Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 28 Accruals and prepayments and other adjustments for financial statements 28.7A The owner of a small business selling and repairing cars which you

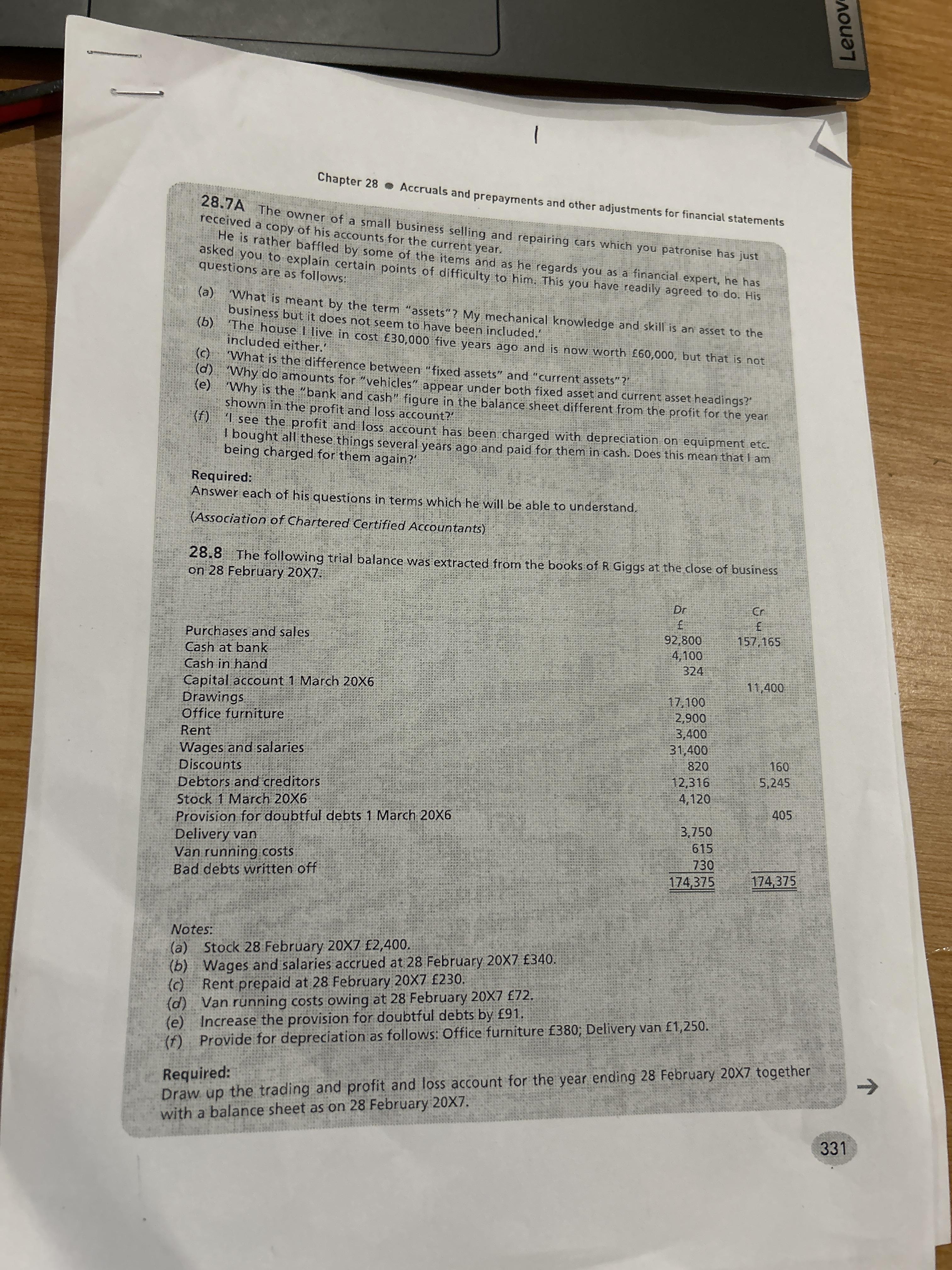

Chapter 28 Accruals and prepayments and other adjustments for financial statements 28.7A The owner of a small business selling and repairing cars which you patronise has just received a copy of his accounts for the current year. He is rather baffled by some of the items and as he regards you as a financial expert, he has asked you to explain certain points of difficulty to him. This you have readily agreed to do. His questions are as follows: (a) (b) (c) (d) (e) 'What is meant by the term "assets"? My mechanical knowledge and skill is an asset to the business but it does not seem to have been included." 'The house I live in cost 30,000 five years ago and is now worth 60,000, but that is not included either.' 'What is the difference between "fixed assets" and "current assets"?" 'Why do amounts for "vehicles" appear under both fixed asset and current asset headings?" 'Why is the "bank and cash" figure in the balance sheet different from the profit for the year shown in the profit and loss account?" (f) 'I see the profit and loss account has been charged with depreciation on equipment etc. I bought all these things several years ago and paid for them in cash. Does this mean that I am being charged for them again?' Required: Answer each of his questions in terms which he will be able to understand. (Association of Chartered Certified Accountants) ****** 28.8 The following trial balance was extracted from the books of R Giggs at the close of business on 28 February 20X7. Purchases and sales Cash at bank Cash in hand Capital account 1 March 20X6 Drawings Office furniture Rent Wages and salaries Discounts Debtors and creditors Stock 1 March 20X6 Provision for doubtful debts 1 March 20X6 Delivery van Van running costs Bad debts written off Notes: kkkkkk S Dr Cr f 92,800 4,100 324 157,165 11,400 17,100 2,900 3,400 C 31,400 820 160 12,316 4,120 5,245 3,750 730 ** Xity N KENAANxk***** 174,375 174,375 XXXXX K (a) Stock 28 February 20X7 2,400. (b) Wages and salaries accrued at 28 February 20X7 340. (c) Rent prepaid at 28 February 20X7 230. (d) Van running costs owing at 28 February 20X7 72. (e) Increase the provision for doubtful debts by 91. (f) Provide for depreciation as follows: Office furniture 380; Delivery van 1,250. Required: XXXNXX ANNING ARDO YOUR Draw up the trading and profit and loss account for the year ending 28 February 20X7 together with a balance sheet as on 28 February 20X7. 331 Lenov

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started