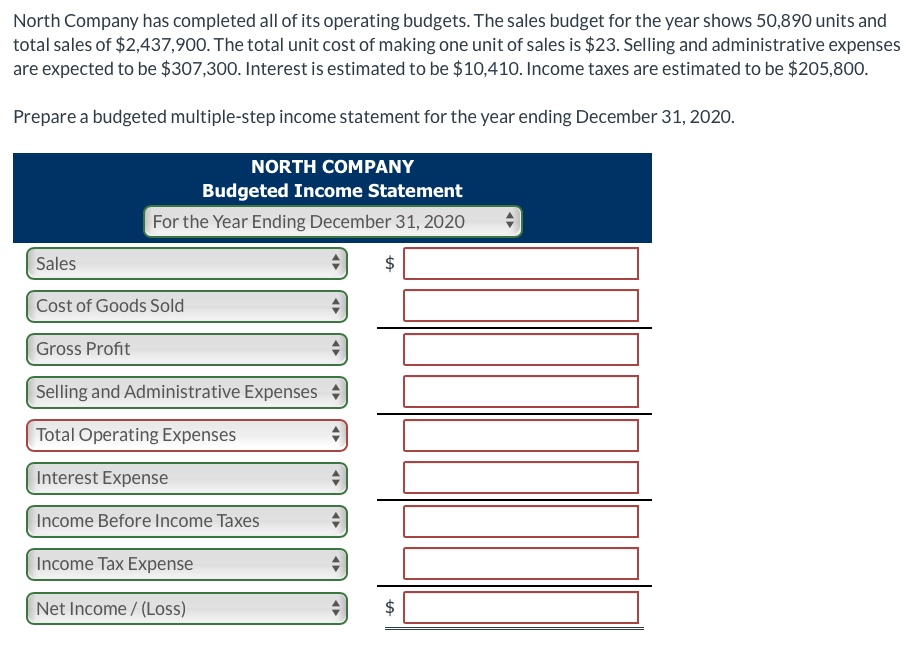

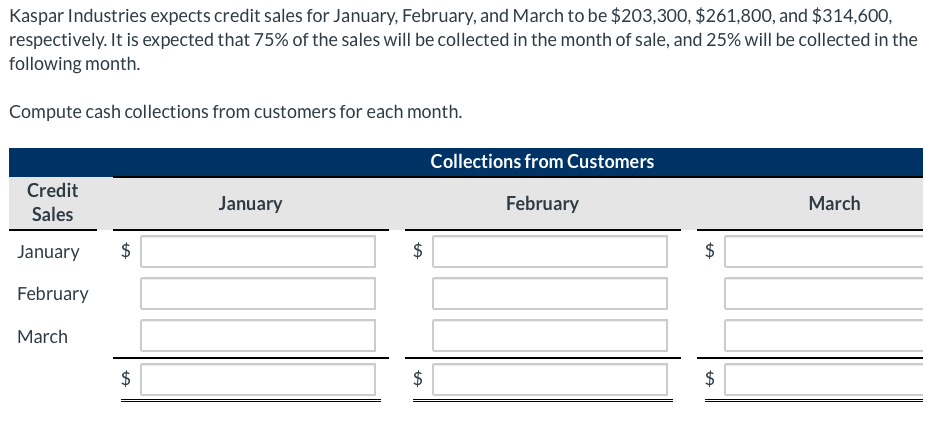

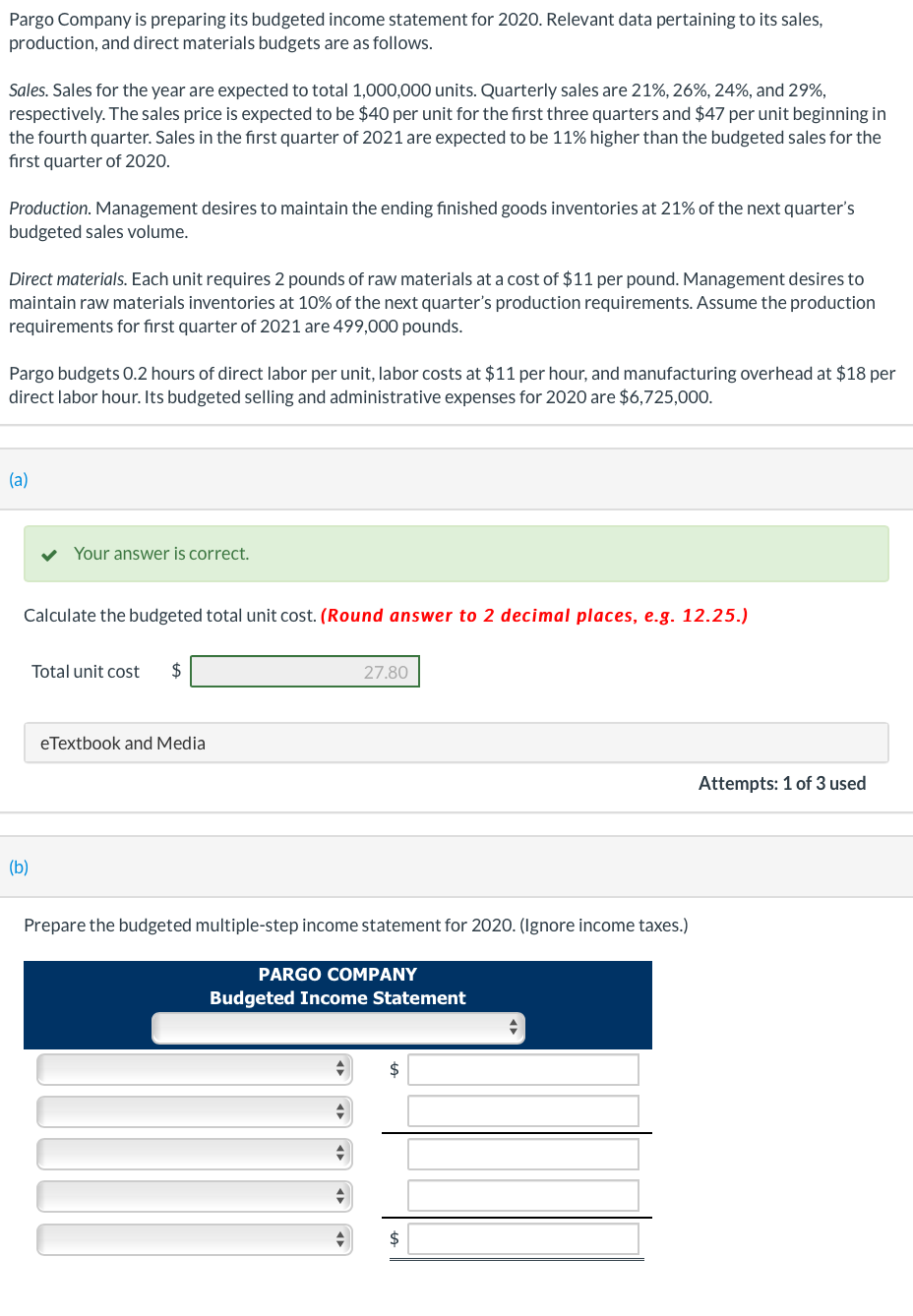

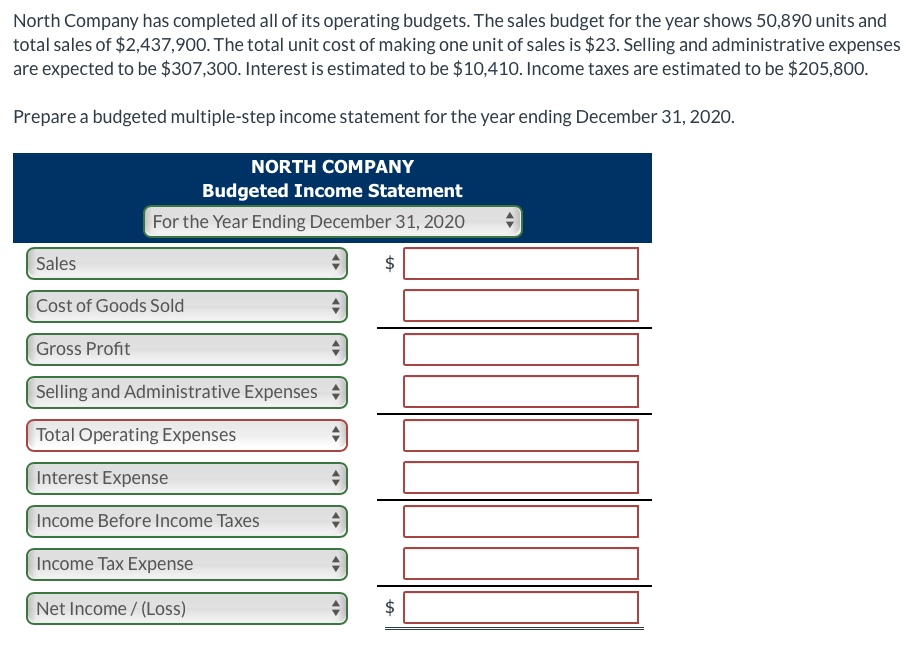

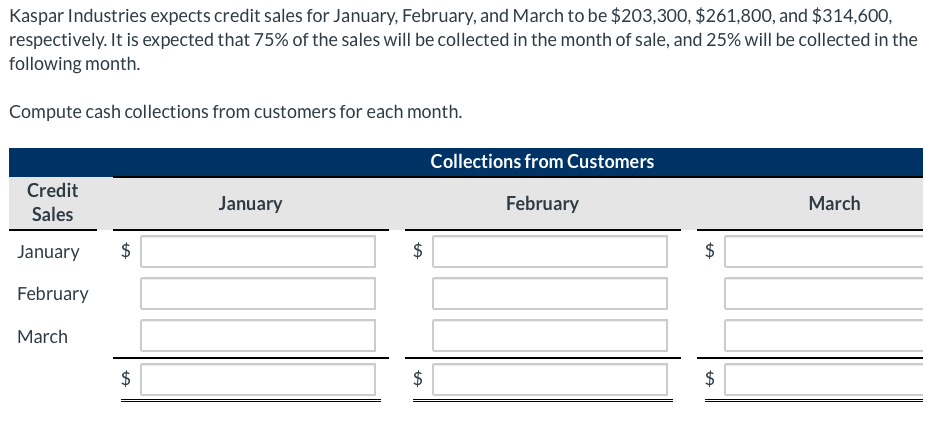

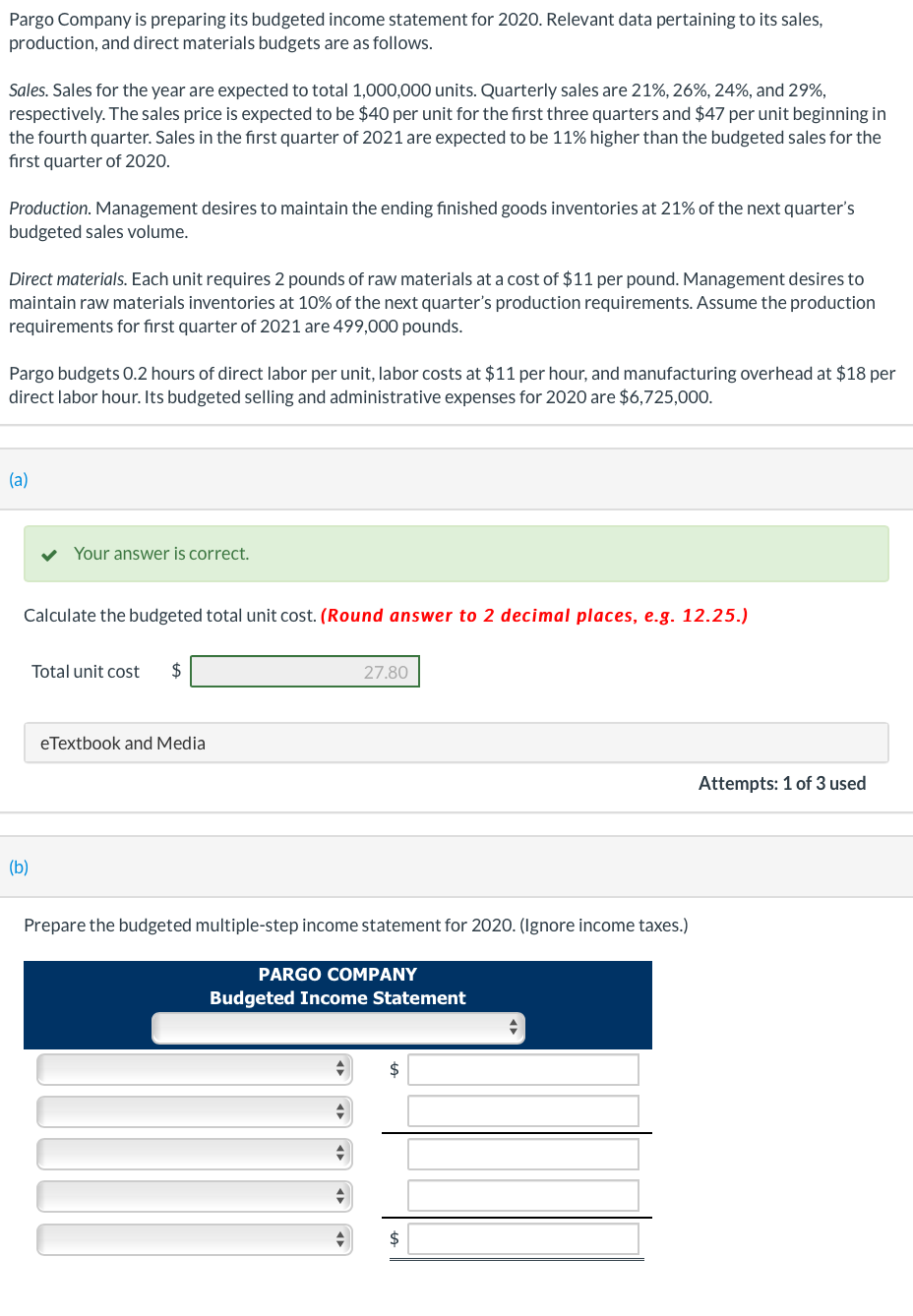

Pargo Company is preparing its budgeted income statement for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are as follows. Sales. Sales for the year are expected to total 1,000,000 units. Quarterly sales are 21%, 26%, 24%, and 29%, respectively. The sales price is expected to be $40 per unit for the first three quarters and $47 per unit beginning in the fourth quarter. Sales in the first quarter of 2021 are expected to be 11% higher than the budgeted sales for the first quarter of 2020. Production. Management desires to maintain the ending finished goods inventories at 21% of the next quarter's budgeted sales volume. Direct materials. Each unit requires 2 pounds of raw materials at a cost of $11 per pound. Management desires to maintain raw materials inventories at 10% of the next quarter's production requirements. Assume the production requirements for first quarter of 2021 are 499,000 pounds. Pargo budgets 0.2 hours of direct labor per unit, labor costs at $11 per hour, and manufacturing overhead at $18 per direct labor hour. Its budgeted selling and administrative expenses for 2020 are $6,725,000. (a) Your answer is correct. Calculate the budgeted total unit cost. (Round answer to 2 decimal places, e.g. 12.25.) Total unit cost $ 27.80 e Textbook and Media Attempts: 1 of 3 used (b) Prepare the budgeted multiple-step income statement for 2020. (Ignore income taxes.) PARGO COMPANY Budgeted Income Statement $ North Company has completed all of its operating budgets. The sales budget for the year shows 50,890 units and total sales of $2,437,900. The total unit cost of making one unit of sales is $23. Selling and administrative expenses are expected to be $307,300. Interest is estimated to be $10,410. Income taxes are estimated to be $205,800. Prepare a budgeted multiple-step income statement for the year ending December 31, 2020. NORTH COMPANY Budgeted Income Statement For the Year Ending December 31, 2020 Sales $ Cost of Goods Sold Gross Profit Selling and Administrative Expenses Total Operating Expenses Interest Expense Income Before Income Taxes Income Tax Expense Net Income /(Loss) $ Kaspar Industries expects credit sales for January, February, and March to be $203,300, $261,800, and $314,600, respectively. It is expected that 75% of the sales will be collected in the month of sale, and 25% will be collected in the following month. Compute cash collections from customers for each month. Collections from Customers Credit Sales January February March January $ CA $ February March $ $ $

1.b

1.b