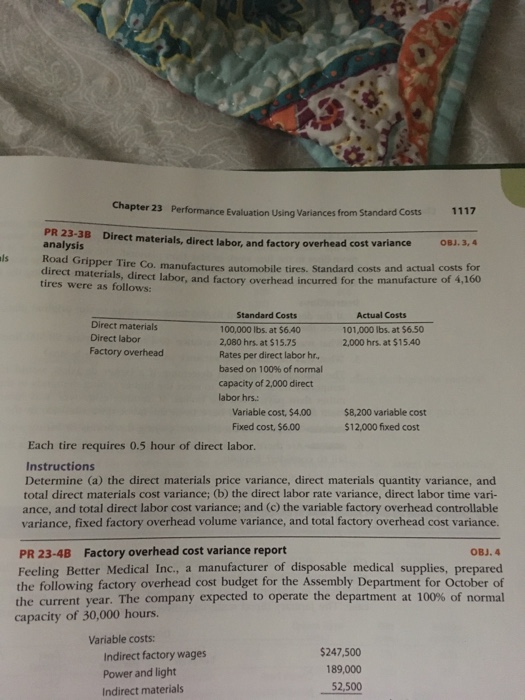

Chapter 23 Performance Evaluation Using Variances from Standard Costs PR 23-3B Direct materials, direct labor, and factory overhead cost variance analysis OBJ, 3, 4 Road Gripper Tire Co. manufactures automobile tires. and actual for direct materials, Standard costs costs direct labor, and factory overhead incurred for the manufacture of 4,160 tires were as follows: Actual Costs Standard Costs Direct materials 101.000 lbs. at $6.50 100,000 lbs. at $640 Direct labor 2,080 hrs at $15.75 2,000 hrs at $15A0 Factory overhead Rates per direct labor hr, based on 100% of normal capacity of 2,000 direct labor hrs: Variable cost, $4.00 $8,200 variable cost Fixed cost, $6.00 $12,000 fixed cost Each tire requires 0.5 hour of direct labor. Instructions Determine (a) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (b) the direct labor rate variance, direct labor time vari- ance, and total direct labor cost variance; and (c) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. PR 23-4B Factory overhead cost variance report Feeling Better Medical Inc., a manufacturer of disposable medical supplies, prepared the following factory overhead cost budget for the Assembly Department for October of the current year. The company expected to operate the department at 100% of normal capacity of 30,000 hours. Variable costs: $247,500 Indirect factory wages 189,000 Power and light 52,500 Indirect materials Chapter 23 Performance Evaluation Using Variances from Standard Costs PR 23-3B Direct materials, direct labor, and factory overhead cost variance analysis OBJ, 3, 4 Road Gripper Tire Co. manufactures automobile tires. and actual for direct materials, Standard costs costs direct labor, and factory overhead incurred for the manufacture of 4,160 tires were as follows: Actual Costs Standard Costs Direct materials 101.000 lbs. at $6.50 100,000 lbs. at $640 Direct labor 2,080 hrs at $15.75 2,000 hrs at $15A0 Factory overhead Rates per direct labor hr, based on 100% of normal capacity of 2,000 direct labor hrs: Variable cost, $4.00 $8,200 variable cost Fixed cost, $6.00 $12,000 fixed cost Each tire requires 0.5 hour of direct labor. Instructions Determine (a) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (b) the direct labor rate variance, direct labor time vari- ance, and total direct labor cost variance; and (c) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. PR 23-4B Factory overhead cost variance report Feeling Better Medical Inc., a manufacturer of disposable medical supplies, prepared the following factory overhead cost budget for the Assembly Department for October of the current year. The company expected to operate the department at 100% of normal capacity of 30,000 hours. Variable costs: $247,500 Indirect factory wages 189,000 Power and light 52,500 Indirect materials