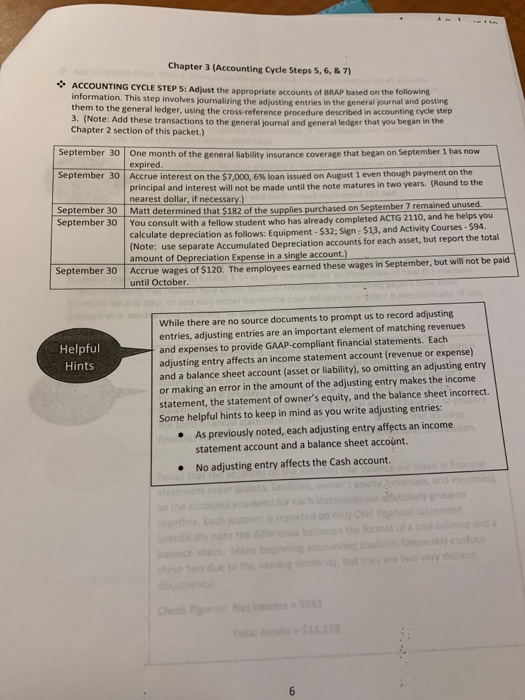

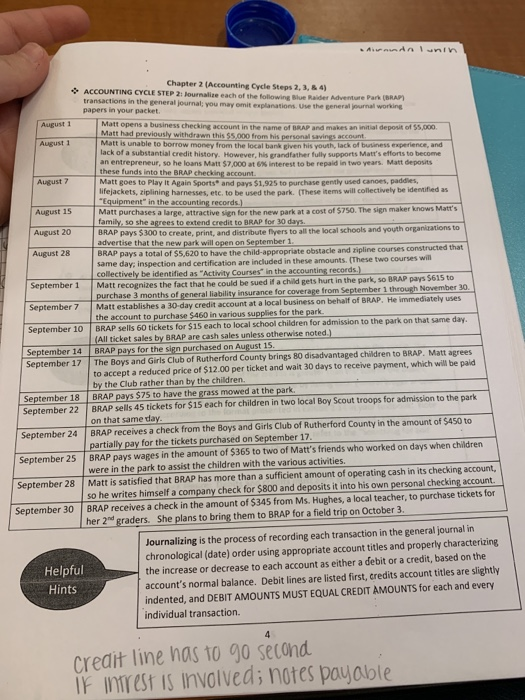

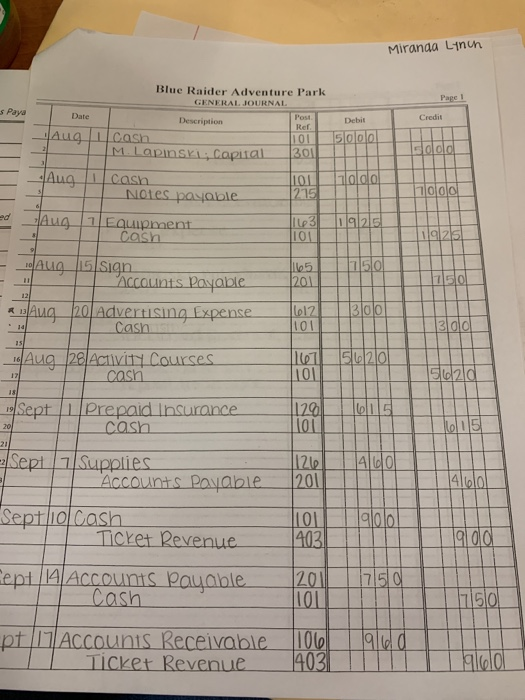

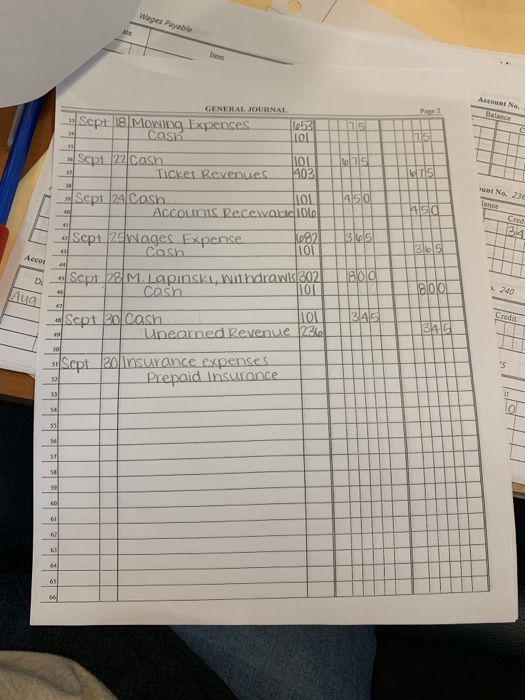

Chapter 3 (Accounting Cycle Steps 5, 6, &7) ACCOUNTING CYCLE STEP 5: Adjust the appropriate accounts of BRAP based on the following information. This step involves journalizing the adjusting entries in the general journal and posting them to the general ledger, using the cross-reference procedure describd in accounting cycle step 3. (Note: Add these transactions to the general journal and general ledger that you began in the Chapter 2 section of this packet.) September 30 One month of the general liability insurance coverage that began on September 1 has now expired. 30 Accrue interest on the $7.000, 6 % loan issued on August 1 even though payment on the principal and interest will not be made until the note matures in two years. (Round to the nearest dollar, if necessary.) Matt determined that $182 of the supplies purchased on September 7 remained unused. You consult with a fellow student who has already completed ACTG 2110, and he helps you calculate depreciation as follows: Equipment -$3 (Note: use separate Accumulated Depreciation accounts for each asset, but report the total amount of Depreciation Expense in a single account.) Accrue wages of $120. The employees earned these wages in September, but will not be paid until October September September 30 September 30 Sign- $13, and Activity Courses-$94. September 30 ol While there are no source documents to prompt us to record adjusting entries, adjusting entries are an important element of matching revenues and expenses to provide GAAP-compliant financial statements. Each adjusting entry affects an income statement account (revenue or expense) and a balance sheet account (asset or liability), so omitting an adjusting entry Helpful Hints or making an error in the amount of the adjusting entry makes the income statement, the statement of owner's equity, and the balance sheet incorrect. Some helpful hints to keep in mind as you write adjusting entries: fo As previously noted, each adjusting entry affects an income statement account and a balance sheet account. No adjusting entry affects the Cash account. re sted in fioca and ecenses), statement order grouped so the together Specilically nore the difference behwen the format of a trial baance and a balance sheat these two due to the namin sitarity, but they are two very distinc docuents ny ONE fiancist satemnt ount is reported on any beginning acounting students frequently confuse Che Fu Stocome 3 Total Ass$15 1 6 LO A dn 1unin Chapter 2 (Accounting Cycle Steps 2, 3, & 4) ACCOUNTING CYCLE STEP 2: Journalize each of the following Blue Raider Adventure Park (BRAP) transactions in the general journal; you may omit explanations. Use the general journal working papers in your packet August 1 Matt opens a business checking account in the name of BRAP and makes an initial deposit of 55,000. Matt had previously withdrawn this $5,000 from his personal savings account. Matt is unable to borrow money from the local bank given his youth, lack of butiness experience, and. lack of a substantial credit history, However, his grandfather fully supports Matt's efforts to become an entrepreneur, so he loans Matt $7,000 at 69% interest to be repaid in two years. Matt deposits these funds into the BRAP checking account Matt goes to Play It Again Sports and pays $1.925 to purchase gently used canoes, paddles, lifejackets, ziplining harnesses, etc. to be used the park, (These items will collectively be identified as "Equipment" in the accounting records.) Matt purchases a large, attractive sien for the new park at a cost of $750. The sign maker knows Matt's family, so she agrees to extend credit to BRAP for 30 days BRAP pays $300 to create, print, and distribute flyers to advertise that the new park will open on September 1 BRAP pays a total of $5.620 to have the child-appropriate obstacle and zipline courses constructed that same day; inspection and certification are included in these amounts. (These two courses will collectively be identified as "Activity Courses" in the accounting records.) Matt recognizes the fact that he could be sued if a child gets hurt in the park, so BRAP pays $615 to purchase 3 months of general liability insurance for coverage from September 1 through November 30. Matt establishes a 30-day credit account at a local business on behalf of BRAP. He immediately uses the account to purchase $460 in various supplies for the park BRAP sells 60 tickets for $15 each to local school children for admission to the park on that same day. (All ticket sales by BRAP are cash sales unless otherwise noted.) BRAP pays for the sign purchased on August 15. The Boys and Girls Club of Rutherford County brings 80 disadvantaged children to BRAP. Matt agrees to accept a reduced price of $12.00 per ticket and wait 30 days to receive payment, which will be paid by the Club rather than by the children. BRAP pays $75 to have the grass mowed at the park. BRAP sells 45 tickets for $15 each for children in two local Boy Scout troops for admission to the park on that same day. BRAP receives a check from the Boys and Girls Club of Rutherford County in the amount of $450 to partially pay for the tickets purchased on September 17. BRAP pays wages in the amount of $365 to two of Matt's friends who worked on days when children were in the park to assist the children with the various activities. Matt is satisfied that BRAP has more than a sufficient amount of operating cash in its checking account, so he writes himself a company check for $800 and deposits it into his own personal checking account. BRAP receives a check in the amount of $345 from Ms. Hughes, a local teacher, to purchase tickets for her 2nd graders. She plans to bring them to BRAP for a field trip on October 3. August 1 August 7 August 15 August 20 the local schools and youth organizations to- August 28 September 1 September 7 September 10 September 14 September 17 September 18 September 22 onma September 24 September 25 September 28 September 30 Journalizing is the process of recording each transaction in the general journal in chronological (date) order using appropriate account titles and properly characterizing the increase or decrease to each account as either a debit or a credit, based on the account's normal balance. Debit lines are listed first, credits account titles are slightly indented, and DEBIT AMOUNTS MUST EQUAL CREDIT AMOUNTS for each and every individual transaction. Helpful Hints 4 90 second creait line has 10 INTEST is invalved; notes payable IF Miranaa Linun Blue Raider Adventure Park GENERAL JOURNAL Page 1 s Paya Date Credit Post Description Debit Ref Aug cash 5000 101 M.LapinskL Capiial 301 Aug 101 |215 cash NOtes payable ed Aug Equipment cash ILp3 101 1925 l925 T50 le5 201 "Accaunts Payable 750 12 300 BAUG 20 Advertsng xpense Cash lo12 101 A 13 3 00 14 15 |T 51020 101 14Aug 28 ActiviN Courses cash 5020 12 18 Sept 1Prepaid Insurance cash 129 lo15 le15 20 28 Sept Supplies 12lp 201 AlCO 2 Accounts Payabie 4bl0 Sept 10 Cash TICKET Revenue 90d 403 ept 4 Accouns Payable Cash 201 750 7150 pt ACcouniS Receivable 100 TICket Revenue 1403 Wages Payable ate hem Account No. Balance Page 2 GENERAL JOURNAL 15 Le53 Sept 18 Mowing Expenses Cash 75 Sept 22 Cashn 403 TICKET Revenues vunt No. 236 32 1450 lance i01 38 450 Sept 24 Cash Cred 24 ACcounis Recewabi1ol |365 4 Sept 29Woges Expense Cash 305 43 41 1800 Accou Sept 28 M.Lapinski, withdrawls02 cash 240 D. 46 Aug Credit 1345 346 Sept 20 Cash Unearned Revenue 22 49 s Sept 20 nsuaY Once expenses Prepaid Insuronce 50 51 it 57 53 54 55 60 61 67 61 64 65 66